INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

India to lead Commercial Aviation recovery in South Asia

According to Boeing’s 2023 Commercial Market Outlook, India and South Asia are expected to have over 2,705 new airplane deliveries until 2042

In a pivotal moment for the aviation industry, Boeing’s latest forecast positions South Asia, led by India, as the fastest-growing commercial aviation market globally. Propelled by India’s robust economy and a burgeoning middle class, the region is poised to experience an impressive annual traffic growth of over 8 per cent in the next two decades.

Boeing’s Commercial Market Outlook (CMO) reveals that South Asian carriers are gearing up to quadruple their fleets, necessitating the addition of more than 2,700 new airplanes over the next 20 years. This substantial expansion is a strategic response to the escalating demands of both passengers and cargo.

At the heart of this aviation boom is India, where the expanding middle class is playing a pivotal role in driving regional air travel. Boeing anticipates that carriers in the South Asian region will require an extensive fleet expansion to meet this surge in passenger and cargo demand.

“Indian low-cost carriers continue to stimulate demand and connect emerging regions with low fares, holding nearly a 90 per cent share of all domestic seats in the region. This reflects the rapid pace of the region’s recovery and economic activity, as traffic and capacity now exceed pre-pandemic levels,” said Darren Hulst, Boeing Vice President of Commercial Marketing.

COMMERCIAL AIRPLANE DELIVERIES TO INDIA AND SOUTH ASIA (2023-2042)

| Regional Jet | <5 |

| Single Aisle | 2,320 |

| Widebody | 380 |

| Freighter | 5 |

| Total | 2,705 |

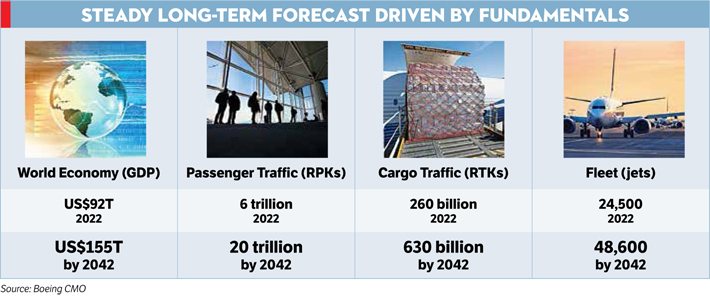

While focusing on South Asia, Boeing’s forecast also shed light on the broader global aviation landscape. The industry is on a trajectory to return to pre-pandemic traffic levels, with a forecasted demand for over 42,000 new airplanes in the next two decades. This resurgence is underpinned by a recovery in domestic and regional markets, closely followed by a rebound in international travel.

“Similarly, long-haul traffic and capacity to and from India and South Asia lead the way globally, relative to 2019, as nonstop services to North America, Europe, East Asia and Oceania continue to be added. Strong economic growth and confidence in the commercial aviation market have led to record orders for new, more efficient airplanes in India,” Hulst added.

Growth of India’s middle class, tourism, and manufacturing will drive 4X 2022’s GDP growth over 2050, a $15 trillion GDP output by 2050, gaining the third highest GDP world ranking by 2031.

The CMO also brought to light that while the capacity is back, the dynamics still vary and the supply recovery has been lagging resilient demand. However, airlines continue to evolve to meet market dynamics, with a large number of carriers simplifying existing fleets, increasing premium cabin offerings and providing more point-to-point capacity. Likewise, changing supply chain models and the growth of e-commerce continues to drive robust demand for dedicated freighters.

Boeing’s projection for the South Asia market until 2042 includes:

- 72 per cent of 2,705 new deliveries supporting fleet growth.

- 28 per cent replacing older jets with more fuel-efficient models.

- Single-aisle airplanes constituting over 85 per cent of new deliveries.

The surge in South Asia’s aviation sector is expected to create a demand for 37,000 pilots and 38,000 maintenance technicians by 2042, with India being a primary driver of this workforce expansion.

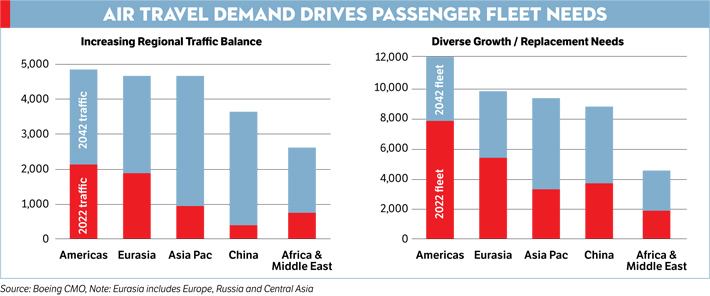

As global air travel outpaces economic activity, mature markets like North America and Europe are anticipated to witness slower growth, while emerging markets, particularly in Asia, will experience above-average growth. This forecast underscored a geographically balanced global aviation market in the long term. On average, 2-3 per cent of the commercial jet fleet is replaced every year. Growth and replacement needs vary widely between regions. In markets with large installed fleets, new airplane demand is focused more on replacement. Twothirds of projected new airplane deliveries to North American carriers will replace existing fleets. In contrast, markets earlier in their aviation development and with smaller installed fleets have lower replacement needs but higher growth demand. Asia-Pacific markets are forecast to deploy over 60 per cent of new airplane deliveries for growth.

