INDIAN ARMED FORCES CHIEFS ON

OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

I am confident that SP Guide Publications would continue to inform, inspire and influence.

My compliments to SP Guide Publications for informative and credible reportage on contemporary aerospace issues over the past six decades.

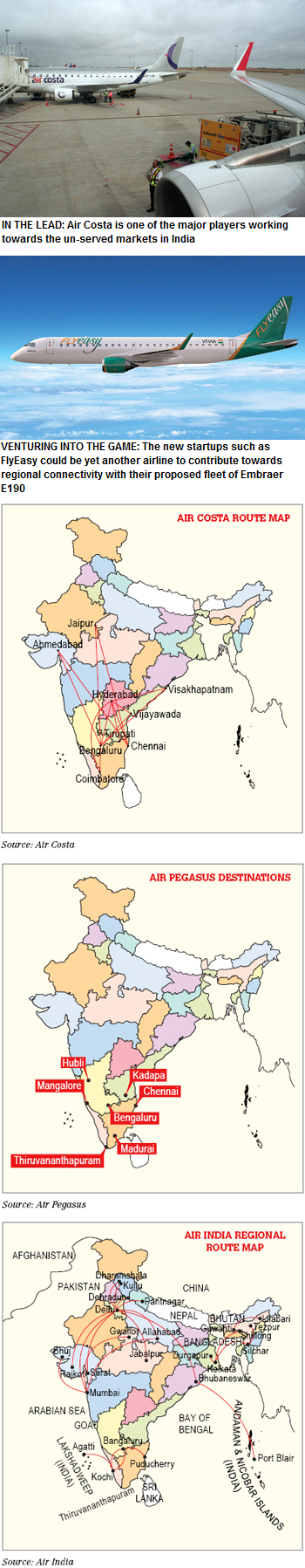

Tapping into Under-Served & Un-served Markets

Civil Aviation Ministry in its draft Policy has clearly mentioned in its objectives that it intends to enhance regional connectivity through fiscal support and infrastructure development

The top 10 airports of Delhi, Mumbai, Bengaluru, Chennai, Hyderabad, Kolkata, Kochi, Ahmedabad, Pune and Dabolim contribute almost 80 per cent of the passenger traffic in India. The rest is accounted for by the other 70 destinations that airlines, including regional airlines, connect to. It certainly is skewed in favour of the major cities. According to the 2011 census, there are 270 cities in the country with a population of over one lakh, of which about 50 cities can be termed as ‘Million Plus’ cities with population of over a million. While the megapolises are bursting at their seams, the Tier-II and III cities are also expanding at quite a pace. As these cities are witnessing unbridled growth, the Narendra Modi Government has embarked upon ‘100 Smart Cities’ project, which will factor in aviation.

This is likely to spur frenetic economic activity in many regions. If some of the regions house, special economic zones (SEZs) then it goes without saying that the SEZ success or failure depends totally on the multi-modal transportation network. Airport and port connectivity is going to play a crucial role in economic development and planners are cued into it.

Having realised this potential, the Ministry of Civil Aviation (MoCA) is laying emphasis on regional connectivity and policies are getting formulated with that in mind. The MoCA in its revised draft National Civil Aviation Policy has clearly mentioned in its objectives that it intends to enhance regional connectivity through fiscal support and infrastructure development. Already 50 smaller airports have been identified for further development and they are in various stages of implementation. Once the smaller airports become operational (of the 426 airports in the country, about 90 are said to be operational for different kinds of aircraft) for regional airlines and also for general aviation / business aviation, the sector is going to witness unprecedented domestic passenger growth.

The Mandatory RDG

Presently, thanks to the route dispersal guidelines (RDG) of the MoCA, airlines are flying to destinations which may not be that lucrative for business, particularly if one is deploying an aircraft which is not suited for the market. Regional aircraft – be it a turboprop or a regional jet—is the answer to begin with to tap the un-served and under-served markets. It certainly requires nurturing by not just the government but also the other stakeholders.

As per the RDG, routes have been classified as Category I, II, IIA and III. In Category I there are 30 routes including all large metropolitan cities and Category II routes are in remote areas, Category II intra-remote areas and Category III are routes not covered by the first three categories. To comply with these norms, an airline has had to rethink on its business model. It has to have a proper mix of aircraft – single aisle aircraft such as the Boeing 737 or the Airbus A320 (which in underserved and unserved markets would make no sense at all) to regional aircraft such as ATRs and Embraer E-Jets with less than 100-seating capacity. While the intention of RDG has been good, lack of infrastructure (airport facilities, proper road network to the airports, lower cost for airlines etc) has hampered the growth of regional aviation. It is only now that the government is serious of regional connectivity and if it promotes regional aviation, then it could do away with RDGs which has been eroding airline profitability. Regional airlines can fill that gap.

