INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- A leap in Indian aviation: Prime Minister Modi inaugurates Safran's Global MRO Hub in Hyderabad, Calls It a Milestone

- All about HAMMER Smart Precision Guided Weapon in India — “BEL-Safran Collaboration”

- India, Germany deepen defence ties as High Defence Committee charts ambitious plan

- True strategic autonomy will come only when our code is as indigenous as our hardware: Rajnath Singh

- EXCLUSIVE: Manish Kumar Jha speaks with Air Marshal Ashutosh Dixit, Chief of Integrated Defence Staff (CISC) at Headquarters, Integrated Defence Staff (IDS)

- Experts Speak: G20 Summit: A Sign of Global Fracture

Regional Aviation - Options Aplenty

The Indian Government plans to encourage regional flights to about 80 Tier-III and Tier-IV destinations by auctioning these unenticing routes to the airlines. It is also likely to formulate fresh incentives for smaller aircraft to cater to the growing number of passengers from non-metro cities. And there are plenty of regional aircraft to choose from.

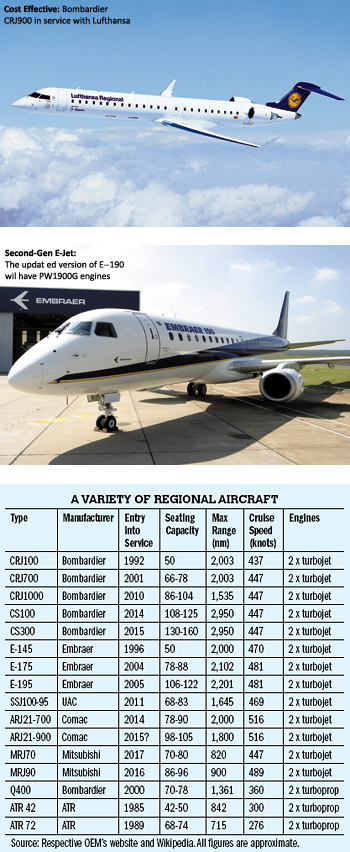

The global commercial aircraft market is dominated by two fierce rivals, the European giant Airbus and the US corporation Boeing. Their competition is especially intense in the narrow-body jet segment where the next 20 years should see sales of over 20,000 aircraft like the Airbus 320 and the Boeing 737. But when it comes to regional jets, it is Bombardier of Canada and Embraer of Brazil that have carved up the market between them, while Bombardier and Europe’s ATR fight it out to rule the regional turboprop space. And working feverishly to challenge the Bombardier-Embraer duo are other original equipment manufacturers (OEMs) who would like to see their forthcoming regional jets corner a significant share of sales.

Bombardier’s 20-year commercial aircraft market forecast released last June predicts deliveries of 12,800 jets and turboprops in the 20-149 seats segment from 2012-31. This year’s forecast is unlikely to vary much. India is projected to need only about 640 planes in the 60-149 seats category. That is because the country’s major airports are located in the traffic-intensive metros and large cities, making it essential for airlines to deploy aircraft with 180 plus seats like the Airbus 320 and Boeing 737. The regional market, however, needs much smaller planes, since a majority of airports have short runways and their demand is insufficient to fill even a standard narrow-body airliner.

Private carriers like SpiceJet and Jet Airways are eager to tap the regional market because that is where the next wave of growth is expected. SpiceJet has acquired a fleet of 15 Bombardier Q400 NextGen aircraft to connect Tier-II and Tier-III cities across the country. The airline has options for another 15 of these versatile turboprops. Jet Airways operates 16 ATR 72-500 turboprop aircraft and is inducting five ATR 72-600s so as to touch a number of smaller airports that are unviable with jets. The Indian Government plans to encourage regional flights to about 80 Tier-III and Tier-IV destinations by auctioning these unenticing routes to the airlines. It is also likely to formulate fresh incentives for smaller aircraft to cater to the growing number of passengers from non-metro cities. And there are plenty of regional aircraft to choose from.

Bombardier’s Brainwave

Bombardier Aerospace, the world’s third-largest aircraft manufacturer, can justifiably claim to have sparked the modern regional jet party in 1992. When it hit upon the idea of transforming the unsuccessful Challenger business jet into the 50-seat Canadair Regional Jet (CRJ), the experts were not impressed. But the CRJ100/CRJ200 sold well and encouraged Bombardier to think even bigger. Over the years, the larger CRJ700 (66 to 78 seats), CRJ900 (75 to 90 seats), and CRJ1000 (86 to 104 seats) have succeeded in lowering seat-mile costs significantly and have come to epitomize regional jets. As of March 31, 2013, Bombardier has delivered 1,680 jets of the CRJ family and has an order backlog of 102 aircraft.

Then there is Bombardier’s eagerly awaited CSeries regional jet, the biggest and most complex aircraft it has yet built. The CS100 with 108-125 seats and the CS300 designed for 130-145 passengers will both have the impressive new Pratt & Whitney geared turbofan (GTF) engine, the PW1524G. According to Bombardier, the CSeries should have a 15 per cent lower operating cost, 20 per cent fuel burn advantage and impressive environmental credentials compared to Embraer E-Jets.

