INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Expanding India’s Galactic Horizons

India’s space economy is set for significant growth as the nation continues to be a major global player, driven by momentum in the private sector, new industry entrants, substantial investments, and supportive policy initiatives

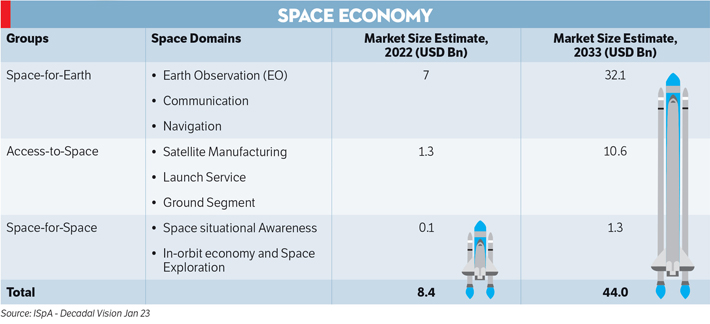

The Indian space sector is undergoing a significant transformation, evolving from being exclusively managed by ISRO to including a growing number of private companies and startups. This shift is driving economic growth, job creation, and technological advancements. In 2022, the Indian space market was valued at approximately $8.4 billion, accounting for about two per cent of the global space market. According to the decadal vision report by Indian National Space Promotion and Authorisation Centre (IN-SPACe) and Indian Space Research Organisation (ISRO), this market is poised to expand to $44 billion over the next decade, potentially capturing eight per cent of the global market and significantly boosting India’s economy.

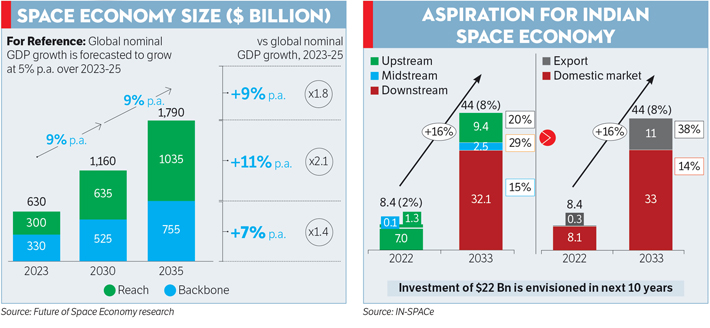

Globally, according to the recent World Economic Forum (WEF) report, the space economy is projected to reach $1.8 trillion by 2035, driven by its transition from a niche industry to one that offers solutions to some of the world’s most pressing challenges. Space technologies are now integral to everyday life, impacting various industries. With over $70 billion invested in the sector in 2021 and 2022, space tourism is also on the horizon, led by high net worth individuals, projected to generate $4-6 billion by 2035. This growth is further supported by the increasing cultural interest in space and its potential to address global concerns such as climate monitoring, medical advances and improved humanitarian responses.

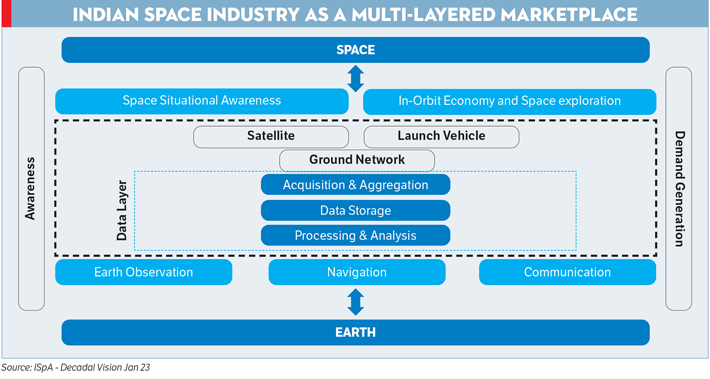

SCOPE OF THE SPACE ECONOMY

The space economy is often thought of as revolving around satellites, launchers, and services like broadcast TV and GPS. These core components, which constitute the “backbone” of the industry, contributed over $330 billion in 2023, making up more than half of the global space economy, according to the WEF report. However, the impact of space technologies extends far beyond these direct applications. They play a pivotal role in enabling businesses across various industries to generate significant revenues—a concept known as the “reach” of the space economy. For instance, without satellite signals and smartphone chips, platforms like Uber couldn’t have scaled globally, connecting drivers and riders across cities. The reach of space technologies is increasingly pervasive, touching everyday life through weather forecasting, parcel tracking, food delivery, e-commerce services, and more. In 2023, this “reach” was valued at approximately $300 billion, effectively representing the other half of the global space economy. When combined, the backbone and reach components could push the global space economy to an estimated $1.8 trillion by 2035, growing at a robust annual rate of nine per cent, nearly double the projected global GDP growth rate.

ENABLERS FOR SPACE ECONOMY GROWTH

The rapid expansion of the space economy is fueled by reduced launch costs and ongoing commercial innovation. In the past two decades, satellite launches have increased by 50 per cent, while launch costs have dropped tenfold, making space more accessible and frequent. This has also driven down data costs, essential for global connectivity, a trend set to continue.

