INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Dragon Flexes its Muscle

China is the world’s second largest air transport market and its civil aviation authority has given substantial importance to development of regional airlines, regional airports and network

The 12th Five Year Plan (2011-15) of China had set ambitious targets for the civil aviation sector with investments totalling $230 billion. It was forecast that these investments would be required to address the growing transportation needs of the country with air passenger traffic expected to reach 450 million and the number of airports to exceed 230. The plan period is just over and it remains to be seen what the achievements have been.

There is no doubt whatsoever that China has invested substantially in developing multi-modal transportation network, understanding how crucial it is for economic development. China is the world’s second largest air transport market and the civil aviation authority has given substantial importance to development of regional airlines, regional airports and network.

According to aircraft manufacturers, China holds enormous promise. Brazilian aircraft manufacturer Embraer has stated that the next one to two decades will witness the golden era in the development of China’s transport industry and regional aviation will be intrinsic to this development.

According to Guan Dongyuan, Senior Vice President, Embraer and President, Embraer China, “Regional aviation will play a more significant role in boosting economic development and restructuring, particularly with more regional airports coming online in central and western China. Since the official launch of the ‘Essential Air Service Programme’ and the gradual implementation and improvement of subsidies and policies supporting regional aviation development, the sector is assured of a promising future.”

A report on civil aviation said that revenue passenger kilometres (RPKS) grew more than 11 per cent annually from 2004 to 2014. The total number of passengers carried in 2013 was 354 million and accounted for one-ninth of the world volume. In 2013, civil aviation posted a profit of Chinese Renminbi (RMB) 24.81 billion, of which RMB 16.24 billion was attributed to airlines. By the end of 2013, there were 31 airlines. Six of those airlines operated regional aircraft with 100 or fewer seats. According to statistics from the Civil Aviation Administration of China (CAAC), there were 111 regional airports nationwide in 2005 and 160 in 2013. The number of regional routes increased from 568 in 2005 to 1,512 in 2013. The number of flights on regional routes increased by 17 per cent annually and on trunk routes it was 11 per cent.

The current overall domestic demand suggests huge untapped potential for regional aviation. Tianjin Airlines, the largest regional airline in China, had a fleet of 50 E190s and 23 ERJ-145s as of July 2014. Tianjin Airlines has had four consecutive years of profits in its balance sheet and its net profit exceeded RMB 200 million in 2013.

Tianjin Spreading Wings

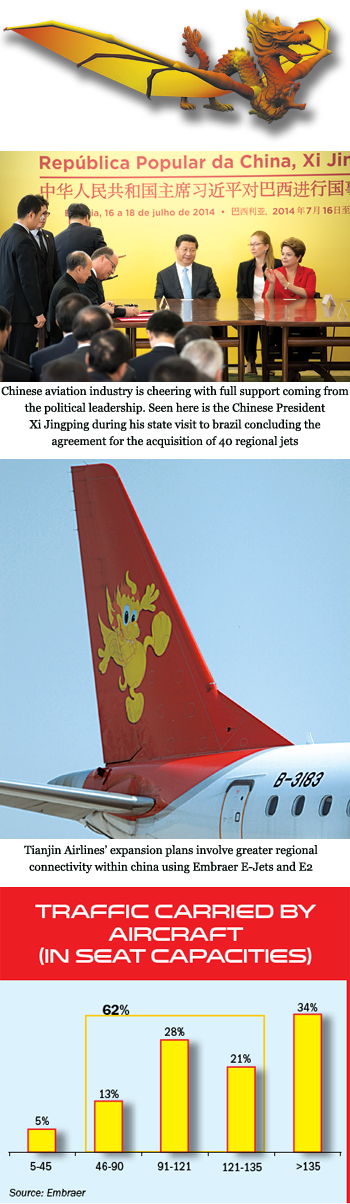

In July 2014, the parent company announced the acquisition of an additional 20 current generation E-Jets, the first of which will be delivered in 2015, and 20 next-generation E2s. The airline will start receiving its E2s in 2018. Tianjin Airlines is the first Chinese carrier to operate the E2. The agreement was concluded during a state visit to Brazil by Xi Jingping, the President of China.

Formerly Grand China Express Air, Tianjin is a regional airline headquartered in Tianjin Binhai International Airport passenger terminal building, Dongli district, Tianjin, in China operating domestic scheduled passenger and cargo flights out of Tianjin Binhai International Airport, in the north-east region of China. Tianjin Airlines, launched in 2007, operates a fleet of 74 planes and services 63 individual destinations. It is a subsidiary of Grand China Air Company Ltd.

The current overall domestic demand suggests huge untapped potential for regional aviation in China

The airline was established in 2004 in an effort to merge the major aviation assets of Hainan Airlines, China Xinhua Airlines, Chang’an Airlines and Shanxi Airlines, and received its operating licence from the CAAC in 2007. Scheduled flights were launched under the brand name Grand China Express Air, using 29 to 32-seat Dornier 328-300 jets. At that time, the company was China’s largest regional airline, operating on 78 routes linking 54 cities. On June 10, 2009, the name of the company was changed to Tianjin Airlines.

