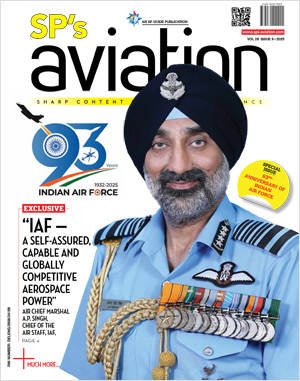

INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Mixed Trends in 2023

In mid-April, Bizjet activity slipped back fast in Europe while seeing some growth towards the end of the month

Analysing the activities of business jets throughout April, WingX Advance charted the business aviation performance from all across the world. Picking up from the WingX data and ahead of the European Business Aviation Convention and Exhibition (EBACE) 2023, we take a look at how April turned out for business aviation in Europe.

With the gap closing between commercial airline activity in 2023 and 2019, business aviation trends are moving in the other direction, with just under 10 per cent gain in April 2023 versus April 2019. In the US, fractional operators are still hitting record levels of activity. In Europe, bizjet flights out of Germany and Austria are now trending well below 2019 levels, and activity in France is now flat compared to four years ago. Other countries inside and outside Europe, including Spain, Italy, Turkey, UAE, Israel, are still seeing strong gains in bizjet activity compared to 2019.

In Week 16 Global business jet activity fell two per cent compared to Week 15, six per cent fewer than the same dates in 2022. 1st – 24th April, business jet and turboprop sectors are seven per cent below last year, nine per cent ahead of 2019. Over the same period, scheduled airlines flew 1.6 million sectors, 16 per cent more than 2022, although 14 per cent below 2019. Focussing on business jets, sectors are down nine per cent compared to last April, 13 per cent ahead of 2019.

In Week 16 European bizjet sectors grew nine per cent compared to Week 15, two per cent below the same dates last year. In the last four weeks activity has fallen six per cent behind the same dates last year. Despite departures falling 11 per cent compared to last April, Le Bourget is the busiest airport in the region, departures are up three per cent compared to 2019. Elsewhere, departures from Nice are up three per cent compared to last year, 12 per cent ahead of 2019. Geneva is seeing a 12 per cent drop compared to last year and Milan Linate is up 20 per cent.

The only aircraft segments this month to see growth compared to last April are Ultra-Long-Range jets, flights of these aircraft types are up two per cent compared to last year, up five per cent compared to 2019. Bizliners are still way behind pre-pandemic activity levels, sectors down 61 per cent compared to April 2019, down 11 per cent compared to last year. Light jets are the busiest aircraft segment in Europe this month, although departures are down eight per cent compared to last year, eight per cent ahead of 2019.

In mid-April, Bizjet activity slipped back fast in Europe. Bizjet flight activity in Germany has slipped back an eye-watering 27 per cent in April 2023 compared to April 2019. Other countries in Europe are also seeing big declines, with the overall region now below the 2019 waterline.

In Week 15 there were 9,553 bizjet departures from Europe, eight per cent more than week 14, four per cent fewer than the same dates in 2022. In the last four weeks the trend has been eight per cent below the same dates in 2022.

By April 20, European bizjet activity was down seven per cent compared to the same period last year, three per cent below the same period in 2019. Exclude Russia, and the trend is seven per cent below last year, on par with 2019. Part 135 & 91K bizjet sectors this month are 11 per cent down compared to last year, one per cent more than in 2019. Part 91 activity is five per cent ahead of last April, 12 per cent behind 2019.

Le Bourget stood to be the busiest bizjet airport in Europe by mid April, activity in decline compared to prepandemic April as well as last year. Sectors are down 14 per cent compared to April 2022. Nice is well ahead of last year, departures are up by 14 per cent compared to April 2022, 20 per cent per cent ahead of 2019.

In Europe, bizjet flights out of Germany and Austria are now trending well below 2019 levels, according to WingX Advance

Most bizjet flights in April had been on Aircraft Management fleets, departures down 18 per cent per cent compared to 2019, 13 per cent per cent down on last April. Branded Charter flights are down seven per cent per cent compared to April last year, although four per cent ahead of 2019. Private and Fractional fleets are seeing double digit growth compared to 2019, one per cent and six per cent compared to last year retrospectively.

There is always significantly less flying during the Easter holidays and as that came earlier this year, the trends were suppressed compared to 2022 and 2019. That said, the deficits compared to 2022 were widening into Q2-2023, reflecting a weakening economic environment and sensitivity to the cost of flying private.

Global bizjet sectors in Week 14, April 3rd through April 9th, amounted to 65,681 sectors, five per cent fewer than the previous week, 16 per cent fewer than the week last year. European bizjet activity this month is actually below 2019 levels, but this is largely due to an earlier Easter holiday this year. In the last four weeks the global trend for business jet activity has been at 10 per cent per cent below the same dates in 2022. In the last four weeks worldwide charter and fractional activity is trending one per cent, behind the same dates in 2022, but still up 24 per cent vs comparable 2019. Scheduled airline activity continues to recover but still trends 16 per cent below April 2019.

In Week 14 there were 8,880 bizjet departures from Europe, eight per cent fewer than Week 13, 15 per cent fewer than the same dates in 2022. In the last four weeks the trend has been seven per cent below the same dates in 2022. The downward trend has clearly been exaggerated by the much earlier Easter holidays this year compared to 2019 and 2022.

By April 20, European bizjet activity was down seven per cent compared to the same period last year

In the first seven days of April European bizjet departures were down four per cent compared to last year, four per cent ahead of 2019. France was the top market, sectors down five per cent compared to the same dates in 2022, three per cent ahead of 2019. The United Kingdom and Germany complete the top three markets, both seeing declines compared to last year. Departures from Le Bourget are 10 per cent below comparable 2022, 12 per cent ahead of 2019. Nice was the only airport in the top five to see bizjet departures above last year.

In week 13, In Europe, 9,702 bizjet sectors were flown, one per cent more than in week 12, four per cent fewer than the same dates in 2022. In the last four weeks activity is five per cent below the same dates in 2022.

Business jet departures from Europe in the first quarter of this year were eight per cent down compared to Q1 2022, five per cent ahead of comparable 2019. Excluding Russia and the Q1 trend was five per cent down compared to 2022, nine per cent ahead of 2019. Light jets were the busiest aircraft segment in Q1 of 2023, departures down 10 per cent compared to 2022, although still six per cent ahead of comparable 2019. Across the aircraft segments demand was mixed in Q1, Heavy jets, entry level jets and Bizliner departures were behind 2019, although Super Light, Very Light and Midsize jets saw double digit growth compared to 2019.