As space technologies integrate further into daily life, their impact on industries like supply chain, transport, food and beverage, defence, retail, and digital communications is expected to grow significantly, potentially driving 60 per cent of the global space economy by 2035. These industries will benefit from lower costs and enhanced operations through space-enabled technologies.

The past decade has seen accelerating growth in the space sector, with increasing investments from public, private, and non-space sectors, indicating that space-based applications are reaching a pivotal point. This trend is highlighted by global public sector investments, such as India’s recent achievement of becoming the first country to land near the lunar south pole.

THE INDIAN SPACE ECOSYSTEM’S TRANSFORMATION

India’s space sector is undergoing a remarkable transformation. The reforms initiated in 2020 have catalysed this transformation, opening up the space sector to private players and fostering innovation. Many startups are making global strides, while traditional ISRO vendors are scaling up their capabilities. With the total investment in the sector reaching $125 million in 2023, India is now seen as a burgeoning hub for space business on the global stage. Additionally, the success of ISRO with missions like Chandrayaan-3 and Aditya L1, has further established trust on its technologies, increasing international collaboration and participation. Further, NewSpace India Limited (NSIL), ISRO’s commercial arm, has paved the way for foreign and Indian customers to launch aboard ISRO rockets as well as allowed Indian industries to participate in technology transfers.

“The emerging space sector shows private players have a great role to play and the government has realised this and then brought the space sector reforms and the policy which opens the possibilities for private companies to take up from building rockets to delivering applications. It is encouraging to see entrepreneurship, incubation startups as well as bigger players coming in to take up different roles. More operators and foreign investors are also coming to India, making the space ecosystem more vibrant. With all of this we are hoping that the scale of economy of space activities in India is likely to grow substantially higher,” Dr S. Somanath, Secretary, Department of Space (DoS) and Chairman, ISRO told SP’s Aviation.

In recent years, the Indian government has taken significant steps to strengthen its space ecosystem. In 2019, NSIL was established to commercialise ISRO’s technologies, followed by the creation of IN-SPACe in 2020, which opened the industry to private players, and the Indian Space Association (ISpA) as the apex industry body. The 2023 Indian Space Policy, along with the norms, guidelines, and procedures (NGP) issued by IN-SPACe this year, further facilitated private sector participation in satellite building, launching, ground stations, and remote sensing data. Additionally, the government approved amendments to the FDI (Foreign Direct Investment) policy, allowing 100 per cent FDI in satellite manufacturing without approval and easing rules for launch vehicles. The Indian Finance Minister also announced a 10-billion-rupee venture capital fund recently to expand the space sector, aligning with the government’s vision to grow India’s share in the global commercial space economy to 10 per cent by 2030.

IN-SPACe’s decadal vision, aiming for a $44 billion market by 2033 is structured around three key segments: Space-for-Earth, Access-to-Space, and Space-for-Space, each with specific growth domains.

The Space-for-Earth segment, projected to reach $32.1 billion, will be the primary driver of downstream growth, supporting socio-economic development through applications in agriculture, healthcare, transport, and education. The Access-to-Space segment, which includes satellite manufacturing and launch services, is set to expand rapidly, potentially contributing $10.6 billion to the market. The future growth of India’s space sector relies on a four-pillar strategy: building platforms, creating an industrial ecosystem, enabling industry participation, and international outreach. This comprehensive approach aims to position India as a global leader in space, ensuring that the country not only meets its domestic needs but also plays a significant role in the global space economy.

THE ROLE OF PRIVATE SECTOR AND START-UPS

By allowing private companies to participate in the space sector, the barriers to entry for space activities are lowered, leading to more frequent and affordable launches, technological advancements, cost-effective solutions and the development of new markets that drive growth and expand the range of spacerelated activities.

The private sector’s involvement is vital for India’s ambition to increase its share in the global space economy. With private missions ranging from deep space exploration to satellite data analytics, the space sector is now a hotbed of innovation, attracting significant investment and driving economic growth.

In 2022, Skyroot Aerospace became the first private Indian company to launch a rocket, Vikram-S. This year, AgniKul Cosmos launched a single-stage technology demonstrator rocket — Agnibaan SOrTeD (suborbital technological demonstrator), the first launch from a private launchpad and the first using a combination of gas and liquid fuel. Bellatrix Aerospace had successfully launched its Rudra and Arka propulsion systems onboard ISRO’s PSLV C-58 launch vehicle this year; Rudra is the nation’s first High-Performance Green Propulsion system. In July this year, Dhruva Space received authorisation from IN-SPACe for Ground Station as a Service (GSaaS). Digantara launched the satellite Pushan-Alpha which will serve as a space weather testbed in a sun-synchronous orbit. GalaxEye signed the agreement to build systems & develop a miniaturised satellite capable of carrying multiple payloads up to 150 kg for the Indian Air Force. Pixxel recently launched Aurora, its cutting-edge Earth Observation Studio. These are just some examples, there are many other companies like Manastu, SatSure, SkyServe, EtherealX, Azista Aerospace, Piersight, and others that are developing advanced technology to solve problems and raising investments.

