INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Way Ahead of Competition

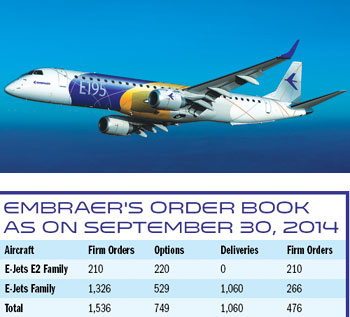

Embraer has notched up over 1,000 deliveries of E-Jets since inception and is going strong, dominating the market for regional jets

While there is a see-saw competition between the two big airframers – Airbus and Boeing—as regards regional jets, there is a clear leader and that is Brazil’s Embraer. The aircraft manufacturer has given new meaning to regional aviation by offering aircraft which are not only comfortable and efficient but also giving an airline the ‘right’ aircraft to serve regional markets. The Brazilian company this year passed an important milestone of having delivered 1,000 aircraft since inception, further consolidating its position as market leader. Embraer has had 8.2 per cent year-on-year increase of its E-Jets family and to keep that lead, it has reworked its strategy by reducing the family of four to three. The new-look E2 Jets are going to be game-changers.

As the company embarks upon these changes, its Canadian rival Bombardier has fair gains with a hike of nearly 7.5 per cent in the CRJ700/900/1000 fleet, notching up sales of about 650 aircraft. Unlike Embraer, Bombardier also offers Dash 8 Q-400 turboprop regional aircraft. The other two major regional jet players—Mitsubishi Regional Jet (MRJ) and Sukhoi Superjet 100 International—are new entrants in the market and are slowly gaining foothold. The other key regional player is a turboprop aircraft manufacturer – ATR that has a short haul market of its own. The fleet of ATR72 has registered 14.6 per cent growth to tally 581 aircraft. The fleet of Russian aircraft such as Ilyushin II-76, Tupolev Tu-154 and Yakovlev Yak-40 are witnessing a slow decline as new aircraft are emerging within Russia and elsewhere. Even as these new players, mostly from Asia-Pacific, make their forays, Embraer has established a strong lead.

Embraer’s Success Story

On initiative by the Brazilian Government, the Brazilian aircraft manufacturer came into being on July 29, 1969, as a culmination to the country’s aviation ambition. The General Command for Aviation Technology (CTA – Centro Tecnico Aeroespacial), a unit of the Brazilian Air Force, coordinated all technical and scientific activities related to aerospace. Over the years, CTA commissioned several defence projects. In 1965, CTA research wing IPD embarked upon a project known as IPD-6504, a turboprop aircraft, which was later named Bandeirante which flew for the first time in 1968. And in 1969, the government established Embraer to take up commercial production of Bandeirante.

Since then, there has been no looking back and its growth metamorphosis has been amazing to say the least. From 500 employees at inception it now has almost 20,000 on its rolls. Embraer’s initial target was to build two Bandeirante aircraft a month and the first of the aircraft were delivered to the Brazilian Air Force in 1973, the year it recorded its first commercial sale to TransBrasil.

Buoyed by this success, Embraer explored the export market and by 1990 when Bandeirante ceased production, it had already notched up sales of 500 in about 35 countries. Importantly, this phase put Embraer on the global aviation map. In the 1970s, it developed the Brasilia, a turboprop regional plane with a capacity of 30 to 40 passengers. It was certified in May 1985 and the first aircraft was sold to the US-based Atlantic Southeast Airlines. Brasilia was said to be the fastest and lightest aircraft in the 30- to 40-seat capacity category. However, around the same time Embraer ran into financial difficulties, attributed to its government control, lack of business orientation and out of sync with market needs. In the early 1990s, Embraer drastically cut costs and laid-off over 50 per cent of its employees, numbers dropping from nearly 13,000 in 1990 to about 6,100 in 1994. In 1994 fiscal, Embraer posted $250 million in revenue and $330 million in loss.

Turnaround

It was these cascading effects that made the government privatise Embraer in 1994. However, the government retained veto power on sale of shares to foreign investors, employee relationships and the terms of sale of aircraft to the military. Control over the company was acquired by a syndicate of Brazilian investors, consisting of the Bozano Group and two of Brazil’s largest government-owned pension funds, Previ and Sistel. Each of these investors held 20 per cent of the voting capital of the company. Mauricio Botelho, the former Executive Director of the Bozano Group, became the new President and CEO of Embraer. Though he had no experience in the aviation industry, the Embraer board had confidence in his ability to revive the company. Within two months of taking charge, he unveiled a strategic turnaround plan of concentrating in the first two years to improving productivity and regaining solvency. For this he put in place a strategy of job layoffs and wage cuts, though it was difficult to push through these reforms with a belligerent union. He however convinced them of his plan and they bought it.

Focus on Regional Jets

Embraer was running behind schedule on many projects and new product development initiatives were in shambles. Consequently, Embraer had few products that showed commercial potential. An exception was the ERJ-145 project which had been launched in 1989. The ERJ-145 was a 50-seat regional passenger jet which was being designed to compete against Bombardier’s comparable CRJ-200.

