INDIAN ARMED FORCES CHIEFS ON

OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

I am confident that SP Guide Publications would continue to inform, inspire and influence.

My compliments to SP Guide Publications for informative and credible reportage on contemporary aerospace issues over the past six decades.

Headwinds Still

Business jet shipments increased to 722 units, an increase of 6.5 per cent from the 678 business jets shipped in 2013

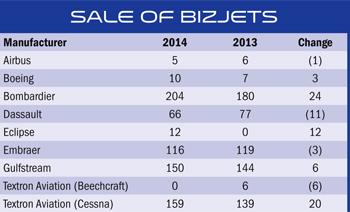

The good news is that business jet sales are on the rise, driven by positive market sentiments. The North American market continues to dominate the business jet market with 52.2 per cent of the sales, followed by Europe at 19.5 per cent. In Asia-Pacific, it was the turboprop market that seemed to be doing well. The General Aviation Manufacturers Association (GAMA) has released the worldwide 2014 year-end aircraft billing and shipment numbers which indicates that general aviation (GA) airplane shipments rose 4.3 per cent from 2,353 units in 2013 to 2,454 units in 2014. Billings for GA airplanes worldwide increased to $24.5 billion, up 4.5 per cent from $23.4 billion in 2013. The fixed-wing billings increase marks the second largest sales value recorded after 2008, when billings were $24.8 billion.

Mixed Results

GAMA President and CEO Pete Bunce reported that shipments of piston-engine airplanes were positive, rising 9.6 per cent in 2014. Business jet shipments rose 722 units, an increase of 6.5 per cent from the 678 business jets shipped in 2013. Turboprop shipments declined, however, by 6.5 per cent to 603 units. Rotorcraft shipments slowed for both piston and turbine aircraft compared to the previous year. A total of 230 rotorcraft and 778 turbine rotorcraft were shipped in 2014, which is a 31.3 per cent and a 20.3 per cent reduction, respectively, from the strong deliveries posted in 2013.

“The mixed results among segments indicate that the general aviation manufacturing industry is still facing headwinds given the tepid US economic recovery and the political and economic uncertainties in Europe,” GAMA President and CEO Pete Bunce said. “The 2014 year-end numbers make crystal clear the need for GAMA’s priorities in 2015 – specifically, reform that facilitates the introduction of new safety-enhancing products to market, reduces the inconsistent application of regulations, and strengthens the global engagement and cooperation among aviation authorities. We will continue to press forward on these issues, especially as the Federal Aviation Administration (FAA) reauthorisation moves forward this year in the US Congress and major general aviation regulatory change takes shape in Europe.”

In the business jet segment, Bombardier had good outing in 2014, registering an increase by 24 units from the previous year, followed by Textron Aviation (Cessna) which saw 20 units more sold in 2014. The following table shows the mixed performance of aircraft manufacturers in the business jets category. Bombardier topped the sales figures and became the world’s largest business jet manufacturer in the fourth quarter of 2014, though it is facing delays both in its business jet and flagship CSeries commercial jet programmes. After about two years of activity, Bombardier shipped 78 planes valued at $2.7 billion and Gulfstream delivered 42 planes worth $2.2 billion. The Canadian airplane manufacturer delivered 204 aircraft valued at $7.56 billion, up from $6.3 billion in 2013. It shipped 80 large Global aircraft, 90 Challengers and 34 Learjets in 2014. Gulfstream shipped 150 planes worth $7.78 billion, up from $7.35 billion in 2013.

According to GAMA, the sales figures are Bombardier (Challenger 300/350) – 54 sold; Global 6000/Express – 80 sold; Embraer sold 73 Phenom 300; Gulfstream sold 117 units of G300/350/400/450/500/550/650 and Textron Aviation sold 46 units of Cessna Citation M2. GAMA noted that this Eclipse reentered the market. The Eclipse 500 had proved popular in the very light jet market upon its introduction in 2006, but Eclipse Aviation declared bankruptcy in 2009. Eclipse Aerospace (now renamed ONE Aviation) bought the company’s assets and have brought the updated Eclipse 550 back to airplane buyers. It is the only twin-engine light jet priced below three million dollars and it only burns about 54 gallons an hour, so has low operating costs. It sold 12 units in 2014, having drawn a blank the previous year.

Embraer’s Phenom 300 continues to grow in popularity as it has done since its introduction in 2009. Several fractional operators include this light jet in their fleets. The large-cabin private aircraft remained popular, proving to be the top sellers for Gulfstream and Bombardier. In its second year of sales the Citation M2 achieved a very respectable 46 unit shipments. This light jet is competitively priced at slightly over $4 million. Turboprop sales declined slightly in both North America and Europe. However, the increased market share elsewhere, particularly in the Asia-Pacific market, made up for most of this. A total 603 turboprops were shipped worldwide in 2014 compared to 645 in 2013. The top sellers were the Pilatus PC12 with 66 units, King Air 350 with 71 units and the Cessna Grand Caravan with 81 units.