“The assertion that a robust domestic economy hinges on substantial private sector participation is undeniably accurate. India’s space programme, spearheaded by ISRO, has achieved remarkable milestones. However, to truly harness the sector’s potential and become a global space powerhouse, a symbiotic relationship between the government and private enterprise is imperative” said Anirudh Sharma, Founder and CEO of Digantara, a space surveillance and intelligence company.

RISING INVESTMENTS IN INDIA’S SPACE SECTOR

India’s space sector is experiencing a significant influx of investment from both domestic and international investors. According to the DPIIT Start-Up India Portal, the number of space startups in India had surged from just one in 2014 to 189 in 2023 (now that number is over 200), with investments in these startups reaching $124.7 million.

A report by Inc42 highlighted that over 150 space tech startups secured more than $285 million in funding between 2014 and 2023 supported by a diverse range of investors. Skyroot has raised more than $66 million in funding so far. This year itself, Dhruva Space raised ₹123 crore in a Series A funding round, Digantara raised $2 million to close a $12 million Series A funding round, GalaxEye raised $6.5 million while EtherealX raised $5 million. Many of the startups have also significantly expanded their teams, setting up their headquarters and establishing a strong infrastructure for the sector.

“I think a lot of investors are now waking up to the potential of the sector. India enjoys significant cost arbitrage and a very interesting geopolitical space that allows us to collaborate with pretty much every country in the world. This builds the base for allowing Indian companies to be global enterprises,” said Rahul Seth, Scouting Director & Investor at Antler, a global early-stage VC.

The Indian government’s proactive stance, exemplified by the Indian Space Policy 2023, has played a pivotal role in this growth. While more clarity is still sought, the policy encourages full-spectrum participation of Non-Governmental Entities (NGEs) in all space activities, incentivising private sector involvement through a supportive legal and regulatory environment.

“The nexus between the rule of law and a stable secure economy is well documented. Law has the effect of influencing the flow of capital into a sector, by regulating the relationship between the investor, the investee and the state. By ensuring a clear, predictable, fair and non discriminatory regulatory atmosphere, investors will feel empowered to invest into a nascent industry like space” said Ashok G.V., Partner, Factum Law and a space lawyer.

India’s space sector is also expanding through international collaborations and market expansions. With advancements in remote-sensing technologies, optimised use of satellite data, and a focus on indigenous satellites, communication systems, and heavy-lift launch vehicles, Indian startups are well-positioned to capture a larger share of the global space market.

“Going by the figures shared by INSPACe, we expect the sector to grow to 8-10 per cent by 2030. But to achieve that, there are multiple things which have to happen. The success of the leading start-up companies in their expected plans is important, like SkyRoot and AgniKul, being able to get through their orbital launches at the earliest, to become a player in the market. Similarly, the likes of Pixxel, Druva, Digantra, being able to put the number of satellites they want to. The initiative by NSIL for public-private partnership for example for the LVM-3 rocket, is a positive step; and the kind of response companies have shown for this indicates there is a great potential in the market. The investments by venture capitalists have been in the range of $123-126 million in the last two years, which is a positive indicator. Even the government deciding to announce 1,000 crores for venture capitalists indicates a very positive intent” said Lt General A.K. Bhatt (Retd), Director General, ISpA.

THE ORBIT AHEAD

India’s space economy holds a bright future, marked by several upcoming missions like Gaganyaan. Areas like reusable launch vehicles, advanced remote sensing, space situational awareness, satellite imagery, data analysis and space tourism are set to drive growth. However, the challenges of sustainability, the capital required, and risk of space ventures still loom.

“High costs, a shortage of skilled talent, and a limited domestic market are some current challenges. The government must take the lead by becoming a major buyer of space-based products and services. At the same time, boosting research and development, investing in training skilled workers, simplifying regulations, and encouraging partnerships between government and private companies are crucial for building a thriving space industry. That said, we are moving in the right direction,” added Sharma.

The surge of space startups in India has been significant. Established companies are also entering the market, adding to the growth potential of the industry as well as competition. However, the space industry is inherently a high-risk & capital-intensive venture, raising concerns about the survival of all the current startups. It becomes further crucial that the ones with proven technology and funding succeed, for the industry’s overall development.

“I believe that we are poised to take off. The holy trinity of talent, capital and an enabling ecosystem has emerged. Space technology is one of the very few areas where India has a global right to win; not only are we less expensive, we are just as good or even better than the very best,” added Seth.

As ISRO shifts focus towards deep space research, collaboration and possibly consolidation within the industry are likely to become important in the future. Nevertheless, as India continues to build its space capabilities, the combination of government support, legal frameworks, and a thriving startup ecosystem is setting the stage for the country to emerge as a major player in the global space economy. With significant cost advantages and a favorable geopolitical position, Indian companies are well on their way to becoming global enterprises.