Move Towards All-Synthetic SAF

Initiatives Drive Production of Neat SAF, Paving the Way for Cleaner Aviation

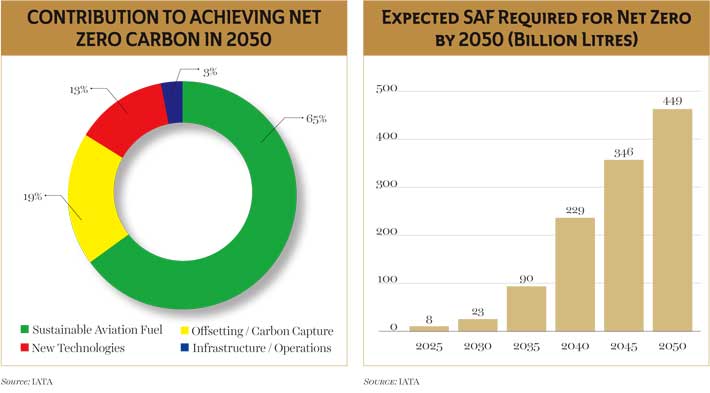

Multiple initiatives to spur production of Sustainable Aviation Fuel (SAF) will soon lead to greater availability to business aviation operators. Even as today’s SAF blends come into their own, engine manufacturers and airframe OEMs are already looking to the next generation of “neat” SAF, free of all fossil fuels, for aviation use.

WHAT IS SUSTAINABLE AVIATION FUEL?

Sustainable Aviation Fuel (SAF) is a low-carbon synthetic jet fuel that can be used safely in any turbine-powered aircraft. Derived from sustainable feedstocks – including cellulosic biomass, wastes and residues, waste steel mill gases and captured CO2 – SAF potentially can reduce lifecycle greenhouse gas (GHG) by up to 80 per cent compared to conventional jet fuel and is considered pivotal to achieving the aviation industry’s goal of a 50 per cent net reduction in CO2 emissions in 2050.

While the availability of SAF at FBOs around the country continues to grow, additional supply at a competitive price is critical to achieving industry sustainability goals, with a goal of reaching a production capacity of 3 billion gallons by 2030.

Currently, SAF is typically comprised of 30-50 per cent fuel derived from renewable feedstocks, with regular, petroleum-based jet fuel filling the balance. However, testing indicates SAF completely derived from those same feedstocks can be used in jet engines without blending with any petroleum-based jet fuel.

Gurhan Andac, Engineering Technical Leader for aviation fuels and additives at GE Aerospace, noted no performance limitations or additional maintenance requirements with neat SAF. “Once we qualify unblended SAF as a drop-in fuel it will be reidentified as ASTM D1655 Jet A/A-1 fuel just as the blends of today; then we’ll be able to utilise SAF’s full sustainability potential,” he said.

“SAF is essential for the decarbonisation of long-range travel,” added Stefan Wriege, Head of External Communications for the Business Aviation unit at Rolls-Royce. “By the end of this year, all our production engines will have proved compatibility with 100 per cent SAF. A few last tests are still outstanding, but we don’t anticipate any surprises.”

On the airframe side, Gulfstream Aerospace was an early adopter of blended SAF in its corporate and flight test operations and has flown its G650 on neat synthetic fuel. “We want to set the stage that today’s aircraft are ready for pure, drop-in SAF,” said company Staff Scientist/Technical Fellow Charles Etter.

SAF USE GAINING TRACTION

Advocates of Sustainable Aviation Fuel (SAF) say the environmentally friendly alternative to conventional Jet A is gaining traction in the business aviation industry, despite its cost and limited availability.

“SAF is finally starting to get some momentum,” says Darryl Young, Director of Trip Support at AEG Fuels and a member of the NBAA Environmental Subcommittee.

In fact, pure SAF – known in the industry as “neat SAF” – has the potential to reduce lifecycle greenhouse gas emissions by up to 80 per cent compared to conventional jet fuel. Business aviation sees it as a cornerstone of its unified plan to achieve net-zero carbon emissions by 2050.

