INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- The layered Air Defence systems that worked superbly, the key element of Operation Sindoor

- Operation Sindoor | Day 2 DGMOs Briefing

- Operation Sindoor: Resolute yet Restrained

- India's Operation Sindoor Sends a Clear Message to Terror and the World – ‘ZERO TOLERANCE’

- Japan and India set forth a defence cooperation consultancy framework, talks on tank and jet engines

Market Outlook - An Engine of Growth

Aviation infrastructure needs to be developed to facilitate unconstrained growth of the aviation market. Not only the investment requirements have to address the existing capacity constraints in various airports but also should address requirements in the context of growth scenario forecast for the next decade and thereafter.

Notwithstanding the fat e of Kingfisher Airlines, notwithstanding the ever-ailing national carrier Air India, notwithstanding the travails of other airlines, there exist an undying optimism that the civil aviation sector in India will come good in the years to come. This optimism is borne from the fact that civil aviation is getting the necessary push, albeit delayed, as it has been identified as a key enabler of economic growth of the country.

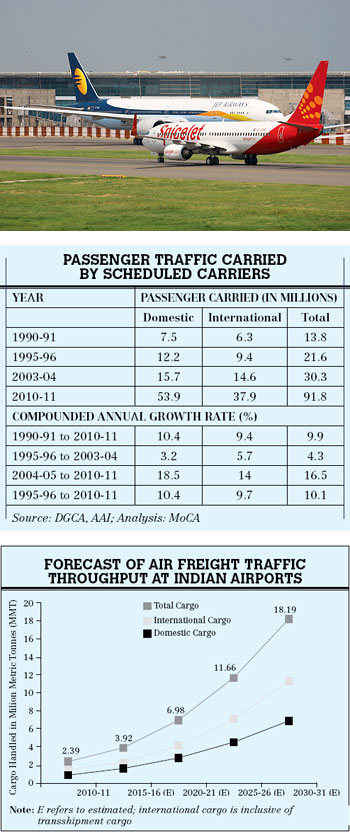

Passenger and air cargo growth are among the key indicators of the well-being of a nation and India’s passenger growth story has been exceptional, despite the vicissitudes of airlines. During the last 10 years, the compounded annual growth rate of passenger traffic has been about 15 per cent. As regards air cargo, which undoubtedly is languishing, there lies enormous untapped potential. In 2011, the total air-cargo volume handled was 2.3 million tonnes by all Indian airports which was far less than that handled by individual airports like Hong Kong, Memphis, Shanghai, Incheon, Anchorage and Paris. The Ministry of Civil Aviation has forecast that the total cargo throughput at Indian airports is expected to grow 7.6 times in the next 20 years (compounded annual growth rate [CAGR] of 11.2 per cent).

Airline industry

At present, the health of the airline industry is not all that good...some of them are on ventilators, while others are getting ‘injections’ (read foreign direct investment) and some others are ‘managing’ to stay afloat. But all of them are hoping that the turbulence will soon be over and they will be soaring up and up, considering the fact that passenger and air cargo will rise phenomenally in the years to come.

1,450 new airplanes needed through 2031

To meet such phenomenal passenger movement, aircraft inductions have to take place and the US aerospace giant Boeing has forecast that demand for commercial jets in India will increase more than 4.5 times of the world market by 2031. “India is projected to have highest passenger traffic growth in the world. It will need 1,450 new planes through 2031 worth a total of up to $175 billion,” Dinesh A. Keskar, Senior Vice President (Sales), had said last year while releasing the company’s latest “India Current Market Outlook.”

The growth story is pegged to the growth of the low-cost carriers (LCC) which have shown not only strong resilience but also become innovative in surging ahead. From a level of about one per cent in 2003-44, the market share of LCC is exceeding 70 per cent of the total domestic traffic. Boeing’s forecast is again tied to the LCC story and Keskar has mentioned that India will not be ordering as much wide-body long-haul fleets as smaller aircraft as the domestic sector will be looking at short haul routes.

160-180 million passengers in 10 years

As per estimates, domestic air traffic will touch 160-180 million passengers per annum in the next 10 years and the international traffic will exceed 80 million passengers per annum from the current level of 60 million domestic and 40 million international passengers respectively. According to International Air Transport Association’s (IATA) Airline Industry Forecast 2012-16, India’s domestic air travel market would be among the top five globally, experiencing the second highest growth rate.

Domestic air traffic that would be carried by scheduled carriers in India in 2020-21, is set to cross 164 million passengers as against 54 million in 2010-11, suggesting a growth of three times the present traffic in ten years. International passengers to and from India by 2020-21 will be 92 million, implying a growth of about 2.4 times the traffic of 38 million in 2010-11. Forecast for 2030-31 reveals that domestic air passengers to be carried in India will be 438 million and that of international passengers will be 217 million.

The government has initiated certain measures which are likely to boost the airline industry and one of which is allowing foreign airlines to acquire 49 per cent stake in Indian airlines. The first the announcements could be between UAE’s Etihad Airways and Jet Airways. The beleaguered Kingfisher Airlines is hoping that a foreign investor will bail it out. Also the reform in airline fuel purchasing is expected to provide some relief to the airlines which have high operating costs (almost 40 per cent is fuel bill).

However, there is dissent from the state-run Air India which has warned the government that allowing investments by foreign airlines will hurt the interests of domestic airlines and prevent Indian airports from developing into international hubs.

Air Cargo

The role of the air cargo industry has been limited, so to say, while bulk of the cargo is moved by sea lines due to economics. Nevertheless, air cargo represents about 10 per cent of the airline industry’s revenues. As 35 per cent of the value of goods traded internationally is transported by air, air cargo is a barometer of global economic health.

India’s international air trade to GDP ratio, according to reports, has doubled from four per cent to eight per cent in the last 20 years. The projections are that domestic air cargo volume growth would be between eight and ten times and international cargo between four and 7.5 times by 2030-31.

The Civil Aviation Ministry has forecast that the total cargo throughput at Indian airports is expected to grow 7.6 times in the next 20 years (CAGR of 11.2). Domestic cargo throughput is expected to grow 7.8 times in the next 20 years (CAGR of 10.4 per cent). International cargo throughput is expected to grow 7.5 times in the next 20 years (CAGR of 11.7 per cent). Trans-shipment segment has significant market potential. It is assumed to be five per cent by 2015-16, 10 per cent by 2020-21, 15 per cent by 2025-26 and 20 per cent of international cargo by 2030-31.

With Government of India’s goal being to double exports from $225 billion to $450 billion by 2014 and the National Manufacturing Policy 2011 announced by the Ministry of Industry and Commerce’ aim to enhance share of manufacturing in GDP to 25 per cent by 2020 from current level of 15 per cent, the air cargo projections are achievable.

India’s domestic and international cargo traffic (carried) from and to India is projected to reach a level of 3.6 and 8.2 million tonnes per annum by 2030-31 respectively, from the level of 0.5 and 1.2 MMT per annum in 2010-11.