INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Highs & Lows of India's Airlines

The first half of 2015 shows towering performance by IndiGo that carried 145.80 lakh passengers from January to June, registering a leading market share of 37.5 per cent

Since the new millennium, civil aviation in India has been witnessing growth despite the many impediments and failing airlines. Industry-friendly policies, efficient management practices and the general surge in air transportation are likely to propel aviation business to higher levels. Passenger traffic has been significantly strong and the projections are highly encouraging. In financial year 2015, the total passenger traffic stood at 190.1 million, increasing by 12.47 per cent over the previous year. With rising incomes, low air fares due to fierce competition, enhanced regional connectivity, improved infrastructure and rapid urbanisation, passenger traffic has expanded at a compounded annual growth rate of 11.16 per cent in the period 2006 to 2015.

The development of the civil aviation sector has a multiplier effect on the economy. According to a study by the International Civil Aviation Organisation (ICAO), the output multiplier and employment multiplier indices are 3.25 and 6.10 respectively. In other words, every 100 rupees spent on air travel would result in 325 rupees worth of total benefits and every 100 direct jobs in aviation would result in 610 jobs overall. Passenger and cargo traffic, airport development are all on a high-growth trajectory.

India is presently the ninth largest civil aviation market in the world with a market size of around $16 billion and is likely to be among the top three markets in the near future. “The world is focused on Indian aviation – from manufacturers, tourism boards, airlines and global businesses to individual travellers, shippers and businessmen. If we can find common purpose among all stakeholders in Indian aviation, a bright future is at hand,” said Tony Tyler, Director General and CEO, International Air Transport Association (IATA).

Market Size

In the second quarter of 2015, domestic air passenger traffic surged 19.2 per cent to 20.3 million from 17 million in the corresponding period a year ago. Over the next five years, domestic and international passenger traffic are expected to increase at an annual average rate of 12 per cent and eight per cent respectively, while domestic and international cargo traffic are estimated to rise at an average annual rate of 12 per cent and 10 per cent respectively. Consultancy firm CRISIL has pointed out that Indian carriers will have a collective operating profit of Rs. 8,100 crore in fiscal 2016. India’s potential is largely untapped and the initiatives been taken by the government and the industry per se are going to prop the aviation sector.

Performance Parameters

How are airlines in India doing in such a scenario where opportunities exist? We look at Indian airlines on parameters such as passenger growth, passenger load factor, compliance of route dispersal guidelines, and on-time performance.

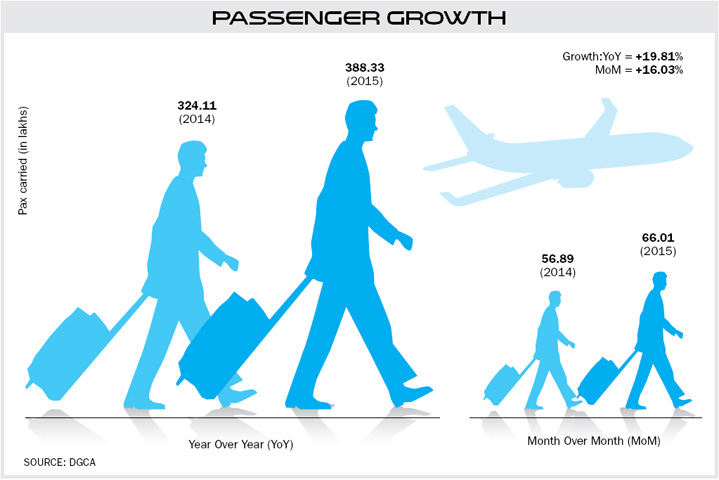

Passenger Growth

Passengers carried by domestic airlines during the period January to June 2015 were 388.33 lakh as against 324.11 lakh during the corresponding period of previous year thereby registering a growth of 19.81 per cent.

IndiGo, the Runaway Market Leader

The first half of 2015 shows towering performance by IndiGo, the runaway market leader. The airline carried 145.80 lakh passengers from January to June, registering a leading market share of 37.5 per cent. IndiGo is the only airline to touch the three digit mark. IndiGo is followed way behind by Jet Airways with a market share of 19.35 per cent having carried 75.12 lakh passengers. Air India carried 64.95 lakh passengers with a market share of 16.8 per cent; SpiceJet 40.93 lakh passengers with a market share of 10 per cent; JetLite 14.87 lakh passengers with a market share of 7.8 per cent; GoAir 33.98 lakh passengers with a market share of 8.75 per cent; AirAsia India 5.14 lakh passengers with a market share of 1.3 per cent; Air Costa 3.82 lakh passengers with a market share of only one per cent; and Air Pegasus which started operations in April this year has carried 9,000 passengers with a market share of 0.01 per cent.

IndiGo continues its aggressive expansion plans, riding high on its market success. On its ninth birthday recently, it firmed up its last year’s commitment and ordered 250 A320neo family aircraft on India’s 69th Independence Day. Aditya Ghosh, President of IndiGo, said, “This new order further reaffirms IndiGo’s commitment to the long-term development of affordable air transportation in India and overseas. The additional fuel-efficient A320neo aircraft will enable us to continue to bring our low fares and courteous, hassle-free service to more customers and markets and will create more job opportunities and growth. The IndiGo team is even more energised and excited than ever before to herald this new phase of our growth for many years to come.”