Revised RDG

RDG has succeeded in creating connectivity to remote locations. Capacity actually deployed on Cat II and III is in excess of the RDG threshold, highlighting the business potential in these regions.

The revised draft policy envisages:

- Category I routes will be rationalised by adding more routes based on a transparent criteria. The criteria proposed for a Cat I route is a flying distance of 700 km, average seat factor of 70 per cent and annual traffic of 5 lakh passengers based on information available with the DGCA. MoCA will endeavour that the rationalisation of Cat I routes does not cause undue financial and operational burden on airlines.

- The traffic to be deployed on Cat II, IIA and III expressed in terms of a percentage of CAT I traffic will remain the same.

- Revised categorisation will apply 12 months after the date of notification in order to allow sufficient time to airlines to plan their operations. The review of routes under different categories will be done by MoCA once every 5 years.

- Airlines may change routes within Cat II and III with a 30-day prior intimation to MoCA and DGCA. However, withdrawal of any existing domestic operation to and within North East region, Islands and Ladakh will require prior permission from MoCA.

Air India Regional getting aggressive

Considering the policy proposal, some of the airlines are already mulling the idea of starting regional services. Air India Regional (formerly Alliance Air) is becoming lot more active and it is connecting the destinations of Dharamshala, Kullu, Pantnagar, Dehradun, Rajkot, Surat, Allahabad, Jabalpur, Bhubaneswar-Port Blair (from Delhi); Bhuj, Allahabad and Gwalior (from Mumbai); Durgapur, Shillong and Silchar-Tezpur (from Kolkata); Puducherry and Kochi-Agatti (from Bengaluru) and Guwahati-Lilabari.

Having realised the potential, the Ministry of Civil Aviation is laying emphasis on regional connectivity and policies are getting formulated with that in mind.

It operates air services with leased fleet of 3 CRJ (70 seater), 4 ATR 42-320 (48 seater) and 5 ATR 72-600 (70 seater) aircraft with base stations in Delhi, Bengaluru, Kolkata, Hyderabad and Mumbai. These flights are operated mostly to Tier-II and III cities or those which link these cities to the metro hubs. Air India Regional has 226 (including schedule charter) flight departures per week and 32 flight departures per day. Air India Regional provides connections to international stations through its hubs.

Air Costa thinking of hub-based regionals

The next regional airline – Vijayawada-based Air Costa connects nine destinations (Vijayawada, Hyderabad, Vizag, Tirupati, Bengaluru, Chennai, Coimbatore, Ahmedabad and Jaipur). At the time of writing it had a depleted fleet level of two Embraer E-190 with two E-170s having been returned to lessors recently. The company has plans of going national and would require a minimum of five aircraft and it has planned accordingly. In fact, in October 2014 during its first anniversary celebrations, its Chairman Ramesh Lingamaneni had talked about connecting regional destinations from various hubs in the other three zones. With Air Costa and the other two regional players – Air Pegasus and Trujet – Southern India seems fairly connected by regional aviation Air Costa has announced that it has got the no objection certification from MoCA for pan-India operations and that it would be starting the same in summer of 2016. The new destinations it will be connecting include Delhi, Pune, Bhubaneshwar and Varanasi.

South well connected

Air Pegasus with two ATR aircraft has on its route map the following cities – Bengaluru, Hubli, Madurai, Mangaluru, Chennai, Thiruvananthapuram and Kadapa. Turbo Megha Airways (Trujet) with one ATR is connecting Bengaluru, Chennai, Hyderabad, Aurangabad, Rajahmundry, Goa and Tirupati. And another regional airline FlyEasy which is waiting for its air operators permit has indicated that it would fly to Bhubaneswar, Goa, Guwahati, Amritsar, Surat and Pune. But if one looks at the connectivity of all these regional players, it appears that they are focused on secondary markets and these markets are not under-served, least of all un-served. None of them has shown any indication of tapping into the un-served markets. Nevertheless, if they are going to service the under-served markets, one can expect a lot more passenger movement from these cities. The need to grow these markets has been understood but then these players should have a strategy in place to tap into the market, giving competition to rail-road.

80 destinations covered

In fact, if one looks at the airline connectivity map, it is fairly impressive, connecting 80 destinations from the North to the South, from the West to the East, particularly North-East. However, the frequency of flights from some of the destinations may be limited as the airlines are in the chicken and egg syndrome. The issue is who is going to cultivate these new markets. Obviously, it has to be a joint effort, just deploying aircraft when facilities are not there seems a futile exercise.

