INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Top Civil Aero Engines in the World Today

An aircraft engine is a complex machine that is expected to operate at very high altitudes and at very high speeds; its components have to withstand high rotation speeds and very high or low temperatures

The turbofan engine market is dominated by a handful of mostly Western players. In an increasingly globally-linked world, aircraft engines are an important component for transport applications, including commercial, military, business and general aviation. Many companies have large portfolios of engines for different uses. As per the Annual Strategy Dossier – 2021, the top four global commercial aircraft turbofan engine manufacturers are Pratt & Whitney, Rolls-Royce, GE Aviation and Safran. GE and Safran of France have a joint venture called CFM International. Pratt & Whitney also have a joint venture, International Aero Engines with Japanese Aero-engine Corporation and MTU Aero Engines of Germany. Pratt & Whitney and General Electric have a joint venture, Engine Alliance selling a range of engines for aircraft such as the Airbus 380.

There are others like Honeywell Aerospace, Russian and Chinese companies into aircraft engine manufacturing. Most engine manufacturers make engines for both civil and military aircraft. Business of most companies was badly affected by the COVID-19 Pandemic. As per the report released by global business data platform “Statista” in May 2021, CFM International had 39 per cent market share of the commercial aircraft engines in 2020; Pratt & Whitney (35 per cent); GE Aviation (14 per cent) and Rolls-Royce (12 per cent). It is interesting to look at the product range and size of some of the top engine manufacturers.

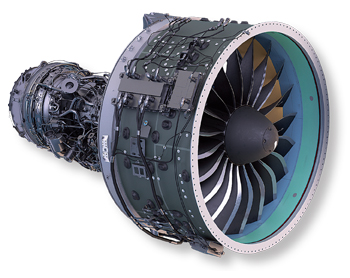

PRATT & WHITNEY

Pratt & Whitney that has joint ventures with the leading engine manufacturers, is a subsidiary of Raytheon Technologies. Its aircraft engines are widely used on both civil and military aircraft. Today, it has over 13,000 large commercial engines installed. The GTF engine with its revolutionary geared fan technology, powers the Airbus A220 and A320neo family and Embraer E190-E2. The Mitsubishi Regional Jet (MRJ) and Irkut MC-21 are currently undergoing flight testing. The GTF engine also incorporates advances in aerodynamics, lightweight materials and other major technology improvements.

The JT9D has the distinction of being chosen by Boeing to power the original Boeing 747 “Jumbo jet”. The PW4000 series is the successor to the JT9D and powers some Airbus A310, Airbus A300, Boeing 747, Boeing 767, Boeing 777, Airbus A330 and MD-11 aircraft. The PW4000 is certified for 180-minute Extended Twin Operations (ETOPS) when used in twinjets. PW4000 has three variants with 94-inch (2.4m) fan diameter, 100-inch (2.5m) fan engine developed specifically for the Airbus A330 twinjet and the 112-inch (2.8m) designed to power the Boeing 777.

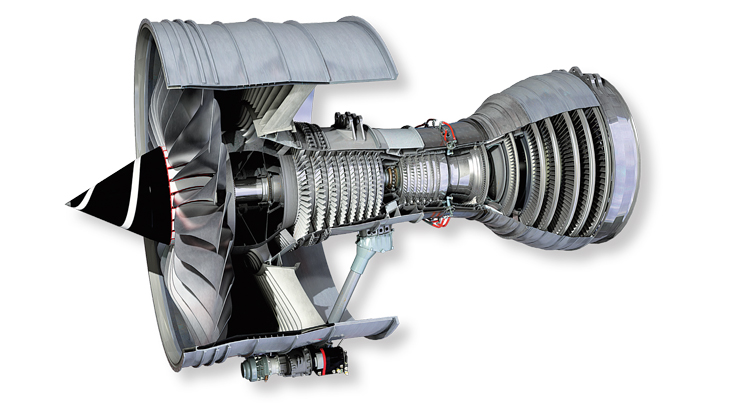

GENERAL ELECTRIC (GE) AVIATION

Formed in 1892, today GE’s primary business divisions are Additive, Aviation, Capital, Digital, Healthcare, Power, Renewable Energy and Global Research. On November 9, 2021, the company announced it would divide into three public companies focused on aviation, healthcare, and energy respectively. The GE engines include the CF6 on the Boeing 767, Boeing 747 and Airbus A330. The GE90 is only on Boeing 777. The GenX was developed for the Boeing 747-8 and Boeing 787 Dreamliner and proposed for the Airbus A350. The GE9X currently holds the title for the most powerful engine in the world. The engine will feature on the upcoming 777X and has already flown a number of test flights. The engine is based on the design of the GE90.