The CS100 is expected to record its first flight in June and its entry into service (EIS) may be in mid-2014. The CS300’s EIS is expected in 2015. What may give Airbus and Boeing sleepless nights is a proposed 160-seat CS300 variant that would blur the divide between regional and narrow-body jets. Bombardier currently has firm orders for 145 CSeries planes and options on 193.

Embraer Emerges

Embraer’s first regional jet, the 50-seat ERJ-145 entered service in December 1996 just when the US carriers were yearning for short-range jets to replace their unpopular turboprops on regional routes. Embraer soon began to challenge Bombardier in the regional jet market. And not complacent with the success of the ERJs, it introduced the larger and roomier E-Jets in 2004. These too were highly successful, giving regional airlines an option midway between small regional jets and the narrow-bodies from Boeing and Airbus. The E-175 with 78-88 seats and the E-195 with 106-122 seats gave Embraer an immediate advantage over Bombardier, which in turn responded with the stretched CRJ700 series. As of March 31, 2013, Embraer has delivered 925 E-Jets and has a firm order backlog of 211 and 624 options.

Reacting to Bombardier’s CSeries, Embraer has opted for an updated version of the E-Jets instead of a new design. Expected to enter service by 2018, these “second generation” E-Jets will have composite-based wings, longer fuselage, and taller landing gear to accommodate fuel-efficient GTF engines, Pratt & Whitney’s PW1700G for the E-170 series and PW1900G for the E-190 series.

Sukhoi’s Slow Success

In April 2011, the United Aircraft Corporation (UAC) Sukhoi Superjet SSJ100-95 (86 to 103 seats) entered commercial service. This Russian regional jet was designed to compete internationally. However, an unfortunate accident during a demonstration flight in Indonesia in May 2012 in which 45 perished, revealed several technical flaws denting its popularity. The official backlog of the SSJ100 stands at 179 aircraft. Sukhoi has also begun flight-testing a long-range version, the SSJ100LR.

Increasing Competiton

The long-delayed Comac ARJ21 Xiangfeng (“Soaring Phoenix”) will be the first passenger jet to be indigenously developed and produced in China. To enhance demand for regional jets, China is working zealously to open new airports in small cities. The ARJ21 is fitted with specially developed General Electric CF34-10A engines that give it powerful take-off and climb performance, permitting the use of airports with short runways. While the ARJ21-700 baseline model will have a capacity of 78-90 seats, the ARJ21-900 stretched version will take 98-105 passengers. Comac now aims to deliver the first ARJ21-700 in 2014 and claims to have secured 309 orders till date, with 20 options.

Then there is the keenly awaited Mitsubishi Regional Jet (MRJ), designed by Japan’s Mitsubishi Aircraft Corporation. The MRJ too will have Pratt & Whitney’s fuel-efficient PW1217G GTF engines. The MRJ90 (86 to 96 seats) is likely to complete its first flight during the fourth quarter of this year and enter service by early 2016. Development of the MRJ70 (70 to 80 seats) is expected to lag perhaps a year. Mitsubishi has 167 firm orders from customers convinced that the MRJ will live up to the Japanese reputation for technological excellence. The company claims that the MRJ90 will achieve 20 per cent better fuel burn than rival Embraer E-190. But it is still guarded about the proposed 100-seat MRJ100X, a variant in which European airlines have shown great interest.

India is the only BRICS country without indigenous passenger aircraft manufacturing capability. It has set up a National Civilian Aircraft Design Bureau which is working on the preliminary design of the project expected to be a 70 to 90-seat jet with a range of 2,500 km. Such a plane would have strong regional utility within the country. Russia’s UAC, which manufactures the SSJ100, has reportedly offered to set up joint development and manufacturing facilities in India for the purpose.

Turboprops Triumph

For some years, regional jets threatened to completely marginalise the slow and noisy turboprops. However, the inexorable rise in fuel prices over the last ten years has helped fuel-efficient turboprops stage a spectacular comeback.

The Bombardier Q-Series turboprops were introduced in 1984. According to Bombardier, the 70 to 78-seat Q400 (EIS 2000) burns 30-40 per cent less fuel on routes where it has replaced older regional jets. It is also quieter and more comfortable than older turboprops. As of March 31, 2013, Bombardier has delivered 1104 Q-series aircraft and has an order backlog of 34.

The French-Italian aircraft manufacturer, ATR, with headquarters in Toulouse, France, builds the 42 to 50-seat ATR 42 and 68 to 74-seat ATR 72, both introduced in the 1980s. With the series-600 programme, launched in 2007, ATR further strove to improve the performance and efficiency of these aircraft without making significant changes. The new aircraft look much the same externally but are very different inside. Their new engines provide five per cent additional power at take-off, improving performance from short runways and “hot and high” conditions. The avionics suite has also been transformed. While the ATR 72 competes with the Bombardier Q400, any airline needing a new 50-seat turboprop can only buy the ATR 42. By December 31, 2012, ATR had delivered 1,033 aircraft (422 ATR 42 and 611 ATR 72) and its backlog stood at 221, the largest backlog for any regional aircraft of up to 90 seats.

In about five years, the regional aircraft market is expected to see several OEMs jostling for space. Will turboprops eclipse jets? The price of oil holds the key.