INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

RCS Helping Create an Ecosystem

The policy sets out to establish an integrated ecosystem which will lead to significant growth of civil aviation sector, which in turn would promote tourism, increase employment and lead to a balanced regional growth

In 2014, the Bharatiya Janata Party (BJP) in its election manifesto stated that it would modernise existing and operational airports and build new ones especially connecting smaller towns and all tourism circuits. In addition, it said there is potential for inland air transportation to various remote locations in the country. Such airstrips will be developed so that low-cost air travelling becomes possible within the country. True to its word, the BJP-led NDA Government is working towards fulfilling its election manifesto with particular reference to aviation. The broad swathe of reforms it has been unravelling over the past two years is indicative of the fact that the government is truly interested in inclusive development.

RCS Objective, Enhancing Regional Connectivity

The latest testimonial to that fact is the announcement on July 1, 2016, of the draft Regional Connectivity Scheme (RCS) which was open for suggestions/comments by stakeholders till July 22, 2016. The final policy is due soon and will be in conjunction with the earlier announced National Civil Aviation Policy 2016 (NCAP). One of the objectives is to “enhance regional connectivity through fiscal support and infrastructure development.” The policy sets out to “establish an integrated ecosystem which will lead to significant growth of civil aviation sector, which in turn would promote tourism, increase employment and lead to a balanced regional growth.”

Competitive Market Environment

It also seeks to sustain and nurture a competitive market environment, stating that it would be best for growth in the sector and establishment of regional air connectivity to materialise through open market mechanisms in terms of airlines assessing demand on various routes, developing networks through deployment of appropriate capacities and technologies, infrastructure development in sync with demand, etc. To stimulate the segment it is providing for financial support, at least in the initial period, to trigger participation of players.

AIRFARE FOR AN RCS SEAT WILL NOT BE SUBJECT TO ANY LEVIES OR CHARGES IMPOSED BY THE AIRPORT OPERATORS INCLUDING PASENGER SERVICE FEE (PSF), DF (DEVELOPMENT FEE) AND UDF (USER DEVELOPMENT FEE)

The operation of RCS is proposed to be through a market mechanism where operators will assess demand on routes; submit proposals for operating / providing connectivity on such route(s); and seek viability gap funding (VGF), if any, while committing to certain minimum operating conditions.

Different Cost of Operations

The Ministry of Civil Aviation (MoCA) has acknowledged that different aircraft operated by operators for the same stage lengths can have varied cost of operations due to differences in inherent economics of aircraft types for various stage lengths, cost of operations based on business models, fleet utilisation, scale of operations, etc. The government has reiterated that the primary objective of RCS is to facilitate/stimulate regional air connectivity by making it affordable.

The RCS will support operators through concessions by Central and state governments and airport operators to reduce the cost of airline operations on regional routes and financial support to meet the gap, if any, between the cost of airline operations and expected revenues on such routes.

Concessions Listed Out

The draft has suggested concessions to be offered by airport operators and they are:

- Airport operators (whether under the ownership of the Airports Authority of India (AAI), state governments, private entities or the Ministry of Defence, shall not levy landing charges and parking charges on RCS flights.

- AAI shall not levy any terminal navigation landing charges (TNLC) on RCS flights.

- Route navigation and facilitation charges (RNFC) will be levied by AAI on a discounted basis at 42.50 per cent of normal rates on RCS flights. Normal rates refer to applicable rates specified by the AAI without any discounts or concessions.

- Selected airline operators will be allowed self-ground handling for operations under the scheme at all airports.

Central Concessions

The concessions offered by the Central Government are:

- Excise duty at a rate of 2 per cent shall be levied on aviation turbine fuel (ATF) purchased by the selected airline operators from RCS airports for an initial period of three years from the date of notification of the scheme.

- Selected airline operators will have the freedom to enter into code sharing arrangements with both domestic as well as international airlines.

- Concession on service tax on tickets.

State Concessions

The concessions to be offered by the state governments at RCS airports within their states shall be as follows:

- Reduce VAT to 1 per cent or less on ATF at RCS airports located within the state for a period of 10 years.