ROLLS-ROYCE

Incorporated in February 2011, Rolls-Royce Holdings is a British multinational engineering company, a business established in 1904. Rolls-Royce was the world’s 25th largest defence contractor in 2021 by defence revenues. The company is known for the RB211 high-bypass turbofans and Trent series, as well as their joint venture engines for the Airbus A320, McDonnell Douglas MD-90 family and the Boeing 717 (BR700). Rolls-Royce Trent 970s were the first engines to power the new Airbus A380.

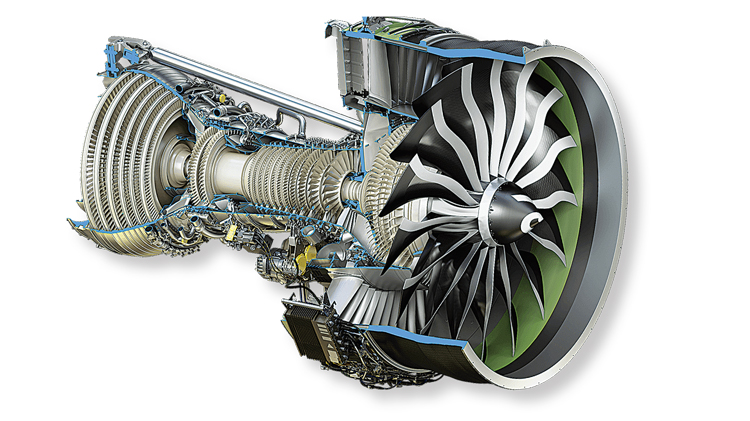

CFM INTERNATIONAL

CFM International is a 50:50 joint venture between GE Aircraft Engines and SNECMA of France. They have created the very successful CFM56 series, derived from GE’s CF6 and Snecma’s M56. It powers the Boeing 737, Airbus A340 and Airbus A318 to A321 family of aircraft. Around 30,000 CFM56 engines have been delivered to over 550 operators worldwide. The Leading Edge Aviation Propulsion (LEAP) engine entered service in 2016. It has 15 per cent improvement in fuel consumption compared to latest CFM56 models and maintains the same level of dispatch reliability and life-cycle maintenance costs. Over 2,500 LEAP engine variants are flying on the Airbus A320neo, Boeing 737 MAX and COMAC C919.

CFM RISE PROGRAME

GE Aviation and Safran have launched a bold technology development programme targeting more than 20 per cent lower fuel consumption and CO2 emissions compared to today’s engines. CFM’s RISE Revolutionary Innovation for Sustainable Engines (RISE) programme will demonstrate and mature a range of new, disruptive technologies for future engines that could enter service by the mid-2030s. The programme includes open fan architecture, hybrid electric capability, demonstrator ground and flight tests around middle of decade. It plans 100 per cent sustainable aviation fuel and hydrogen capability. The companies also signed an agreement extending the CFM International 50/50 partnership to the year 2050, declaring their intent to lead the way for more sustainable aviation in line with the industry’s commitment to halve CO2 emissions by 2050. Through the RISE technology demonstration programme, they plan to reinvent the future of flight, bringing an advanced suite of revolutionary technologies to market that will take the next generation of single-aisle aircraft to a new level of fuel efficiency and reduced emissions. They also embrace the sustainability imperative. “Deliver for the future” is the mantra. Plan is to accelerate efforts to reduce impact on the environment. Their LEAP engine already reduces emissions by 15 per cent compared to previous generation engines. The technologies matured as part of the RISE programme will serve or the next-generation CFM engine that could be available by the mid-2030s. They will also ensure 100 per cent compatibility with alternative energy sources such as Sustainable Aviation Fuels and hydrogen.

Many major manufacturers have formed joint ventures to access both technology and markets

Central to the programme is state-of-the-art propulsive efficiency for the engine, including developing an open fan architecture. This is a key enabler to achieving significantly improved fuel efficiency while delivering the same speed and cabin experience as current single-aisle aircraft. The programme will also use hybrid electric capability to optimize engine efficiency while enabling electrification of many aircraft systems. The programme is being led by a joint GE/Safran engineering team that has laid out a comprehensive technology roadmap including composite fan blades, heat resistant metal alloys and ceramic matrix composites (CMCs), hybrid electric capability and additive manufacturing. The RISE programme includes more than 300 separate component, module and full engine builds. A demonstrator engine is scheduled to begin testing at GE and Safran facilities around the middle of this decade and flight test soon thereafter. Today, CFM is the world’s leading supplier of commercial aircraft engines with a product line that serves as the industry benchmark for efficiency, reliability and low overall cost of ownership. More than 35,000 CFM engines have been delivered to over 600 operators around the globe, accumulating over one billion flight hours.

