INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

MRO Asia Competition Heats Up

Maintaining, repairing and overhauling aircraft is labour intensive and time consuming, two elements that aren’t compatible with the low-cost, low-fare airline philosophy

There’s big money to be made maintaining Asia’s airline fleets. While profit margins may be razor-thin with the region’s commercial air carriers, the returns and growth prospects for MROs look consistently healthy. Fueling the demand is the explosive rise of low-cost carriers which, by their very nature, outsource maintenance to eliminate overhead, keep costs low and ticket prices competitive.

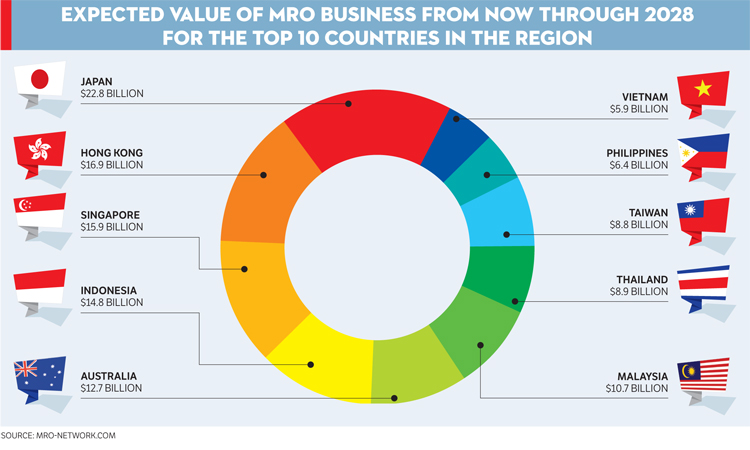

AvWeek’s MRO-Network.com ranked the expected value of MRO business (US$ billion) from now through 2028 for the top ten countries in the region.

LABOUR COST IS KEY

Maintaining, repairing and overhauling aircraft is labour intensive and time consuming, two elements that aren’t compatible with the low-cost, low-fare airline philosophy. The LCC model works well with standardisation, uncomplicated processes, automation, digital sales channels, and contracted maintenance. It’s why MRO providers, especially in Asia, are investing in facilities that cater to A320s and B737s, the most popular narrow body jets for LCCs around the world.

The growing proportion of these two aircraft types in the pan-Asia commercial fleet, driven by acquisitions by LCCs, is highlighting the disparity in MRO labour rates around the region. Technical skills may be more developed in Japan, Hong Kong and Singapore where MROs have long-established facilities, but the low salaries and newly trained employees in other countries are playing catch-up, and winning business.

INDONESIA ON THE RISE

Garuda’s GMF AeroAsia opened the largest hangar in Asia four years ago, specifically to accommodate narrow body jets. It can service 16 aircraft inside the structure located at Jakarta’s Soekarno-Hatta Airport. GMF counts AirAsia, IndiGo and Russia’s Nordwind among its customers. It had planned to open a new $41 million, 25,000 m2 hangar at Batam, across the strait from Singapore, sometime in 2019. The venture had faced years of delays. Still, it intends to invest $400 million in new facilities with a focus on narrow body jets, supplementing the four hangars it already has in Jakarta.

The LCC model works well with standardisation, uncomplicated processes, automation, digital sales channels, and contracted maintenance. It’s why MRO providers, especially in Asia, are investing in facilities that cater to A320s and B737s, the most popular narrow body jets for LCCs around the world.

GMF claims it can tap into the country’s huge population to produce skilled labour. Its advantage lies in the salaries it pays its technicians. They earn just one sixth of the wages of those working in Singapore. The company also wants to expand to South Korea and the UAE through joint ventures and staff those MRO operations with low-cost Indonesian mechanics.

THAILAND WANTS ITS SHARE

The story is similar in Thailand. According to a 2018 report in the Nikkei Asian Review, some 60 per cent of all maintenance for the nation’s air carriers was outsourced in 2017. The government wants to bring that business in-house and establish Thailand as a center for technical support. It has proposed generous tax incentives to encourage companies to relocate.

Last year, Thai Airways International agreed to establish a maintenance facility with Airbus in a special economic zone on the coast of the Gulf of Thailand. The value of the investment is about $329 million. In a further initiative, Thai Airways received certification from Rolls-Royce to be an authorised repair center for the manufacturer’s Trent engines. It’s welcome news for the airline that uses the engine type on its own fleet and for the new business it can generate overhauling engines of LCCs that fly to/from Bangkok’s Don Mueang Airport, just 30 km from Suvarnabhumi Airport.

SINGAPORE GOES HIGHER TECH

Although its labour rates are appreciably higher, the industry in Singapore is not complacent. It has turned to automation to stay competitive, with cutting-edge technology that sets it apart from other MROs. STE, Singapore Technologies Engineering, has tested a type of drone that flies over aircraft in the hangar. The machines detect anomalies in aircraft structures such as cracks, and surface scratches and stains on aluminum skin. It also has ventured into the production of small spare parts in the cabin. It’s using 3D printers to make cup holders and seat tray tables.

Singapore Aero Engine Services, a partnership between SIA Engineering and Rolls-Royce, has joined up with the Singapore Agency for Science, Technology and Research. The team will explore ways to improve automation and develop digital technologies that can be used by aircraft manufacturers and MROs.

OTHERS WANT THEIR SHARE

HAECO of Hong Kong reported a 20.5 per cent increase in year-over-year profit for the first six months of 2018 although weaker forward bookings for some services was expecting to impact the second half of the year while the number of engine overhaul hours appeared steady. HAECO has some 16,000 employees and subsidiaries or part ownership of MROs in the Americas and Xiamen.

Japan’s All Nippon Airways has partnered with JAMCO and Mitsubishi Heavy Industries to establish MRO Japan and a new facility at Naha Airport in Okinawa. Citing a lack of heavy maintenance capacity in the country and a growing dependence on Chinese MROs, the new venture will serve the ANA fleet and carriers in Asia Pacific. Japan Airlines has been outsourcing its heaving maintenance to HAECO in Hong Kong and Xiamen, and to ST Aerospace in Guangzhou. Both carriers facing increasing costs from Chinese MROs and competition for hangar space as China’s own commercial fleet grows.

Technical skills may be more developed in Japan, Hong Kong and Singapore where MROs have long-established facilities, but the low salaries and newly trained employees in other countries are playing catch-up, and winning business.

VAECO in Vietnam, Korean Air Maintenance and Engineering, Sepang in Malaysia are all eager capture a share of the lucrative MRO business. Evergreen Aviation Technologies is a new joint venture between GE and EVA Air to provide MRO services at Taipei.

Lufthansa Technik Philippines is planning a $40 million expansion of its Villamor Airbase facility in Pasay City. The company forecasts business to increase between 4 per cent and 5 per cent every year and is preparing for the growth. It intends to hire 300 aircraft mechanics which, according to LTP President and CEO Elmar Lutter, could lead to a labour shortage in the Philippine MRO industry since Filipinos have an outstanding reputation for technical excellence. LTP has operations in Cebu, Davao, Pampanga and Aklan.

Trade Secretary Ramon Lopez has said that the Philippine government aims to make the country an MRO hub in Asia Pacific. It seems that everyone wants a piece of the pie.