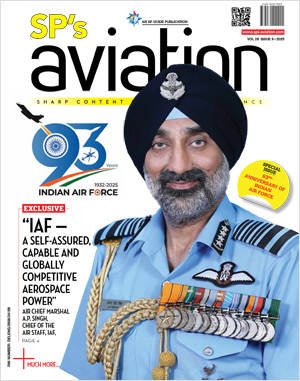

INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

The insightful articles, inspiring narrations and analytical perspectives presented by the Editorial Team, establish an alluring connect with the reader. My compliments and best wishes to SP Guide Publications.

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Leasing & Finance Market

That India is forecast to be the third largest aviation market globally by 2030, is evidenced by the massive fleet orders where there are over a thousand aircraft on order

The coming decade belongs to Asia as global growth for the next decade will be led by India and China. Each of the two countries has sizeable population, high consumer demand and robust traveller base. It is no wonder then that the directional focus for aviation is eastwards. By 2030, India is forecast to be the third largest aviation market globally, and this is evidenced by the massive aircraft acquisition programmes where currently, there are over a thousand aircraft on order (See Table 1). The challenge of finding the means of financing these aircraft, however, still remains.

MARKET DYNAMICS

Traditional sources of financing have included leasing, capital markets, commercial banks, export credit agencies and at times, even the aircraft and engine manufacturers. More recently, private equity and hedge funds have shown great interest in aircraft financing and new variations on sophisticated structures such as the Asset Backed Security (ABS) have evolved. In the case of India though, leasing remains the dominant method for airlines to acquire aircraft. In the current commercial aviation fleet, more than 80 per cent is leased compared to the global average of ~41 per cent. The reasons for this are that most Indian carriers gravitate towards to an asset-light model, cashflow considerations and a favorable financing climate. Until recently, credit markets were very liquid with low interest rates, high competition and high demand. This made for an attractive financing environment where airlines had banks, lessors and even manufacturers, were in competition and provided extremely attractive financing offers. However, this honeymoon appears to be getting over. Interest rates are rising, with the London Inter-Bank Offer Rate (LIBOR) up 26 per cent and geopolitical dynamics seem to be more complex than ever – Brexit, the situation in the Middle East, slowdown in key Latin American economies and US-China trade tensions; currency fluctuations are at an all-time high and there is consolidation in the lessor markets as well. All of this combined is making for a tighter financing environment going forward.

Table 1: Deta ils of Aircraft on Order and Sources of Financing

| Airline | Aircraft in service | Aircraft on order (including options) | Financing of current fleet |

| IndiGo | 209 | 397 | • Sale and Lease Back • Finance Lease • Dry Lease |

| SpiceJet | 78 | 236 | • Sale and Lease Back • Export Credit Financing • Dry Lease |

| Air Asia India | 20 | TBD | • Dry Lease |

| GoAir | 48 | 114 | • Sale and Lease Back |

| Vistara | 22 | 52 | • Dry Lease |

| Jet Airways* | 109 | 201 | • Sale and Lease Back • Finance Lease • Bank Financing |

| Air India | 124 | 4 | • Sale and Lease Back • Dry Lease • Bank Financing |

| Others | 40 | 30 | Various |

| Total Fleet | 645 | 1,042 |

SLB – A CORNERSTONE OF FLEET FINANCING IN INDIA

For India, the most popular source remains the Sale-and-Lease Back (SLB) model in which the airline acquires the aircraft at an attractive price, then sells the aircraft to a lessor at a profit and leases it back for its own use. SLBs are important as they are cash-generating and allow the airlines a degree of fleet flexibility. The flipside is that airlines are left with asset-light balance sheets. Over time, they end up paying more for the asset. On the operating leases, they lose out on the depreciation cover. To combat this, some airlines have considered a combination of finance lease and outright purchase; but the SLB model continues to dominate.

Given the voluminous orders by Indian carriers which make for extremely attractive aircraft pricing, the SLB model will continue to be a cornerstone of fleet financing in India

The SLB model depends on liquidity on the aircraft type and this is usually driven by supply and demand, as well as the ability of a lessor to place these aircraft with a number of airlines during their life. Since the Airbus A320 and the Boeing 737 are widely used, these are highly liquid aircraft and thus lessors have had no hesitation in financing these aircraft. Yet, with the grounding of the Boeing 737 Max 8, an interesting short-term trend has emerged where there may possibly be a supply-demand imbalance leading to a lower SLB premium. Again, while this is short-lived, it is still a factor to be taken into consideration. For India, the Boeing 737 Max 8 operators are SpiceJet and Jet Airways. Both airlines have already financed 18 aircraft via SLBs. Future deliveries are pending and will resume after the ban on the aircraft is lifted. Given the voluminous orders by Indian carriers which make for extremely attractive aircraft pricing, the SLB model will continue to be a cornerstone of fleet financing in India.