- Provide minimum land, if required, free of cost and free from all encumbrances for development of RCS airports and also provide multi-modal hinterland connectivity (road, rail, metro, waterways, etc.) as required.

- Provide security and fire services free of cost at RCS airports.

- Provide electricity, water and other utility services at substantially concessional rates at RCS airports.

- Provide a certain share (20 per cent for states other than for North-eastern states where the ratio will be 10 per cent) of VGF determined pursuant to the scheme.

The scheme will be applicable for a period of 10 years from the date of its notification by the MoCA. It said that VGF will be provided to RCS flights for a period of three years from the date of commencement of operations of such RCS flights (tenure of VGF support). The scheme will be applicable with respect to RCS airports and heliports. Airfare for an RCS seat will not be subject to any levies or charges imposed by the airport operators including passenger service fee (PSF), DF (development fee) and UDF (user development fee).

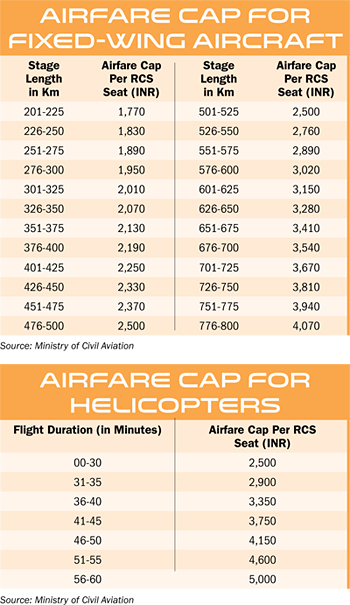

As per the scheme, an all-inclusive airfare not exceeding Rs. 2,500 per RCS seat will be applicable for: RCS flights operated by fixed-wing aircraft for stage length of 500 km and RCS flights operated by helicopters for flight duration up to 30 minutes.

The MoCA has recognised that traffic demand on RCS route(s) will be uncertain, and with most of such routes being untested/non-operational, the market risk for selected airline operator(s) could be significant. Such market risk would tend to be accentuated on account of possible competition from other airline operators – especially in the early stages of route development.

Exclusivity of Operations

It said that such competition in the early stages of development of such routes, especially given the demand uncertainty, could ultimately impact achievement of scheme objectives. Accordingly, to encourage development of such routes by airline operators, selected airline operators shall be granted exclusivity of operations for a certain period on an RCS route. During such exclusivity period, no other airline operator would be allowed to operate flights on the specific RCS route.

Minimum Performance Specifications

Under the scheme, an operator will be required to meet certain minimum performance specifications with respect to its RCS flight operations. For fixed-wing aircraft, an operator shall be required to provide 50 per cent of RCS flight capacity as RCS seats per RCS flight; provided that in a scenario where 50 per cent of RCS flight capacity is more than 40 seats, the number of RCS seats shall be capped at 40 and VGF sought would be limited to such 40 RCS seats; provided further that in a scenario where 50 per cent of RCS flight capacity is less than nine seats, the operator shall be required to provide nine seats as RCS seats per RCS flight.

For helicopters, an operator shall be required to provide five RCS seats per RCS flight. The number of RCS flights to be operated in a week with VGF shall be a minimum of three and a maximum of seven.

16 Underserved Airports

The draft has listed out 16 airports/airstrips as underserved and they are Car Nicobar, Andaman Islands; Jorhat, North Lakhimpur (Lilabari) and Tezpur in Assam; Jamnagar and Bhavnagar in Gujarat; Kullu in Himachal Pradesh; Thoise in Jammu and Kashmir; Agatti Lakshadweep Islands; Shillong (Barapani) Meghalaya; Diu Daman and Diu (Union Territory); Agra and Allahabad in Uttar Pradesh; Gwalior, Madhya Pradesh; Pantnagar Uttarakhand and Ondal (Durgapur) West Bengal. The draft has notified 394 airports and airstrips as unserved.