Boeing’s analysis revealed that, on average, 2-3 per cent of the commercial jet fleet is replaced annually. The dynamics vary between regions, with mature markets emphasising replacement, while Asia-Pacific markets are forecasted to deploy over 60 per cent of new airplane deliveries for growth. The outlook in 2024 is resuming growth with 2.3 per cent GDP growth economically, airline net profit expected to be $27.5B, the cargo market projected to see 4.5 per cent year-o-year (y/y) growth FTKs full year and passenger market to see 105 per cent of 2019 RPKs full year.

As the aviation industry reshapes itself for the future, South Asia, with India at its helm, stands as a beacon of growth, innovation, and transformative change. The skies are not just the limit but a realm of boundless opportunities for the region’s soaring aviation sector.

Air travel is forecasted to continue growing faster than global economic activity driven by tourism demand and increased service levels, particularly in developing markets. Global passenger air travel has become increasingly diverse and balanced over the last several decades, a trend that is expected to continue over the next 20 years. These varying trajectories are driving a more geographically balanced global aviation market in the long-term.

Amid the optimism, the CMO also highlighted some of the challenges facing aviation in India:

- Volatile fuel prices

- Currency pressure

- Low yields

- Infrastructure

- Market share imbalance

- Hyper-competition

As the aviation industry reshapes itself for the future, South Asia, with India at its helm, stands as a beacon of growth, innovation, and transformative change. The skies are not just the limit but a realm of boundless opportunities for the region’s soaring aviation sector.

FREIGHT AVIATION IN INDIA: UNLEASHING A SKYWARD SURGE

In a visionary outlook, Boeing is gearing up for a colossal leap in India’s cargo aviation sector, foreseeing a fivefold growth in market opportunities. The aerospace giant anticipates that India’s cargo fleet will burgeon to an impressive 80 airplanes over the next two decades, underpinned by various strategic factors.

“Financially stable airlines are leading India with profitable books and accessibility to capital. Yield stability would help airlines in managing the profitability. Additionally, cargo as a strategic investment needs to be factored in the planning process. 5X market growth opportunity is projected for dedicated single aisle freighters for India over the next 15-20 years,” said Ashwin Naidu, Managing Director-Commercial Marketing (Indian Subcontinent), Boeing.

At the core of this ambitious projection lies India’s domestic strength, a powerhouse of untapped potential with a mere 15 freighter aircraft currently in operation. Bolstered by a robust 7 per cent GDP growth, the flourishing e-commerce landscape, and an expanding middle class, the demand for freight services is poised to soar, necessitating the addition of 45 or more airplanes to meet burgeoning requirements.

Boeing envisions a significant uptick in regional cargo expansion, driven by economic collaborations with ASEAN and the Middle East. The ongoing redesign of manufacturing and supply chains, with India at the epicenter, is expected to result in the acquisition of 20 or more cargo airplanes.

India’s ’Make in India’ initiative, coupled with burgeoning pharmaceutical and automotive trade links, is reshaping the global trade and manufacturing landscape. As supply chains realign globally, and technology manufacturing gains momentum, the demand for widebody airplanes is projected to escalate, with an estimated addition of 15 or more aircraft.

Boeing foresees a remarkable 7 per cent long-term growth in India’s passenger traffic, surpassing the global average. This robust growth trajectory not only signifies an increased demand for passenger aircraft but also underscores a dedicated freighter opportunity that holds strong potential for substantial expansion.

In response to India’s burgeoning aviation needs, Boeing believes that its diverse family of aircraft is tailor-made for the Indian market. Whether addressing the domestic cargo surge, regional expansions, or the global trade and manufacturing nexus, Boeing envisions its family of products as the ideal fit to support India’s multifaceted growth across all market segments.

As the skies above India witness an unprecedented surge in demand for cargo services, Boeing stands as a stalwart partner, ready to propel the nation’s aviation landscape into new dimensions of growth and connectivity. The future of freight aviation in India is not just promising but poised to redefine the very contours of the nation’s economic and logistical prowess.