As such the full-service airlines and the low-cost carriers, under the mandatory RDG have on their radar many small cities but at the moment they may be unprofitable routes, but the airlines need to stake it out or get aggressive in marketing. Air India connects 66 domestic destinations including Srinagar, Leh, Kullu, Amritsar, Jammu, Chandigarh, Dehradun, Pantnagar, Delhi, Agra, Jodhpur, Jaipur, Udaipur, Gwalior, Allahabad, Lucknow, Patna, Gaya, Bagdogra, Kolkata, Durgapur, Ranchi, Guwahati, Tezpur, Shillong, Silchar, Agartala, Aizwal, Imphal, Dimapur, Dibrugarh, Lilabari, Jorhat, Indore, Bhopal, Khajuraho, Varanasi, Raipur, Vadodara, Ahmedabad, Jamnagar, Mumbai, Surat, Rajkot, Aurangabad, Nagpur, Jabalpur, Bhubaneswar, Pune, Hyderabad, Bengaluru, Visakhapatnam, Port Blair, Vijayawada, Goa, Mangalore, Tirupati, Chennai, Puducherry, Tiruchirapalli, Madurai, Kochi, Agatti, Kozhikode, and Thiruvananthapuram.

Jet Airways connects 51 domestic destinations such as Ahmedabad, Aizawl, Amritsar, Aurangabad, Bagdogra, Bengaluru, Bhavnagar, Bhopal, Bhuj, Chandigarh, Chennai, Coimbatore, Dibrugarh, Dehradun, Delhi, Diu, Goa, Gorakhpur, Guwahati, Hyderabad, Imphal, Indore, Jaipur, Jammu, Jodhpur, Jorhat, Khajuraho, Kochi, Kolkata, Kozhikode, Leh, Lucknow, Madurai, Mangalore, Mumbai, Nagpur, Patna, Porbandar, Port Blair, Pune, Raipur, Rajahmundry, Rajkot, Silchar, Srinagar, Thiruvananthapuram, Tiruchirapally, Udaipur, Vadodara, Varanasi and Visakhapatnam.

And India’s number one low cost carrier, IndiGo connects to Srinagar, Jammu, Delhi, Jaipur, Chandigarh, Lucknow, Patna, Varanasi, Udaipur, Jaipur, Ahmedabad, Vadodara, Bagdogra, Guwahati, Dibrugarh, Imphal, Dimapur, Agartala, Kolkata, Ranchi, Indore, Nagpur, Raipur, Bhubaneswar, Hyderabad, Mumbai, Chennai, Pune, Visakhapatnam, Goa, Bengaluru, Coimbatore, Kozhikode, Kochi, Thiruvananthapuram,

SpiceJet’s destinations include Srinagar, Jammu, Dharamshala, Amritsar, Chandigarh, Dehradun, Delhi, Lucknow, Jaipur, Allahabad, Varanasi, Khajuraho, Udaipur, Bhopal, Jabalpur, Kolkata, Bagdogra, Guwahati, Agartala, Surat, Indore, Aurangabad, Mumbai, Pune, Hyderabad, Visakhapatnam, Rajahmundry, Vijayawada, Hyderabad, Belgaum, Goa, Hubli, Bengaluru, Chennai, Tirupati, Mangalore, Mysore, Coimbatore, Puducherry, Kozhikode, Tiruchirapalli, Kochi, Madurai, Thiruvananthapuram and Tuticorin.

GoAir connects Srinagar, Jammu, Leh, Delhi, Chandigarh, Lucknow, Jaipur, Bagdogra, Patna, Guwahati, Kolkata, Ranchi, Ahmedabad, Nagpur, Bhubaneswar, Mumbai, Pune, Goa, Bengaluru, Chennai and Kochi and Port Blair. Air Vistara routes are Delhi, Lucknow, Bagdogra, Varanasi, Ahmedabad, Kolkata, Guwahati, Bhubaneswar, Mumbai, Chennai, Hyderabad and Bengaluru. And AirAsia is networked to Chennai, Bengaluru, Kolkata, Tiruchirapalli and Kochi.

All put together, 80 destinations are covered by these players and yet many routes are unviable and the reasons for that are many. The RDG came into being to provide better connectivity to remote regions particularly the North East, Jammu & Kashmir and the Andaman & Nicobar Islands. The intention of the government is simple – connect the regions. However, it needs to incentivise the stakeholders to develop the market. It appears the government is listening.