A Year of Growth and Challenges

In 2024, business aviation demonstrated its resilience and adaptability, overcoming challenges while setting new benchmarks in connectivity and efficiency

The business aviation industry marked 2024 as a year of robust growth, technological advancements, and significant strides toward sustainability. As the sector navigated evolving demands and global challenges, it emerged as a vital player in redefining connectivity and efficiency in luxury and corporate travel.

FLEET EXPANSION AND MARKET GROWTH

The business aviation sector experienced steady growth in 2024, with a six per cent year-on-year increase in jet deliveries, according to the General Aviation Manufacturers Association (GAMA). Leading manufacturers like Gulfstream, Bombardier, and Embraer dominated the market with high-performance models such as Gulfstream’s G700 and Bombardier’s Global 7500.

The Asia-Pacific region played a significant role in driving demand, fueled by economic recovery and a growing preference for large-cabin jets capable of intercontinental travel. In response, many operators focused on fleet modernisation, replacing older aircraft with fuel-efficient models to align with stricter environmental standards and optimise operating costs.

Deliveries of Dassault Falcon business jets climbed to 31 in 2024. Dassault doesn’t provide a breakdown of which models were delivered, but the total includes the Falcon 6X, the newest jet in the French company’s stable. The backlog for Falcon jets as of December 31, 2024, is 79. Net orders for new Falcons reached 26 during 2024.

ASIA-PACIFIC DROVE DEMAND WITH A FOCUS ON INTERCONTINENTAL TRAVEL, WHILE FRACTIONAL OWNERSHIP GAINED TRACTION IN NORTH AMERICA

Embraer Executive Aviation ended 2024 with 130 executive jet deliveries, including 75 light jets and 55 medium jets. Deliveries kept pace with the company’s guidance of 125-135 business jets for the year. In the fourth quarter, Embraer delivered 44 business jets, including 22.

Bombardier announced that it has delivered the 200th Global 7500 business jet to a customer in December, 2024.

SUSTAINABILITY TAKES CENTER STAGE

Sustainability became a cornerstone of the business aviation industry’s strategy in 2024. The production of Sustainable Aviation Fuel (SAF) doubled to one million tonnes, with business aviation consuming a considerable share. Operators like Net-Jets committed to long-term SAF procurement agreements, reflecting a broader industry shift toward achieving net-zero carbon emissions by 2050 under initiatives like the Business Aviation Commitment on Climate Change (BACC).

Innovation in green technologies also gained momentum, with electric and hybrid-electric aircraft achieving key milestones. Companies like Lilium and Joby Aviation made progress in certification and production, signaling a new era of eco-friendly aviation solutions.

ADVANCEMENTS IN TECHNOLOGY

Technology continued to reshape the business aviation landscape, enhancing both operational efficiency and passenger experience. In-flight connectivity reached new heights, with Starlink’s broadband services becoming a popular choice among business jet operators. These high-speed internet solutions transformed onboard productivity and entertainment options, solidifying connectivity as a key differentiator in luxury travel.

STARLINK’S HIGHSPEED BROADBAND REVOLUTIONISED IN-FLIGHT CONNECTIVITY, WHILE AIPOWERED TOOLS IMPROVED OPERATIONAL EFFICIENCY

Additionally, advancements in automation, such as AI-powered flight planning tools and predictive maintenance systems, streamlined operations and minimised delays. These innovations not only improved reliability but also reduced operational costs, offering value to operators and passengers alike.

REGIONAL TRENDS AND EMERGING MARKETS

The dynamics of business aviation varied across regions, highlighting unique opportunities and challenges. North America retained its dominance, accounting for over 60 per cent of global business jet activity, with fractional ownership models gaining traction among new users.

(RIGHT) GULFSTREAM AND TEXTRON AVIATION ELEVATED INFLIGHT CONNECTIVITY WITH HIGH-SPEED INTERNET SERVICE ONBOARD THEIR AIRCRAFT.

Europe saw increased demand for ultra-long-range jets to support growing transatlantic travel, while the Asia-Pacific region witnessed a surge in charter services, particularly in China and India. Emerging markets in Africa and Southeast Asia also presented growth opportunities for OEMs and charter operators, further diversifying the industry’s reach.

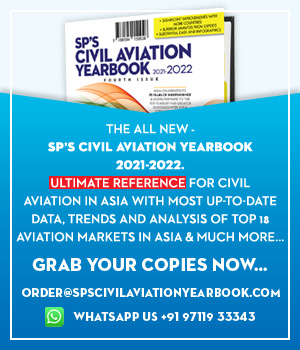

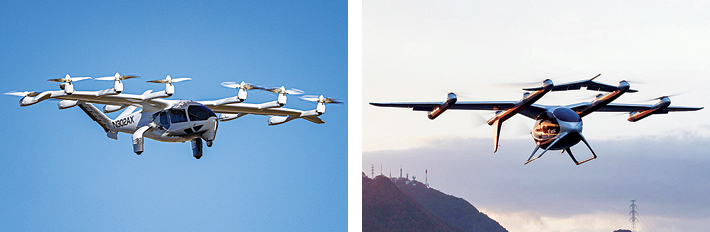

2024: A BREAKTHROUGH YEAR FOR EVTOL AVIATION

The electric Vertical Take-Off and Landing (eVTOL) sector experienced many advancements in 2024, cementing its position as a transformative force in urban and regional mobility. With milestones achieved in certification, production, and operations, eVTOLs moved closer to commercial deployment, signaling a new era in sustainable air transportation.

