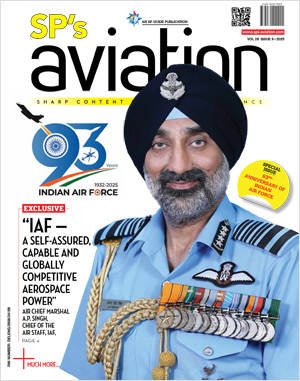

INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

For a Brighter Future

Aircraft require airports and there cannot be meaningful progress in regional aviation unless the availability and standard of regional airports steadily improves. The Indian Government is seemingly preoccupied with large-scale scheduled commercial aviation. But there’s a need to look further afield.

When India’s airline industry began its remarkable growth spurt from 2003 onwards, the nation’s shoddy aviation infrastructure, which had somehow meandered along for decades, was found seriously wanting. Realising how bad the situation could become, the government eventually formulated a comprehensive plan to improve the existing airports and build new ones. There has indeed been much progress over the last decade especially in the metros and 35 major non-metro airports. The government and the Airports Authority of India (AAI) are justifiably proud of it.

Lately, the airline market has slid into negative growth. From January to September 2012, it has attracted 438.4 lakh domestic passengers—0.9 per cent less than last year’s figure of 442.2 lakh over the same period. However, according to the Centre for Asia Pacific Aviation (CAPA), Indian commercial aviation is poised for big things over the decade and once again it is sadly underprepared. “It will not be long before India resumes sustained double-digit traffic growth and at many airports across the country capacity constraints will be encountered sooner rather than later. Since airport capacity cannot be created overnight, there is a need to adopt a proactive approach to airport development, identifying and preparing for potential constraints.”

Well said, because the country’s aviation policy-makers hardly seem proactive about infrastructure. They appear content to bask in the glow of traffic numbers, rather than taking a critical look at the inadequacies, especially of the smaller regional airports. For instance, the majority of runways in the country are unsuitable even for the airline industry’s mainstays—Airbus A320 and Boeing B737 narrowbody jets. Even those that can take regional turboprops like the 80-seat Bombardier Q400 NextGen and the 78-seat ATR 72-500 are few and far between considering the sheer size and population of the country. Yet, rues CAPA, AAI has no airport capacity plan beyond 2017.

Metro Mania

India currently has 93 operational airports, including six run by private operators. In addition there are 28 civil enclaves at military stations. However, according to the Directorate General of Civil Aviation (DGCA), only 73 airports are currently connected by flights, down from last year’s tally of 82. Obviously it is the smaller regional airports that are always the first to lose air links, since aviation services are heavily biased in favour of major cities. The six metros account for no less than 70 per cent of domestic traffic and some, like Mumbai Airport, are fast approaching their limits. But besides the metros, much of the country is urbanising rapidly and by 2050, half its people are projected to be urban dwellers. Demands for air connectivity from rapidly growing cities are bound to mushroom. Can they be met?

CAPA projects that total airport passenger traffic may triple from approximately 143 million in 2010-11 to 450 million by 2020-21, making India the third largest aviation market in the world, behind only the US and China. Over the same period, the scheduled airline fleet is expected to swell from 430 to 1,030 aircraft. According to AAI estimates, traffic from non-metro airports is growing twice as fast as that from the metros and may surge to 45 per cent of the total within just five years. These and other figures indicate that the current metro-centric distribution is unsustainable and traffic must be diverted to other places.

The AAI has an ambitious agenda to operationalise 225 airports across the country by 2020, over a dozen being Greenfield airports. Hopefully it has taken into account the size of the catchment area and the potential for airlines to operate from there and will simultaneously address contentious airspace issues. These airports are in various stages of planning and development but many of them are mired in land-acquisition issues. Hence, runway lengths and other airport facilities may have to be kept to the bare minimum. The usual practice is to set up small functional airports first and promise to undertake necessary expansion at a later date. However, that date might never come. Take Mysore’s Mandkalli Airport. Defunct from the mid-1980s, it was reopened to scheduled services in 2010, but its runway was suitable only for ATR-72 class aircraft. The planned Phase-II, which would allow Airbus A320 and Boeing B737 airliners to use the extended runway, has been stalled due to land-acquisition hassles involving the realignment of NH-212. Airport projects in other regions are likely to be similarly constrained.

Passenger demand from new and remote airports may also be insufficient to support narrow-body jets, at least to begin with. A study by Embraer last year found that around 30 per cent of the flights from smaller cities in India depart with loads appropriate for a 70-seat aircraft and 47 per cent of the flights depart with loads appropriate for 90 to 110-seat planes. Carriers with regional aspirations, therefore, need to have smaller aircraft, preferably turboprops like the ATR 42-500 (50 seats), the ATR 72-500 (78 seats) or the Bombardier Q400 NextGen (80 seats). Aircraft with up to 80 seats are exempt from airport landing and parking charges and billed at reduced rates for navigation facilities. Those with take-off weight less than 40,000 kg pay just four per cent sales tax on aviation turbine fuel (ATF) across the country, whereas larger aircraft pay an average of 24 per cent. ATF accounts for about 50 per cent of an airline’s operating cost, so this is a big gain.