Botelho cancelled all other projects and staked Embraer’s future on the ERJ-145, a highly risky move for Embraer as Bombardier clearly dominated the market for regional jets at that time. Besides, Embraer had little experience in manufacturing jet passenger aircraft. The company had considerable experience in designing and manufacturing turboprop aircraft. Although these were cheaper to build, but were not very popular with passengers and airlines as they were noisy and the ride bumpy.

Botelho believed that regional jet planes were a better option for the company. Subsequently, the development of the ERJ-145 was carried out in a very systematic manner. Embraer studied the regional jet market carefully to understand the needs and requirements of airlines that used regional jets. Funds to develop the ERJ-145, however, were not easy to come by. Embraer took a $98-million loan from the Brazilian Government to fund the project, with more money being provided by Embraer’s new owners – the Bonazo Group, Previ and Sistel. In addition to this, Embraer also entered into partnerships and technical alliances with companies such as Parker Hannifin Corporation, Allison Engine Company and Honeywell Space and Aviation Control, who collaborated on producing the parts for the plane.

First Flight of the ERJ-145

The ERJ-145 flew for the first in August 1995 and Embraer made the first delivery of the aircraft in December 1996 to Express Jet Airlines,the regional division of US-based Continental Airlines. More orders followed soon and the ERJ-145 went on to become a major commercial success during the second half of the 1990s as the market for regional jets expanded.

The success of the ERJ-145 prompted the company to focus on making regional jets to take advantage of the expanding market. In the late 1990s, Embraer added new models to the ERJ-145 family, launching the ERJ-135 and the ERJ-140, which were modified versions of the ERJ-145. By the end of the 1990s, a total of 192 aircraft from the ERJ-145 family were delivered to various commercial airlines.

The E-Jet Era

The success of the ERJ-145 demonstrated the potential for regional jets and prompted Embraer to consider manufacturing a full range of regional jets to tap more segments of the market. For a better understanding of the regional jet market, Embraer surveyed more than 60 airlines around the world. The survey indicated that the segment for mid-sized regional jets was largely under-served.

Bombardier was the leader in the 50-seat jet segment, while Boeing and Airbus competed in the130-seat segment. However, there were no aircraft available in the 70-, to 110-seat segment. This also seemed to be the segment with the maximum potential. According to estimates by analysts, more than 60 per cent of all flights in the US had been operating with passenger headcounts in this range. Although some of the smaller Boeing and Airbus aircraft could be and were being used to serve this segment, analysts said that these planes came with the same avionics and engineering as the larger planes and hence were not cost effective.

“Airlines are operating with the wrong aircraft and they’re making a loss,” said Botelho. Embraer therefore opted to concentrate on this segment. It was decided that the new Embraer planes would fill the gap between 50- and 70-seat regional jets and the larger jets. The project was announced at the Paris Air Show in 1999. Embraer said that it would introduce four aircraft in what was to be known as the Embraer Jet or more commonly, the ‘E-Jet’ family. The four new planes, the E170, E175, E190 and E195, were to span the 70/110-seat market. The aircraft shared several features, with only minor differences. For instance, the wings and engines of the E170 and E175 were the same, and they only differed in fuselage length and maximum take-off weight. The same applied to the E190 and E195. Reportedly, the four aircraft had 89 per cent commonality. The price tag of this hamily of aircraft were to start from $20 million apiece.

On March 8, 2004, LOT Polish Airlines and US Airways each received an E170. US Airways was the launch customer of the E-Jet in the United States. LOT was the first airline to operate a commercial E-Jet flight between Warsaw and Vienna on March 17, 2004. “E-Jets revolutionised the market for medium-sized jets by incorporating a more spacious cabin for greater passenger comfort and by making it versatile for operators to optimally manage their fleets,” said Paulo Cesar Silva, President & CEO of Embraer Commercial Aviation. “Over these ten years, we have continuously worked to improve the E-Jet family by perfecting its performance and reducing operating costs. This ensures that our customers have the best product in the up to 130-seat jet category and some of the best operational support services in the industry.”

Embraer is the only manufacturer to have developed a family of four modern airplanes specifically for the 70- to 130-seat capacity segment. Since the formal launch of the programme in 1999, Embraer E-Jets have redefined the traditional concept of regional aircraft by operating in other business segments as well. Today, E-Jets are flying with mainline carriers, low-cost and regional airlines and with scheduled tour operators.

In September 2013, Embraer delivered its 1,000th E-Jet, an E175 that was acquired by Republic Airlines, a subsidiary of Republic Airways Holdings Inc of the USA. That same year, the worldwide E-Jets fleet surpassed ten million flight hours and carried some 540 million passengers. Besides their proven reliability established by the average mission completion rate of 99.9 per cent, the global E-Jets fleet has logged more than seven million flight cycles. Operators of E-Jets have access to a strategically located worldwide customer support and network of 37 maintenance, repair and overhaul (MRO) centres, 12 of which are company authorised and 25 that are independent.

Embraer E-Jets command a 50 per cent share of orders, a 62 per cent share of deliveries in the 70- to 130-seat jet segment and are operating in the fleets of 65 airline companies from 45 countries. In June 2013, Embraer launched E-Jets E2, the second generation of the E-Jets family. The first E2 is scheduled for customer delivery in 2018.

Embraer has come a long way indeed in the history of regional aviation.