- eVTOL Market Expansion and Investment: The eVTOL industry witnessed significant growth in 2024, fueled by increased investment and strategic partnerships. Major players like Joby Aviation, Archer Aviation, and Lilium secured substantial funding, with Joby’s manufacturing facility in California and Archer’s operations in Georgia ramping up production capacity.

Asia-Pacific emerged as a key growth region, with countries like Japan and South Korea announcing large-scale urban air mobility (UAM) projects. In the United States, several cities, including Los Angeles and Miami, partnered with eVTOL developers to integrate UAM networks into existing transportation systems. - Certification Milestones: Certification remained a primary focus for eVTOL manufacturers in 2024. Joby Aviation achieved a major breakthrough by obtaining FAA Special Airworthiness Certification for its prototype, while Lilium advanced toward EASA approval for its electric jet. These milestones marked critical steps in meeting safety standards and moving closer to commercial operations.

Additionally, regulatory bodies like the FAA, EASA, and India’s DGCA collaborated with industry stakeholders to establish comprehensive frameworks for eVTOL certification and operations, ensuring global standardisation and safety. - Operational Readiness and Test Flights: Test flights in 2024 showcased the viability of eVTOL technology for diverse applications. Joby completed its first crewed test flight, demonstrating its aircraft’s efficiency and reliability, while Archer conducted successful trials of its Midnight eVTOL in urban environments.

Cargo-focused eVTOLs also gained traction, with Beta Technologies completing multiple test flights of its ALIA-250 aircraft. These trials underscored the potential of eVTOLs for logistics, particularly in last-mile delivery and remote area connectivity. - Sustainability and Technological Advancements: Sustainability remained central to eVTOL development, with manufacturers leveraging renewable energy sources and advanced battery technologies to minimise environmental impact. Significant progress was made in enhancing battery efficiency, extending flight ranges, and reducing charging times, ensuring eVTOLs are aligned with global decarbonisation goals.

Integration of autonomous technologies also gained momentum, with companies like Wisk Aero and EHang focusing on pilotless eVTOL systems to increase efficiency and reduce operating costs. - Regional Trends and Infrastructure Development: Globally, cities continued to prepare for eVTOL integration through the development of vertiports and charging infrastructure. Europe led the way, with projects in Paris and London nearing completion in anticipation of commercial services during the 2024 Olympics and beyond.

In the US, urban air mobility corridors were identified in major metropolitan areas, supported by public-private partnerships to fund infrastructure. Asia-Pacific nations invested heavily in UAM, with South Korea’s “K-UAM Grand Challenge” and Japan’s eVTOL networks garnering significant attention.

KEY INDUSTRIAL DEVELOPMENTS

Several key market trends are driving the demand for eVTOL aircraft, including the rise of urban air mobility (UAM), the push for sustainable transportation, and the increasing interest from both private and public sectors. The rise of urban air mobility, driven by the need to alleviate traffic congestion and improve transportation efficiency in cities, is boosting demand for eVTOL aircraft that can provide fast and efficient shortdistance travel. Additionally, the increasing interest from both private companies and public authorities in developing and deploying urban air mobility solutions is driving investment and innovation in the eVTOL aircraft market. These trends are shaping the future of urban transportation, driving the growth of the eVTOL aircraft market. Here are some of the key developments and highlights from the eVTOL industry as the year 2024 came to a close.

German eVTOL developer Volocopter filed for insolvency on December 26 but remains committed to achieving EASA type certification for its VoloCity aircraft by 2025, with ongoing flight tests progressing steadily. Meanwhile, fellow German pioneer Lilium reached a provisional agreement with Mobile Lift Corporation for asset acquisition, potentially reviving its six-seat Lilium Jet programme in 2025 despite insolvency-related challenges. Efforts to secure new backers, including talks with Saudi investors, continue.

Vertical Aerospace secured $50 million in funding from Mudrick Capital and converted $130 million of debt to equity, providing financial stability to advance its VX4 aircraft development. Similarly, Beta Technologies announced a deposit-backed order from New Zealand Air Ambulance Service for two Alia 250 eVTOL aircraft, with options for 10 more, targeting aeromedical operations in 2028.

