INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

- A leap in Indian aviation: Prime Minister Modi inaugurates Safran's Global MRO Hub in Hyderabad, Calls It a Milestone

- All about HAMMER Smart Precision Guided Weapon in India — “BEL-Safran Collaboration”

- India, Germany deepen defence ties as High Defence Committee charts ambitious plan

- True strategic autonomy will come only when our code is as indigenous as our hardware: Rajnath Singh

- EXCLUSIVE: Manish Kumar Jha speaks with Air Marshal Ashutosh Dixit, Chief of Integrated Defence Staff (CISC) at Headquarters, Integrated Defence Staff (IDS)

- Experts Speak: G20 Summit: A Sign of Global Fracture

Travellers’ Delight

Key forecast figures project Asia as the region that would drive the global growth of aviation industry. Today, many a regional player are vying with the traditional market dominators in providing business as well as pleasure travellers a wide range of choice to select from.

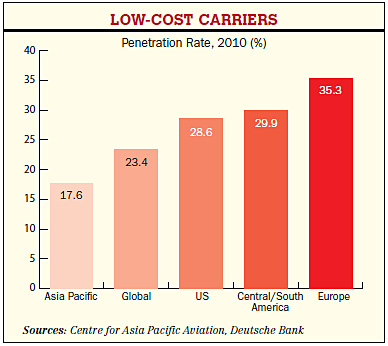

A decade ago, the Asian aviation scenario was circumscribed to a handful of large international carriers. Today, Asian markets are a travellers’ delight, with many a regional player vying with the traditional market dominators in providing business as well as pleasure travellers a wide range of choice to select from. Perhaps the most exciting success story of all in this region is that of AirAsia. A former music industry executive, Tony Fernandes, bought a failing company in 2001 from the Malaysian Government for the token amount of one ringgit (26 US cents) and proceeded to bring it to a standard for which it was named the world’s best low-cost airline in 2009 and 2010 by the aviation consortium Skytrax. Fernandes started AirAsia with just two aircraft and one destination; and now the Kuala Lumpur-based carrier has close to a hundred aircraft and is a force to reckon with in the regional aviation market in Asia whose economic stridency—led by India and China—is a healthy portent of what the future holds for the regional aviation scene. Key forecast figures project Asia as the region that would drive the global growth of aviation industry.

Traditionally, especially in America, regional airlines were considered as those which operate regional aircraft, that is, aircraft with seating capacities of 99 or less passengers. This classification is perhaps still somewhat applicable to the Indian “regional” aviation i.e. connectivity to non-metro cities and towns within India. However, this definition is no longer tenable with aircraft of the A320/Boeing 737 class being used for regional air travel. These single isle (or narrow body) aircraft have seating capacities of 180-odd passengers and can do about four hour legs comfortably. AirAsia differentiates between short haul (AirAsia, which flies legs of around four hours) and long haul (AirAsia-X, which flies longer duration flights). Incidentally, Commercial Aircraft Corporation of China (COMAC) is developing the C919 which will seat 150-160 passengers in a two-class layout or 180-190 in a single-class configuration, depending on customer specifications. The first test flight is expected in 2014 and certification by 2016. The aircraft will be China’s first indigenous narrow body jet aircraft (not counting the smaller ARJ21 regional jet), and COMAC expects to sell 2,000 to 2,200 C919s over 20 years. The C919 is expected to compete with the Boeing 737 and Airbus A320 in the regional aircraft market. China’s big three carriers—Air China, China Eastern Airlines and China Southern Airlines—are the possible launch customers for the planned C919 aircraft. Airbus holds about 43 per cent, and Boeing currently has a 53 per cent share of China’s commercial jetliner market. As quaintly expressed by a report, ‘A’ of Airbus, and ‘B’ of Boeing will soon be joined by ‘C’ of Comac C919 in the “regional” skies over Asia.

There are three ways for a regional airline to do business. As a feeder airline, it could contract with a major airline, or, operate as a subsidiary, delivering passengers to the major airline’s hubs from surrounding communities. SilkAir is the regional wing of Singapore Airlines and operates scheduled passenger services from Singapore to 37 cities in the Asian region (mostly South East Asia, South Asia and China); and thus SilkAir is a “regional airline” subsidiary. Operating under its own brand, an airline could provide service to small and isolated communities, for whom that airline is the only reasonable link to a larger town. In this role, the term commuter airline is generally used. As an independent airline larger than an air taxi or commuter airline service, it could operate scheduled services under its own brand; for example, AirAsia operates to 400 destinations in 25 countries in Asia with its main hub located at Kuala Lumpur. Some other small regional airlines are Berjaya Air, Jetstar (part of Qantas); Tiger Airways and Nok Air, chiefly owned by Singapore Airlines and Thai Airways respectively; and Firefly, a subsidiary of Malaysia Airlines. These regional airlines are a key transportation mode for the archipelagic South East Asia which includes Brunei Darussalam, Indonesia, Malaysia, Philippines and Thailand and is spread over 24,000 islands across 5,200 km from east to west and 3,400 km from north to south.

The growing extent of Asian regional aviation led (in September last year) the International Civil Aviation Organisation’s (ICAO’s) Asia-Pacific planning group to approve the formation of a new team to work towards Seamless Asian Skies (SAS), so as to maximise the efficiency of civil aviation in the region. The new group has begun a two-year planning exercise indentifying what needs to be done to improve Asia-Pacific air traffic management (ATM) and will issue a final report in 2013. As most airlines continue to suffer due to high fuel costs and economic uncertainties continue to render their profitability a grey area, any initiative to eliminate burdensome airspace regulations and allow traffic to flow as smoothly as technology permits, would be a welcome step. SAS appears to be a step in the right direction.