BUSINESS AVIATION IS SPEARHEADING THE ADOPTION OF SAF, VIEWING IT AS A CORNERSTONE IN THE JOURNEY TOWARDS ACHIEVING NET-ZERO CARBON EMISSIONS BY 2050

“It’s the only tangible thing we have right now,” says Erik Dagley, who flies and handles sustainability issues for a California-based global technology company with a fleet of three intercontinental aircraft. “The product is better for the world,” says Dagley. “People who have had no interest before now are interested.”

Virtually identical to Jet A in terms of engine performance, SAF is made from non-petroleum-based renewable feedstocks such as fats, greases and cooking oils.

A Chief Pilot at a large business aviation operator based in the West Coast of US says his company wants “to be contributors toward purchasing more SAF, which ultimately will create demand and drive down the premium per gallon over time.” He says his department typically uploads a 30 per cent SAF blend at its base airport to fuel shuttle flights and pays a premium of $1.50 to $2.00 per gallon to do so. What many may not know is that airports have no way of separating out that true blend for individual uplifts, so operators who aren’t paying for SAF are getting it anyway. “This creates confusion,” he says.

Aircraft OEMs provide their customers with SAF information resources and guidance so “there’s a constant flow of information,” says AEG’s Young. AEG provides support to operators wanting SAF through its trip planning services. Also, the sustainability solutions program 4AIR offers an updated interactive map showing airports that offer SAF. Another option for operators wanting to purchase SAF where it’s not available on site is called book-and-claim. Book-and-claim uses a system of credits to essentially allow operators to purchase SAF that’s located somewhere else. For more information, ask about the book and claim option at FBOs.

To give the industry a boost, lawmakers in the US and Europe have passed legislation aimed at increasing SAF production. A US blenders tax credit went into effect last January, making SAF producers eligible for a $1.25 per gallon credit for each gallon of SAF sold. A newly passed law in the European Union mandates that 2 per cent of all fuel delivered to EU airports must be SAF beginning in 2025, rising incrementally to 70 per cent by 2050.

Meanwhile, SAF availability is expected to remain challenging until production ramps up. “Demand is there,” says Young. “We just don’t have enough of it to go around.”

ALL-SYNTHETIC SAF

The industry is also looking even further ahead toward paraffinic-only fuels produced from hydroprocessed esters and fatty acids (HEFA-SPK) in unblended form. These fuels are free of aromatics, which help aged nitrile-based engine and fuel system seals expand adequately to prevent leaks, but are also a significant source of particulate pollution.

While most modern aircraft engines now use non-nitrile seals, other components in aircraft fuel systems may require modification to safely use HEFA-SPK fuels. Etter noted positive results in tests conducted by Gulfstream on an unmodified G650 flown on a 90 per cent HEFA-SPK blend with 10 per cent aromatics added, with no leaks, so the potential is there.

DESPITE COST CONSIDERATIONS, INDUSTRY LEADERS RECOGNISE THAT SAF IS A TANGIBLE AND CRUCIAL STEP TOWARDS A MORE SUSTAINABLE FUTURE FOR AIR TRAVEL

“From an engine maker’s perspective, we would love to have nonaromatic fuels available that burn much cleaner and with much less emissions,” added Frank Moesta, Senior Vice President of Strategy and Future programs for Rolls-Royce. “We are working diligently to identify what measures are necessary to certify (HEFA-SPK fuels) so we can realise these great environmental benefits.”

“Sustainability is a key focus for industry and our company,” added Scott Evans, Gulfstream’s Director for Demonstration & Corporate Flight Operations. “Our role in that effort is to provide resources (to SAF producers) to help open that envelope even larger.”

GE’s Andac emphasised the importance of business aviation remaining at the forefront of such efforts. “Utilising SAF is very doable and is becoming more economically feasible,” he concluded. “I certainly encourage the business aviation segment to continue its adoption of SAF and give the signal to the industry.”

CONCLUSION

The aviation industry’s pursuit of Sustainable Aviation Fuel signifies a monumental step towards a more sustainable and environmentally conscious future. The transition to all-synthetic SAF, along with ongoing initiatives to increase production capacity, promises a cleaner, greener aviation landscape. With continued dedication and collaboration, the business aviation sector is poised to lead the way in achieving these essential sustainability goals.