US-based Archer Aviation completed its Georgia factory, preparing for production of its Midnight eVTOL in 2025. The company also launched a defense-focused business unit, partnering with Anduril Industries to develop hybrid VTOL aircraft for the US Department of Defense. Rival Joby Aviation expanded its manufacturing footprint, showcased its eVTOL in South Korea, and advanced FAA certification efforts for its JAS4-1 aircraft, while laying groundwork for air-taxi services in Dubai and Abu Dhabi.

Dubai emerged as a key player, granting Joby Aviation exclusive eVTOL rights and progressing on vertiport construction with Skyports. Abu Dhabi struck a deal with Archer Aviation to locally manufacture the Midnight eVTOL, signaling the UAE’s ambition to lead the advanced air mobility sector.

Elsewhere, Eve Air Mobility expanded its footprint, securing commitments for up to 50 eVTOLs from Helicopters Inc. and additional funding from Brazil’s National Development Bank. AutoFlight demonstrated its Prosperity aircraft in Japan, emphasising opportunities for regional connectivity, while the Dubai-based Ambitious Air Mobility Group finalised an order for eight Lilium Jets to launch eVTOL air services in Europe.

Textron Aviation contributed to the electrification movement with deliveries of four Cessna Grand Caravan EX aircraft to Surf Air Mobility, supporting the development of hybrid-electric powertrains. Meanwhile, Nimbus Aerospace achieved a milestone with the maiden flight of its scaled demonstrator for the N1000 electric business jet, targeting service entry by 2032.

As the eVTOL industry grapples with financial challenges and technical milestones, 2024 showcased its resilience and potential to revolutionise urban and regional mobility.

RESILIENT DEMAND DRIVES BUSINESS AVIATION GROWTH

Business aviation demand remains robust post-pandemic, particularly in the United States, where activity significantly surpasses 2019 levels. December 2024 closed on a high note, with fractional operators achieving substantial growth compared to the past five years, despite a decline in corporate flight department activity. In Europe, demand remains steady, albeit with only modest gains compared to pre-COVID 2019.

Globally, through 2024, 3.6 million business jet flights were recorded—a 1 per cent decline from 2023 and 2022, yet 59 per cent higher than 2020 and 30 per cent above 2019. Notably, December 2024 activity exceeded the prior year by seven per cent. Fractional operators led with nearly 7,00,000 flights, their highest in five years, while corporate flight departments recorded an 11 per cent decline from 2023 and 12 per cent below 2019 levels.

Bombardier’s market forecast for 2023–2033 underscores the sector’s growth trajectory, projecting 22,000 business jet deliveries in segments where the company competes. This translates to an estimated industry revenue of $617 billion, highlighting robust demand and evolving market dynamics in private aviation over the next decade.

INNOVATIONS TRANSFORMING PRIVATE JET TECHNOLOGY

Private jet technology has undergone transformational advancements, redefining business aviation with innovations in design, efficiency, and safety.

Modern private jets now feature smart cabins with seamless Wi-Fi connectivity, advanced entertainment systems, and ergonomic seating for enhanced passenger comfort and productivity. These luxurious interiors offer a personalised experience that blends technology with sophistication.

Fuel efficiency has seen significant improvements through advancements in aerodynamic design, modern engines, and the adoption of Sustainable Aviation Fuel (SAF). These innovations, alongside the exploration of hybrid and electric propulsion systems, reflect the industry’s commitment to sustainability.

State-of-the-art avionics, including ADS-B technology, have elevated flight safety by enhancing situational awareness and collision avoidance. Together, these advancements mark a new era of innovation in private aviation, setting benchmarks for luxury, efficiency, and environmental responsibility.

The year 2024 also witnessed several key events including the Farnborough, NBAA, EBACE, MEBAA and others, dedicated to business aviation as well as global events like the Paris Olympics that boosted BizAv activity. However, nationally in India, a lot of work remains in terms of policy, and implementation.

CHALLENGES AND OPPORTUNITIES

Despite its growth, the business aviation sector faced persistent challenges in 2024. Supply chain disruptions continued to cause delays in aircraft deliveries and parts availability, impacting production schedules. Regulatory changes, especially stricter noise and emissions standards in Europe, prompted fleet upgrades and operational shifts to meet compliance requirements.

On the brighter side, these challenges opened avenues for innovation. The demand for sustainable and technologically advanced aircraft grew, driving the development of next-generation solutions. Infrastructure expansion, including new Fixed Base Operators (FBOs) and maintenance facilities, supported the industry’s evolution, ensuring better connectivity and service delivery.

As the business aviation sector moves into 2025, optimism abounds. The focus on sustainability, technological innovation, and emerging markets positions the industry for continued growth. With rising interest in subscription-based models and on-demand charters, the sector is poised to redefine the future of luxury and corporate travel.

In 2024, business aviation demonstrated its resilience and adaptability, overcoming challenges while setting new benchmarks in connectivity and efficiency. As it charts a path forward, the industry’s commitment to innovation and sustainability ensures it will remain a vital component of global mobility for years to come.