INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

BizAv’s Flourishing Rebound Bids Adieu to 2021

With 3.3 million flights from January through December, business jet traffic was 7 per cent higher than in 2019

In the midst of new variants continuously entering the scene; festive celebrations; international events, ease of travel restrictions and holidays’ revival; the global travel scenario is a fluctuating graph right now. Even though speculations about the pandemic and uncertainty greeted us at the end 2021, business aviation industry seems to have had the sun shining brighter on its side.

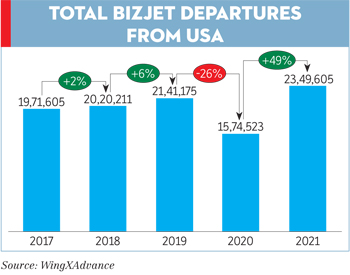

Global data management and analysis company, WingX Advance noted that business aviation flourished in 2021, with a very strong rebound. Business jets flew more sectors worldwide in 2021 than in any previous year on record. With 3.3 million flights from January through December, business jet traffic was seven per cent higher than in 2019, the previous high point for global business jet demand, WingX noted.

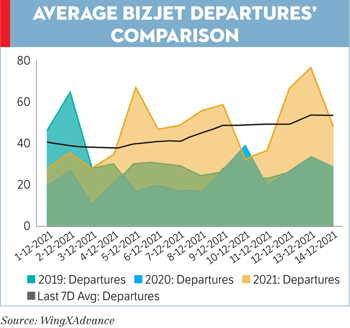

Mid-December, business aviation demand was going through a lot of variety geographically, mainly because of the contrast in the renewed restrictions around the Omicron variant. However, towards the end of the month, business jets and turboprops globally had flown 3,10,914 sectors in December 2021, up 30 per cent on December 2020 and noting seven per cent more activity than in December 2019. The month of December also witnessed 23 per cent more sectors taking flight than December two years ago. This led to comparable growth being at its highest in the last month of the year. Cargo operations showed similar resilience to business jets during 2021, with dedicated cargo sectors up 8 per cent compared to 2019.

WingX reported business jet activity outside North American and European regions constituting a small minority of the global total, with around 200,000 sectors representing around six per cent of worldwide activity in 2021. There was substantial growth compared to pre-pandemic trends, with 28 per cent more business jet flights operated than in 2019. The trends were diverse regionally, with Asia getting modest growth in business jet traffic, buoyed up in India and Australia, but stunted in China, especially in the latter half of the year. The Middle East saw some of the strongest growth in business jet demand in 2021, notably in the United Arab Emirates, sectors up by 73 per cent compared to 2019, contrasting with very modest growth in Saudi Arabia. Elsewhere, Brazil, Nigeria and Egypt saw much more activity in 2021 than in 2019.

REASONS FOR THE RISE

- A major share was due to the increasing demand from the second quarter onwards, characterised by leisure demand, unleashed as travel restrictions loosened.

- In addition to that the extended downtrend in scheduled airline capacity. (Scheduled airline passenger traffic was down by 28 per cent versus December 2019, in line with the full year trend).

- These accompanied by the relentless hygiene concerns around new variants of the novel coronavirus have been identified as reasons that have migrated business aviation services to many new customers.

- The Holiday season almost acted as the cherry on the cake. Over the holiday period (December 20 – January 2), business jets flew 1,27,000 sectors, 41 per cent more than in the same period two years ago.

- Some international events that took place physically especially the Dubai Expo; Dubai Air Show, etc also helped with the demand.

CHRISTMAS AND NEW YEAR HOLIDAYS REVIVE BIZAV IN MOST REGIONS

In North America, including Mexico and Canada, business jets flew six per cent more sectors compared to 2019. The demand was fuelled by the United States (US) market where business jet activity was 10 per cent higher than 2019, contrast neighbouring Canada, which saw 24 per cent fewer sectors than two years ago.

The rebound in business jet demand in the US came from Fractional and Branded Charter operations

The North American region witnessed 1,65,000 business jet departures by the 23rd of December. The US is the busiest business jet market in the region, with sectors flown up by 11 per cent, flight hours up 15 per cent, both with reference to December 2019. Five of the top 15 countries in North America are still trailing December 2019, the biggest being Canada.

The rebound in business jet demand in the US came from Fractional and Branded Charter operations, respectively up by 20 per cent and 18 per cent compared to full year 2019. Private and Corporate Flight Departments noted a more modest recovery in activity but nonetheless surpassed comparative 2019 activity by the end of 2021. The high points in business jet demand in the US showed up in holiday periods and were geographically concentrated around leisure destinations. Demand was exceptionally high during the Christmas and New Year period; between December 20 and January 2, business jets in the US flew 46 per cent more sectors than in 2019. Relatively, scheduled airline traffic was still 16 per cent adrift of the same holiday period in 2019.

Despite the hesitate recovery of European economies from lockdown, business jet activity in the region clearly surpassed 2019 levels, with five per cent more sectors flown by year-end. As in the US, business jet demand peaked during the Christmas and New Year holiday period in Europe too, with 30 per cent more sectors flown than during the same period two years ago. Demand was variable geographically, with the three largest markets, France, Germany and the UK, ending the year still some way short of 2019 in terms of sectors flown. In contrast, Italy and Spain saw the strongest rebound in the EU in 2021, reflecting robust leisure demand. Russia and Turkey, with large domestic markets and looser travel restrictions, both saw consistently very strong increases in business jet sectors, up by a quarter compared to two years ago. Spain continued to see a very strong demand for business jet traffic, flights up by 35 per cent vs 2019. Portugal and Greece also continued with a very strong growth spree in the last month of 2021. Despite being the country where Omicron was first identified, South Africa witnessed a doubling in business jet traffic during December 2021 compared to December 2019.

Despite being the country where Omicron was first identified, South Africa witnessed a doubling in business jet traffic during December 2021 compared to December 2019

Outside Europe and the US, December 2021 proved to be a strong month for business jet activity, with sectors up by 33 per cent compared to December 2020, up 15 per cent versus December 2019. Canada, trailing two years ago December by nine per cent, and China, down by 32 per cent, were the only top 10 countries with a deficit compared to pre-pandemic. Growth vs December 2019 has exceeded 40 per cent from India, Saudi Arabia, and flights are up more than 50 per cent this month in Brazil and UAE. UAE business jet connections with France, Russia and Saudi Arabia are more than double where they were in December 2019.

JET SEGMENTS

Most of the increase in activity came from Private Flight Departments and Aircraft Management Companies. WingX also reported that within the US market, the busiest jet segment in 2021 was light jets; with 6,62,000 sectors flown, almost one million flying hours operated, and traffic gone up by 15 per cent compared to 2019. The super midsize segment saw the largest growth in sectors compared to 2019, up 18 per cent. The Challenger 300 was the busiest business jet type, with 1,79,000 sectors operated, up 12 per cent on the active fleet in 2019. Ultra-Long Range jet activity was well behind pre-pandemic levels during 2020 and the first half of 2021, but by the end of the year, sectors flown had nosed ahead of 2019, even if hours operated were still seven per cent down on two years ago. Across the European region, the standout growth came in the lightest cabins with the very light jet sectors going up 22 per cent in 2021 vs 2019.