IndiGo placed an order in 2005 for 100 A320s which have all now been delivered. In 2011 IndiGo became the first Indian operator to commit to the A320neo bringing their total to 280 Airbus aircraft. With this announcement, IndiGo has ordered 530 A320 family aircraft with Airbus.

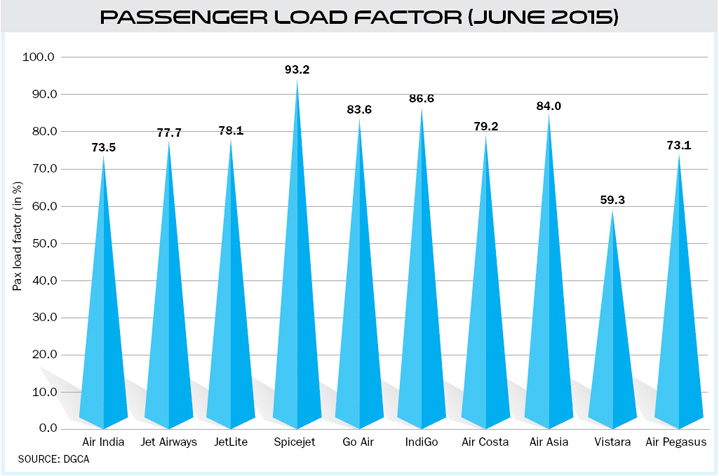

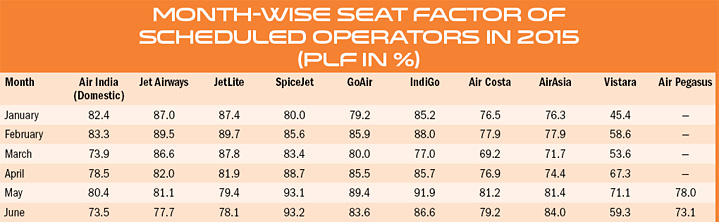

Passenger Load Factor

For the first six months of 2015, the passenger load factor of airlines has been: Air India 78.66; Jet Airways 83.98; JetLite 84.05; SpiceJet 87.33; GoAir 83.93; IndiGo 85.73; Air Costa 76.81; AirAsia India 77.61; Vistara 59.21; and Air Pegasus 70.50.

On-Time Performance

This is a key parameter for discerning customers who have tight schedules, who don’t like waiting at airports and who value time. Airlines have been making efforts to improve their on-time performance (OTP) and airline officials know that a quick turnaround of aircraft is good for business too. OTP of scheduled domestic airlines has been computed for four metro airports, viz. Bengaluru, Delhi, Hyderabad and Mumbai by the Directorate General of Civil Aviation.

IndiGo’s OTP for the first six months was 81.18; GoAir 75.81; Jet Airways (including JetLite) 77.39; Air India 72.91; SpiceJet 72.01; AirAsia 89.12 (for four months); Vistara 96.8 (for three months) and Air Costa 85.73 (for three months) and Air Pegasus 96.25 (for two months). The high OTP by the last three named airlines is due to the fleet size with Air Pegasus just one aircraft; Air Costa four; and Vistara five.

Cancellations

The overall cancellation rate of scheduled domestic airlines for January was 2.21 per cent and this high cancellation rate is attributed to low visibility conditions at airports located in North India. IndiGo has had amazing performance with very low cancellation rate. For the first six months of 2015, the overall cancellation rate of IndiGo has been 0.28, the lowest for any airline. The highest cancellation rate has been that of Air Costa which had two bad months – April and May – wherein technical reasons for cancellation have been given. Air Costa cancellation rate was 3.28 for six months with the highest cancellation been in May at 12.36. The cancellation rate for other airlines are: SpiceJet 1.52; JetLite 1.17; Air India 1.52; AirAsia 0.95; Jet Airways 0.96; GoAir 0.66; Vistara 0.75; and Air Pegasus 1.01 (for two months).

Technical reasons for cancellations was the No. 1 reason in the first six months at 34.81 per cent; closely followed by weather at 31.61; miscellaneous 24.45; operational 6.73; and commercial 0.96 per cent.

Passenger Complaints

The number of complaints per 10,000 passengers carried was highest for SpiceJet at 3.41 and the lowest for Vistara 0.40. IndiGo continued its amazing performance by few complaints and it was 0.85 per 10,000 passengers. The other airlines – GoAir 2.73; Air India 1.88; AirAsia India1.53; Jet Airways and JetLite 1.43; and Air Costa 0.75. The newest regional airline – Air Pegasus had the highest complaints in June at 28.9.

Passenger complaints were varied but were related mostly to flight delays, baggage, customer service, fare, refund, catering, staff behaviour, facilities for disabled, etc.

The star performer among Indian carriers certainly is IndiGo which has posted consistent profits and has shown the airline industry how to perform on various parameters. With competition increasing and passengers becoming highly demanding, performance of airlines will come under greater scrutiny. Those who measure up to that will achieve profitability, goodwill of the passengers and emerge winners or stay winners, as the case may be.