ENGINE ALLIANCE

Engine Alliance is a 50:50 joint venture between GE and Pratt & Whitney. Their GP7200 engine was originally intended to power the later cancelled Boeing 747-500X/-600X. It was later re-optimised for use on the Airbus A380 superjumbo. In that market, it is competing with the Rolls-Royce Trent 900, the launch engine for the aircraft. The engine powers an estimated 60 per cent of Airbus A380. The two variants are the GP7270 and the GP7277.

INTERNATIONAL AERO ENGINES

International Aero Engines is a joint venture between Pratt & Whitney, MTU Aero Engines and Japanese Aero Engine Corporation. The collaboration produced the V2500, the second most successful commercial jet engine in production today and the third most successful commercial jet engine programme in aviation history. The V2500 is a two-shaft high-bypass turbofan engine which powers the Airbus A320 family, the McDonnell Douglas MD-90 and the Embraer KC-390. In July 2021, Pratt & Whitney announced that that the V2500 engines currently powering more than 3,000 aircraft with over 200 customers.

HONEYWELL AEROSPACE

Honeywell Aerospace is a major manufacturer of aircraft engines, avionics and Auxiliary Power Units among other aviation products. It is a division of the Honeywell International conglomerate. The Honeywell HTF7000 series is used in the Bombardier Challenger 300 and the Gulfstream G280. The ALF502 and LF507 turbofans are produced by a partnership between Honeywell and China’s state-owned Industrial Development Corporation. The partnership is called the International Turbine Engine Co.

WILLIAMS INTERNATIONAL

Williams International is a US-based manufacturer of small gas turbine engines. They produce jet engines for cruise missiles and small jet-powered aircraft in the range between 1,000 and 3,600 pounds of thrust. The engines are used on the Cessna Citation Jet CJ1 to CJ4, Cessna Mustang, Beechcraft 400XPR and Premier 1A and there are several development programmes with other manufacturers.

AVIADVIGATEL

Aviadvigatel is a Russian manufacturer of aircraft engines that succeeded the Soviet Soloviev Design Bureau. The company currently offers several versions of the Aviadvigatel PS-90 engines that power the Ilyushin Il-96-300/400/400T, Tupolev Tu-214 series and the Ilyushin Il-76-MD-90. The company is also developing the new Aviadvigatel PD-14 engine for the new Russian MS-21 airliner.

The turbofan engine market is dominated by a handful of, mostly Western, players

IVCHENKO-PROGRESS

Ivchenko-Progress is the Ukrainian aircraft engine company that succeeded the Soviet Ivchenko Design Bureau. Some of their engine models include Progress D-436 fitted on the Antonov An-72/74, Yakovlev Yak-42, Beriev Be-200, Antonov An-148, and Tupolev Tu-334. The Progress D-18T powers two of the world’s largest airplanes, Antonov An-124 and Antonov An-225.

POWERJET

PowerJet is a 50–50 joint venture between Snecma (Safran) and NPO Saturn created in July 2004. The company manufactures SaM146, the sole power-plant for the Sukhoi Superjet-100.

CHINESE TURBOFANS

Three Chinese corporations build turbofan engines. Some of these are licensed or reverse engineered versions of European and Russian turbofans and the others are indigenous models. Shenyang Aircraft Corporation manufactures WS-10, Xi’an Aero-Engine Corporation manufactures WS-15 and Guizhou Aircraft Industry Corporation manufactures WS-13 turbofan.

TO SUMMARISE

There are very few major aircraft engine manufacturers who dominate the industry. An aircraft engine is a complex machine that is expected to operate at very high altitudes and at very high speeds; its components have to withstand high rotation speeds and very high or low temperatures. With many single and twinengine aircraft flying, the engine reliability have to be very high and have to be fuel efficient for better range and endurance to give greater distance per passenger for fuel expended. High thrust-by-engine weight is a very important engine criterion. Despite years of investment in R&D, China continues to struggle in its engine development. Several major manufacturers have formed joint ventures to access both technology and markets. That perhaps is the best route to follow for India too. In the meantime it would be a good idea to get into the MRO market by setting up maintenance, repair and overhaul facilities for existing major engine manufacturers.