INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- Indian Air Force Aims for Full Indigenous Inventory by 2047 — Air Chief Marshal A.P. Singh

- Rajnath Singh assumes charge as Defence Minister for the second consecutive term

- Interim Defence Budget 2024-25 — An Analysis

- Union Defence budget 2024

- Prime Minister Modi Flies in the LCA Tejas

- New Chapter in India-Italy Defence Ties

- Airpower beyond Boundaries

Airline Fleet Strategies: The Embraer Way

Brazilian aerospace major Embraer which is making substantial headway in regional aviation globally has been in the forefront of strategising not just for itself but also for airlines. In sync with this philosophy, Embraer released at the Paris Airshow, ‘The New Metrics of Success’ which provides fresh perspectives on airline fleet strategies. The report is dedicated to helping airlines confront and overcome the challenges of the aviation sector.

The report begins with remarks from Warren Buffett who at a Berkshire Hathaway meeting said “investors have poured their money into airlines for 100 years with terrible results.” Endorsing this somewhat, Embraer said that investing in airlines has commonly resulted in disappointment for shareholders - at least partly because of challenges inherent to the business.

Making a point, Embraer points out that the airline seat is among the world’s most perishable goods. Once the aircraft door is closed, all empty seats accumulate as waste. Hence, some airlines sell them at a very low cost to avoid their being flow empty, thus diminishing the airline’s revenue potential.

So the question is: how can the airline industry provide better returns for investors? Embraer believes such financial success is already emerging from a well-executed business strategy focused on the quality of revenue to boost results. And, from its global perspective, it is clear that the 70 to 130 seat segment can help bring sustainable profitability to the industry.

Pitching 70 to 130

A little over a decade ago, Embraer published “The Rule of 70 to 110” — a rationale for a lower seat count that would help carriers rightsize their capacity to match demand. It was the premise behind its E-Jet family of four. And now, with over 1,000 of them delivered and serving every continent, it is clear the rationale behind “The Rule” was right. A second generation of E-Jets redefines its segment as 70 to 130 seats. “But the essence of our original vision endures, even though the dynamics of our industry have changed. A key example is the now-common focus of airlines on lower unit costs as a strategic advantage in the aggressive pursuit of market share.”

Embraer believes unit profit and return to shareholders are better measures of success. Accordingly, it supports the use of a new metric in conjunction with traditional measures: Return on Aircraft Assets (ROaA), as distinguished from conventional ROA. This, Embraer believes, will be an increasingly important indicator for aircraft evaluation.

From marketshare to shareholder returns

In the competitive environment that emerged since E-jets were introduced, many airlines focused on lower unit costs as a strategic goal. Those carriers exalting cost per seat as their main metric have been left with no choice other than to reduce unit cost, in order to accommodate lower unit revenue, and then see their earnings erode. One result: a lack of service differentiation leading to partial commoditization of air travel.

Empowered passenger

In parallel, dramatic changes in technology brought new levels of transparency that also changed consumer behavior. With the benefit of online search engines, access to fare and seat availability has uncloaked the complexity of ticket-price categories. Consequently, consumers can pay for the products and services they value most. Their bargaining power is greater than ever before.

Vicious cycle

Some airlines in search of the lowest unit cost increased capacity and additional seats, which had to be sold at a lower price. As competition followed suit, market share battles began, which added more pressure to reduce unit costs, increase capacity, and therefore to lower prices even further. Lower costs brought lower revenues and not necessarily higher earnings — leading to a vicious and unhealthy cycle, the report noted.

To achieve positive margins, in hopes of escaping the vicious cycle, airlines have pursued ancillary revenue sources by unbundling and selling services that once were included in the ticket price. Ancillary revenue can increase profits and in some cases can mean the difference between profit and loss. But it is clear that the revenue boost isn’t always enough to ensure success. Which means the best strategies will seek maximum total revenue per passenger by maximizing both average fares and ancillary revenues.

Largely because of intense competition and inherent challenges, average airline returns are seldom higher than the industry’s cost of capital. The current trend of improvement in returns is being driven by fundamental changes in management behavior rather than by desperate cost-cutting. High asset performance is key to sustainable profits. “When you fly an airplane optimally sized to the market, the Return on Aircraft Assets (ROaA) can be impressive. And ROaA is a more meaningful framework for making fleet decisions than unit cost.”

Measuring performance

When it comes to almost everything that can be bought or sold, prices are seldom the same. Consider the difference in price for a bottle of water sold in an upscale restaurant versus in a supermarket. The explanation is willingness to pay; people place different value on the same service. When it comes to air transportation, there are fewer passengers willing to pay more, and more passengers willing to pay less, for the same seat. Airlines adapt to capture the value they create for various passengers by creating different fare classes, as in the following example.”