As of this year, it is connected to 95 destinations excluding those operated on behalf of Hainan Airlines. The airline intends to fly on more than 450 routes linking at least 90 cities, taking more than 90 per cent of the domestic regional aviation market.

Tianjin Airlines fleet consists of 85 aircraft with an average age of 4.1 years — 12 Airbus A320; 23 Embraer ERJ-145 and 50 Embraer 190. Additionally, Tianjin Airlines operates 11 Dornier 328 aircraft which are owned by Hainan Airlines.

Not just Tianjin, but other airlines too are seeing the opportunities. There is a trend towards wider use of smaller aircraft by carriers with the local governments pushing to promote their economies. For instance Hebei Airlines has four E190 LRs and three on order, while China Southern Airlines is leasing 20 E190s to operate in Xinjiang region.

At the end of 2013, there were 2,179 aircraft in China’s civil fleet of which 164 were regional, including 75 E190s, 43 ERJ-145s, 29 CRJs and 17 Modern Ark 60s, accounting for 8 per cent of civilian aircraft fleet. The overall number of regional aircraft is too small to meet the rapid development of China’s regional aviation industry.

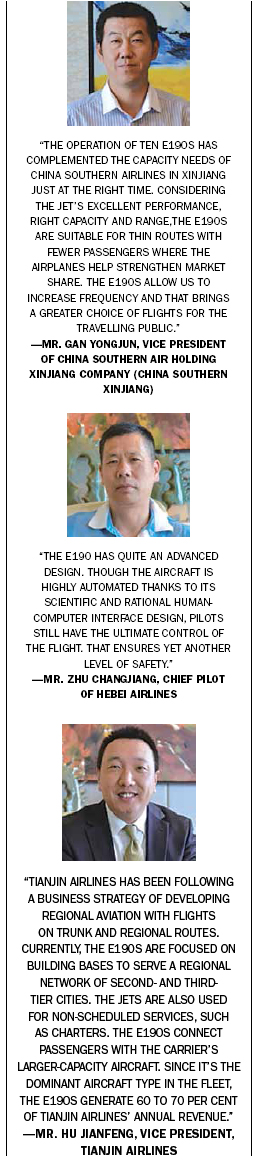

China’s civil fleet relies heavily on narrow-body aircraft. According to CAAC statistics, 62 per cent of scheduled flights were incompatible with narrow-body aircraft. These flights could have been operated more efficiently with 70 to 130-seat jets. On the other hand, for some airlines, regional aircraft still means older 50 to 70-seat aircraft.

Embraer states that with greater demand for flights on long routes and rising fuel prices, large capacity jets have been flying in regional markets since 2000. 70 to 130-seat regional jets, new-generation, large regional aircraft, are significantly superior to narrow-body aircraft. These new airplanes are spacious, quiet, comfortable and economical to operate. They have the same advanced technology and proven reliability as the latest and most advanced narrow-body and wide-body aircraft. They are more suitable for serving markets that average 45-135 travellers per flight and are ideal for opening new routes with comfortable and convenient air service for passengers.

According to official CAAC statistics, airlines operated 2,499 scheduled domestic routes in 2013. The majority of those were categorised as medium and low-density (measured by passengers per day each way (PDEW)). By industry standards, medium and low-density routes are best served by regional airlines when there are 300 or fewer PDEWs. In China, 74 per cent of all routes in 2013 had an average of fewer than 300 travellers. This suggests huge untapped potential for regional aviation.

Local governments attach great importance to promoting regional air service in order to stimulate local economic development. For example, in the six provinces in which regional air service is relatively well developed (Yunnan, Heilongjiang, Inner Mongolia, Sichuan, Xinjiang and Guizhou) there are 65 regional airports which account for about 50 per cent of the total number in China. The local economies in these areas, especially tourism, have developed rapidly as regional air service has grown.

Embraer’s E-Jets and E-Jets E2 that will enter service in 2018 are both excellent examples of large regional jets. Since entering service in 2004, more than 1,000 E-Jets have been delivered to customers in China and around the world. Some 65 airlines from 45 countries fly E-Jets. The E2s, the next-generation of E-Jets, were launched in June 2013 and have already accumulated an impressive number of orders.

By deploying new-generation regional jets that are better aligned with low and medium demand routes, airlines can break even with 70 per cent loads. Compared to narrow-body aircraft, these large regional jets are lower-risk assets with which to open new markets yet have similar per seat operating costs. This allows them to access low and medium-sized routes in remote areas more profitably and significantly improve the scope of network connectivity.

Positioning of Low-Cost Regional Airlines

Having a differentiated strategy for low-cost regional airlines is the key to accessing ‘Blue Ocean’ markets. Low-cost regional airlines with small and medium-sized fleets can choose second-tier cities with relatively huge potential, establish bases, offer frequent flights, charge low ticket prices and develop surrounding markets and even create secondary hubs. With the long-range performance of new 70 to 130-seat jets, airlines can eliminate less-attractive multi-stop and connecting flights that are currently the only option by carriers with narrowbody aircraft.

Embraer has been having a good run and as of August 2014, it had received 216 firm orders from 18 customers in China and had delivered 150 aircraft. To better serve those customers, Embraer increased investment in China by setting up the Embraer China Aircraft Technical Services to offer comprehensive before and after sales service.