Shaky 2015

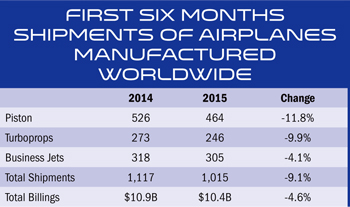

GAMA recently released the second quarter 2015 general aviation aircraft shipment numbers. Industry airplane shipments fell 9.1 per cent to 1,015 units for the first half of the year, and airplane billings declined 4.6 per cent to $10.4 billion, compared to the same period a year ago. Rotorcraft shipments decreased, from 502 units to 447 units, and billings were down an estimated 16.8 per cent to $1.9 billion for the first six months.

The number of piston airplanes delivered fell 11.8 per cent, from 526 units to 464 units. Turboprop shipments also declined 9.9 per cent to 246 airplanes. Business jet manufacturers shipped 305 airplanes compared to 318 airplanes last year, a drop of 4.1 per cent. Piston rotorcraft declined to 130 shipments while turbine rotorcraft dropped from 358 units in 2014 to 317 units in 2015, an 11.5 per cent decline.

“While the second quarter generally improved over the first, our industry is still being buffeted by volatile global markets and contraction within the energy sector,” Pete Bunce said. “Robust new product development continues in each of our member companies, accentuating the need for streamlined certification processes and efficient validation mechanisms between regulatory authorities. Finally, fair global competitiveness for all GAMA members rests on the need for a global level playing field. Therefore, Export-Import Bank reauthorisation remains a key priority for manufacturers.”

The general aviation industry shipped 678 aircraft in the first three months of the year for a total value of $5.3 billion. “The first quarter numbers show that, while our industry has been gaining traction over the past few years, we face some renewed headwinds in several regions of the world, including Asia, parts of Europe and Latin America,” said Pete Bunce. “Our industry is focused on regaining momentum, but we need the US Congress to be a strong partner and reauthorise the Export-Import Bank before the June 30 deadline. It is time to stop playing political games with industry jobs. Congress needs to move ahead and pass reauthorisation quickly to ensure a level global playing field and provide needed stability in a difficult market.”

Total airplane shipments declined from 520 during first quarter 2014 to 441 in first quarter 2015. Airplane billings were down 12.6 per cent from last year to $4.5 billion. Rotorcraft shipments declined by 18.3 per cent to 188 aircraft delivered in first quarter 2015 while billings were down 17.9 per cent to $0.8 billion.

In its 23rd annual Business Aviation Outlook, Honeywell is forecasting up to 9,450 new business jet deliveries worth $280 billion from 2014 to 2024. The 2014 Honeywell outlook reflects an approximate 7 to 8 per cent increase in projected delivery value over the 2013 forecast. Slightly higher unit deliveries are coupled with modest list price increases and the continued strong showing of larger business jet models in the delivery mix to generate the growth.

“2015 industry deliveries are anticipated to be up modestly again, reflecting momentum from several new model introductions and some gains linked to incremental global economic growth,” said Brian Sill, President, Business and General Aviation, Honeywell Aerospace.

Larger Jets Remain Popular

Despite lower overall purchase expectations, operators continue to focus on larger-cabin aircraft classes ranging from super midsize through ultra-long range and business liner, implying these types of aircraft will command the bulk of the value billed from now until 2024. This large-cabin group is expected to account for more than 75 per cent of all expenditures on new business jets in the near term. Volume growth between now and 2024 will be led by these classes of aircraft, reflecting 60 per cent of additional units and nearly 85 per cent of additional retail value.

“The strong desire for larger-cabin aircraft with greater range and advanced avionics is seen again in this year’s survey,” Sill said. “We are also seeing some improved interest in midsize and small-cabin models this year. As a full-spectrum supplier, we are pleased to see aircraft in every class with significant Honeywell equipment content among the most popular models cited in the operator survey.”

Another notable finding in the 2014 survey is the improved interest levels for midsize and small-cabin aircraft in operator purchase plans. While large-cabin models still garner the largest share of specific buying plans, the midsize and smaller models recovered some share for the first time in several years, reflecting improved prospects for popular production models as well as stronger interest in newer models just now available or soon to enter service.

Most operator concerns centred on the economic tempering, tensions and fiscal austerity affecting several of the region’s major economies. However, this is a topical phenomenon as most forecasts call for a relatively strong recovery in economic growth within the region over the next five years.

North America continues to lead

North America, the industry’s mainstay market, has seen new jet purchase plan levels slip about six points to 22 per cent, just under the world average of 23 per cent, after averaging near 25 per cent for the past six years. Though buying plan levels might be moderate when compared with emerging markets, North America represents nearly 60 per cent of projected global demand for the next five years based on the region’s larger installed business jet base, affirming the region’s unquestionable importance to the industry’s future.

“The long-term macro trends that support demand for business jets are still in place, notwithstanding the topical issues we find colouring responses to the 2014 Operator Survey,” Sill said. “We believe global business aviation growth will be aided by structural and regulatory reforms, longer-term economic growth and aircraft innovation. As a systems supplier, we believe product innovation in the form of aircraft connectivity and communication technology solutions like the JetWave Ka-band satellite connectivity system, safety and situational awareness offerings like the IntuVue weather radar, as well as flexible service offerings and value-added upgrades, will support the expanded use of business aircraft as a key tool in the global economy.”