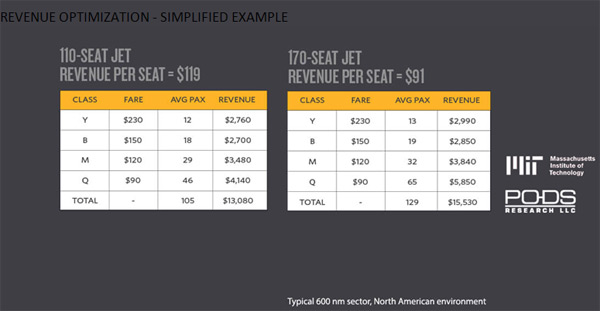

In this comparison between a 110-seater and 170-seater, based on a simplified example of revenue optimization, a market-share-driven strategy would welcome additional passengers attracted by price incentives, yet overall yield would be diluted since excess capacity would be allocated to the lowest fares. On a leg basis, a smaller airplane will have higher revenue per seat than a bigger one. The magnitude of this difference will depend on individual market factors, but simulations run by MIT and PODS Research (USA) indicates that a 30 per cent advantage for the smaller aircraft is widely applicable to our example of 110-seater vs. 170-seater. Subtracting cost per seat from revenue per seat yields profit per seat, mostly higher for the 110-seater.”

Embraer’s vision is that as airlines mature, and are listed in public markets, and as shareholders expect information to compare investment alternatives, return on capital employed measures will be even more widely used. Following this trend Embraer believes that Return on Aircraft Assets (ROaA) is an adequate way to measure asset performance and it can be extremely useful to airlines to gauge the efficiency of aircraft asset allocation, and whether shareholder value is being built. “We invite you to examine the merits of switching the investment criteria from a cost per seat perspective to profit per seat and ROaA maximization. In doing so, you’ll be bringing your asset performance into sharper focus.”

There is only one way to increase unit revenue and load factor at the same time: it is by flying an airplane with appropriate capacity — through proper capacity management. A rightsized aircraft can catalyze revenue management and capacity allocation systems by better accommodating demand variations and maximizing yield. In doing so, airlines can increase unit profit and ROaA — a virtuous cycle that results in sustainable profitability. At Embraer, we stand by our 70 to 130 seat segment. And we encourage you to evaluate how both the current and next generation of E-Jets can improve your earnings and provide a better return on aircraft assets.”

Seizing opportunity

The report said that the E-Jets fit seamlessly with the new metrics of success. And that’s true for current models as well as for E-Jets E2, the next generation. Our continued investment in the original E-Jet family has resulted in now-available improvements such as new avionics functionalities, up to 6.4 per cent savings in fuel cost, and longer service intervals. And now the second generation signals even higher achievement than the first.

Like the original family, E2 was designed to be the best business-oriented solution for the segment — not simply an exercise in technology. Supported by a broad customer base, active on all continents, the E2 program represents a low-risk investment for airlines and the financial community. The modular E2 cabin facilitates the pursuit of premium-fare passengers without sacrificing the budget-sensitive. To further enhance the first-generation benchmark, the E2 includes several innovations unique to its segment. About 30 per cent larger overhead bins allow all passengers to stow their carry-on bags. Individual Passenger Service Units (PSUs) emphasize the sense of personal space. A flexible 0.5” pitch adjustment in economy optimizes the use of the cabin. And a new staggered seat configuration in the premium cabin allows for individual seats and vastly enhanced legroom. Special attention has been given to leasing-company requirements for a very liquid asset. For example: predefined structural and electrical provisions for the most common options, modular cabin monuments, and a first class staggered-seating option that uses the same bins and seat tracks as the economy class.

Life cycle cost

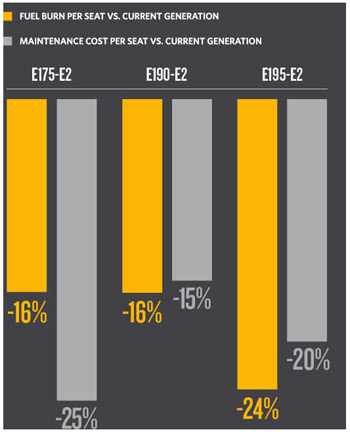

Embraer said that the E2 brings the E-Jet family to a new level of efficiency with double-digit reduction in fuel burn and maintenance costs in all three models - further contributing to unit profit differentiation in comparison with other aircraft. Reduced life cycle cost is also facilitated by its global services and support network, which includes 37 service centres and a central customer care centre that provides prompt response mechanism for a full range of needs, including: field and technical support; material and spare parts; flight and maintenance operations consulting; aircraft upgrades and modifications; comprehensive crew and personnel training and technical publications and eSolutions.

New economics

“At Embraer, we have spent more than 40 years designing and manufacturing some of the world’s finest aircraft — all emerging from our interpretation of industry needs based on keen observation of the marketplace. Today, we continue to believe passionately in the potential of lower seat counts as part of a strategy for higher profits and returns. The economic viability of a commercial aircraft once in service comes down to the airline’s ability to continually sell enough seats on that aircraft — and at high enough fares — to generate an acceptable return on the investment. This fundamental new metric of success — Return on Aircraft Assets (ROaA) — is a meaningful measure to consider as airlines transition from pursuit of market share to a focus on higher shareholder returns,” the report concludes.