INDIAN ARMED FORCES CHIEFS ON

OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

I am confident that SP Guide Publications would continue to inform, inspire and influence.

My compliments to SP Guide Publications for informative and credible reportage on contemporary aerospace issues over the past six decades.

Azul Connects Brazil

Azul’s rise is testimony to its success in carving out a niche for itself – the airline serves predominantly secondary markets in Brazil with Embraer E-Jets and ATR turboprops

The land area in Brazil is three times more than in India. Brazil’s land area is 8.46 million square kilometres compared to India’s 2.97 million sq km. India and Brazil are both members of the BRICS (Brazil, Russia, China, India and South Africa) nations and are emerging economies that are expected to grow rapidly in two different parts of the world. Characterised by large and well-developed agricultural, mining, manufacturing and service sectors, Brazil’s economy outweighs that of all other South American countries and Brazil is expanding its presence in world markets. Brazil is the largest country, in terms of size and population, in South America. Brazil’s aviation sector is comprised of multiple local and international airlines. Brazil has approximately 2,500 airports including landing strips. São Paulo – Guarulhos International Airport is the largest and busiest airport, with Congonhas and Campo de Marte serving as regional airports in São Paulo. TAM Airlines is the biggest Brazilian airline followed by GOL and Azul which operate regionally with some international services.

The aviation sector in Brazil, at the moment, is experiencing a slowdown. “We don’t expect an improvement for the next 24 months,” according to Eduardo Sanovicz, President of the Brazilian airlines association Abear. Azul, which has the third biggest market share in Brazil, said that the airline would cut capacity as much as five per cent, while Gol Linhas Aéreas Inteligentes SA and Latam Airlines Group SA, Brazil’s biggest airlines, have also been doing the same in recent months and postponed airplane deliveries.

Underserved Markets

Be that as it may, here in this article, the focus is on Azul Linhas Aéreas Brasileiras or simply Azul Brazilian Airlines, a lowcost carrier based in Barueri. The company’s business model is to stimulate demand by providing frequent and affordable air service to underserved markets throughout Brazil. It has positioned itself as a small-town carrier airline. Azul’s rise is testimony to its success in carving out a niche for itself – the airline serves predominantly secondary markets in Brazil with Embraer E-Jets and ATR turboprops that TAM and Gol’s narrow-body aircraft cannot operate to profitably.

Azul is the only airline serving on 70 per cent of its more than 200 routes and is the most frequent airline on 10 per cent of its routes. Azul flies 94 times weekly between Viracopos-Campinas and Rio de Janeiro Santos Dumont – its most high frequency route. This is compared with GoL’s 37 weekly flights.

TRIP Acquisition Helps

The company was named Azul (‘Blue’ in Portuguese) after a naming contest in 2008. Azul was established on May 5, 2008, by Brazilian-born David Neeleman, the founder of American low-cost airline JetBlue, with a fleet of Embraer 195 jets. The airline began service on December 15, 2008, between three cities: Campinas, Salvador and Porto Alegre. It launched operations with three Embraer 195 and two Embraer 190 jets. And in quick time, it started connecting many destinations. In 2014, Azul acquired TRIP Linhas Aéreas, the largest regional carrier in Brazil. On May 6, 2014, the merger process was completed with the final approval from Brazilian authorities. That day, the brand TRIP ceased to exist and all TRIP assets were transferred to Azul. The TRIP acquisition gained Azul strategic landing rights at São Paulo Guarulhos and Rio de Janeiro Santos Dumont airports and solidified its position in Belo Horizonte, one of Brazil’s largest cities.

Maximum Number of Cities Served

Azul creates a record by being the largest airline in Brazil by number of cities served, offers more than 900 daily flights to 106 destinations. With a fleet of 140 aircraft and more than 10,000 crew members, the company currently has a 32 per cent share of departures of the Brazilian aviation market. “70 per cent of our market is exclusive. We are growing a lot of markets that did not have air service before,” Neeleman has said.

BEGINNING AS A SMALLTOWN CARRIER, OVER THE YEARS, AZUL HAS EXPANDED ITS BUSINESS AND HAS GROWN INTO A MAJOR AIRLINE

While the airline is not currently a full member in an airline alliance, it signed a code-share agreement with Star Alliance and United Airlines in January 2014, which made it possible for MileagePlus members to earn points when flying with Azul beginning April 1, 2014. Since 2015, Azul is also an equal partner in a Brazilian-Portuguese joint venture that is the majority owner of TAP Portugal, another Star Alliance member.

International operations

Azul started its first scheduled international flights to Fort Lauderdale on December 2, 2014, and to Orlando on December 15, both in the United States. In early 2015, it was announced that Azul had signed a purchase agreement for 35 Airbus A320neo aircraft. It is also to lease a further 28 of the aircraft type. In mid-2015, Azul finalised a deal for 30 Embraer E-195 E2 aircraft (including 20 options) first announced at the 2014 Farnborough International Airshow. The first delivery is scheduled for 2020.

The Chinese HNA Group, owner of Hainan Airlines, has invested in Azul, becoming the largest single shareholder of Azul. This follows the $100 million investment of United Airlines in June 2015.

Azul serves 106 destinations in Brazil, French Guiana, the United States and Uruguay plus some other additional locations by means of dedicated executive bus services to the nearest airports. Services to Portugal will start on June 22, 2016. Azul has codeshare agreements with JetBlue, TAP Portugal and United Airlines.

Azul’s service offering features individual entertainment screens incorporating free LiveTV at every seat on virtually all its jets, extensive legroom with a pitch of 30 inches or more, two by two seating with no middle seats, complimentary beverage and assortment of 12 snacks, and free bus service to key airports including between the city of São Paulo and Campinas airport. Azul has competitive airfares, a comprehensive route network connecting 106 cities Brasil and an innovative frequent flier programme called TudoAzul.

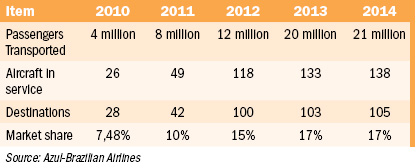

Azul’s differentiated business strategy, superior customer experience, and innovative branding are the key drivers of its continuous growth, as demonstrated by the numbers below.

Grows Cargo Business

Added to its passenger growth, Azul has continuously grown its cargo revenues too. It started cargo operations on August 17, 2009 between Viracopos, Fortaleza, Recife and Salvador airports. In November of the same year, it started door-to-door express service delivery. Azul Cargo daily operates an integrated network of aircraft, vehicles, systems and special team, enabling the exploration of new markets and opening opportunities. In 2014, Azul Cargo began scheduled flights to Fort Lauderdale and Orlando in the United States, opening up new possibilities for business with the international market.

Beginning as a small-town carrier, over the years, Azul has expanded its business and has grown into a major airline. Its business model is worthy of emulation in a country such as India which too has a vast geographical boundary.