LESSORS FACING HEADWINDS

The leasing market has been facing headwinds of sorts. Intense competition amongst the lessors has led to attractive options for airlines, but declining profitability for the lessors. However, that was also manageable given low input costs namely, interest rates, availability of bank debts and exchange rates. As these input costs rise, these are impacting lessor margins leading to lower profitability and resulting in raising issues about the creditworthiness of airlines. Lessors are, therefore, becoming increasingly cautious. The most adversely affected are the smaller airlines and airlines with weak balance sheets. Ironically for lessors, this means a tendency to veer towards quality airlines. Consequently, more lessors are competing for similar deals with the stronger airlines.

In addition, there are various challenges faced by lessors namely, forecast consolidation amongst lessors and a rising interest rate environment. Till the beginning of the year, there was uncertainty regarding the future of GECAS – the largest global lessor. Avolon, the world’s third largest lessor, was also facing turbulence emanating from financial challenges with their owner – the HNA group. Niche market players such as Nordic Aviation Capital have been impacted by a slew of regional airline failures while others are reviewing their portfolios and geographic exposure.

That said, leasing continues to be attractive; but as a leasing executive recently stated, “There are far too many lessors chasing far too many deals which is impacting lease rate factors, structures and lease terms.” As of 2019, the top ten lessors along with number of aircraft in their portfolios are listed in the Table 2.

Table 2. Top Ten Lessors for Airlines in India

| Lessor | Total No. of Aircraft (Owned & Managed) |

| GECAS | 1970 |

| AerCap | 1566 |

| Avolon | 971 |

| Nordic Aviation Capital | 500 |

| Industrial and Commercial Bank of China (ICBC) | 360 |

| BOC Aviation | 343 |

| SMBC Aviation Capital | 453 |

| Air Lease Corporation | 271 |

| Aviation Capital Group | 242 |

| Aircastle | 261 |

FAILURE OF GOVERNMENT FINANCING AND LEASING INITIATIVES

Having realised the importance of enabling financing for the aviation sector, the Indian government is facilitating this via Project ‘Rupee Raftar’. Specifically, the Ministry of Civil Aviation (MoCA) established a Working Group to review and recommend measures to develop an industry for aircraft financing and leasing in India. The group was constituted in mid-2018 and a Report with their final recommendations was released at the Global Aviation Summit in 2019. Following Ireland’s success as a world leader in aviation finance, the Report borrowed heavily from Ireland’s blueprint and listed key areas of concern. It also made recommendations to policymakers towards developing aircraft financing and leasing activities in India.

The financing markets in India are extremely tight resulting in extremely constrained lending and financing to the Indian airline industry by institutions in India

The Report highlighted key tasks that would make this industry in India competitive, but even reading the Report highlights the enormity of the task of aligning stakeholders ranging from the Reserve Bank of India to the Insurance Regulator. Industry sources indicate that not much progress has been made on this front and given the Non-Performing Assets (NPA) situation afflicting banks coupled with unstable Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDAs) at airlines, the financing markets in India are extremely tight resulting in extremely constrained lending and financing to the Indian airline industry by institutions in India.

AN UNCERTAIN FUTURE?

The players in the aircraft financing and leasing market continuously evaluate risk. The risk premium for Indian airlines is trending higher. This comprises default risk, a country’s acceptance of the Cape Town Convention which provides remedies for default, and also precedence. Indian carriers have, in the past, witnessed an increase in risk premiums after the collapse of Kingfisher Airlines and it took several years to restore this confidence. Unfortunately, given the plight of Jet Airways, several analysts are already drawing equivalence as reflected in wary creditors and lessors. The weak sectoral balance sheet and the forecast of a combined loss of $1.5 to 1.7 billion across the Indian airline industry, are not helping either. The outcome will be an inevitable increase in lease rates and collaterals.

For the Indian airline industry, this poses an immediate challenge. In a price-driven market, each element of the cost structure matters and competitive aircraft financing and lease costs are critical to success. Airlines have to follow the mantra of Steven Udavar Hazy, a legendary aviation CEO who said, “It is not only what you pay for the aircraft; it is also what you pay for the money to pay for the aircraft.”

As Indian aviation market continues its ascent towards becoming the third largest in the world, demands for financing by Indian carriers will continue to rise. For the financing and leasing market to perform well, several factors such as a strong demand for aircraft, diverse sources of funding, stable EBITDAs, an in-depth understanding of the sector and solid airline fundamentals, have to be aligned. Other than a strong demand for aircraft, India is trailing behind in most of these measures. The road ahead looks significantly turbulent.