INDIAN ARMED FORCES CHIEFS ON

OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

I am confident that SP Guide Publications would continue to inform, inspire and influence.

My compliments to SP Guide Publications for informative and credible reportage on contemporary aerospace issues over the past six decades.

Getting the Size Right

Fleet planners are challenged with making the right decision for their airline in the existing operating environment while anticipating the airline industry’s future

No one size fits all. It calls for mix and match. It applies to the airline industry too. The size of the aircraft is critical, if the operator is keen on expanding markets and customer base, while remaining financially viable. In mature markets, the issue of seat configuration may not be that much of an issue as it is in developing economies.

Widespread Growth

Several developing countries are witnessing phenomenal growth of Tier-II and Tier-III cities and towns and all waiting to be connected to the metros and beyond. India and China are two emerging economies that are experiencing transformation at different levels. Villages are growing and becoming towns. Towns are becoming cities and cities are transforming into mega cities. Making all this happen is multi-modal transportation, air included.

In India and China, there is a surge of development in Tier-II and Tier-III cities. In India, cities such as Ahmedabad, Amritsar, Bhopal, Coimbatore, Guwahati, Kochi, Lucknow, Mangalore, Pondicherry which are classified as Tier-II, are witnessing rapid economic development. Similarly, in China, Tier-II cities such as Chengdu, Sichuan, Chongqing, Dalian, Liaoning, Hangzhou, Ningbo, Zhejiang, Kunming, Yunnan, Nanjing, Suzhou, Jiangsu, Qingdao, Shandong, Tianjin, Shenzhen and Zhuhai, Guangdong, Wuhan, Hubei, Xiamen, Fujian, Xi’an and Shaanxi are rapidly getting into the mainstream. Besides, there are approximately 200 county-level cities in China that fall in the category of Tier-III cities such Zhongshan, Shantou, Xining and Baoding.

Planning Considerations

In this scenario where all modes of transportation will be at different levels of advancement, air transport certainly will be the one lagging behind for obvious reasons. Investments are high, margins are thin and entrepreneurs have to be daring. This certainly calls for extensive planning and foresight on the part of an airline operator on not just how to nurture the nascent market, but to remain in tune with developments. A classic example of forward planning is that of Vijayawada-based Air Costa which was launched in late 2013 with Embraer E-170 Jets with seat configuration of 67. It presently connects Tier-II cities such as Jaipur, Coimbatore, Ahmedabad, Visakhapatnam, Vijayawada, as well as the metros Bengaluru, Chennai and Hyderabad. The operator claims to have respectable plane load factor and if the going is good, then the operator has to make the next move. In fact, Air Costa has already done so by ordering 50 Embraer E-190 E2 and E195-E2 jets which will have seat capacities of 98 to 118. These routes which currently are thin, are expected to grow. Air Costa can then deploy the E-170s to other Tier-II and III cities.

Flying narrow-body planes such as the Boeing 737 or Airbus A320 which have about 180 seats on thin routes, does not make any business sense as the demand is not there. Demand has to be created and nurtured and this will take time. Airlines such as Spice-Jet, Air India and the defunct Kingfisher Airlines used turboprops on the thin routes.

Matching Size with Demand

Canadian aerospace major Bombardier and Brazilian giant Embraer have started making a pitch for small jets to connect small towns to the cities and metros. They have jets which are configured to provide seating between 70 and 120, thus promising operators a lower seat-km costs. Seat-km cost is the unit cost incurred to fly a certain number of passengers on a particular route.

Brazilian aircraft manufacturer Embraer sees strong growth prospects for small jets in India. “About 84 per cent of all routes in the Asia-Pacific have demand of less than 300 seats. Airlines need to have aircraft that offer the right capacity and cost structure. The E2 jets will offer 20 per cent lower trip costs than a Boeing 737 Max or an Airbus A320neo. In 10 to 20 years, we expect demand for 200 aircraft in the 70- to 120-seat category from India. We expect we will have a significant share of that,” says Mark Dunnachie, Vice President (Asia-Pacific), Embraer Commercial.

The E2 aircraft will give the Indian carriers flexibility to redraw schedules. Airlines can fly a Boeing 737 or an Airbus A320 during the morning rush hour and a 120-seater in the afternoon, when the demand for travel is low. Dunnachie said many airlines including LOT Polish Airlines and Jet Blue deploy Embraer jets during nonpeak hours.

Embraer’s Rule 70-110

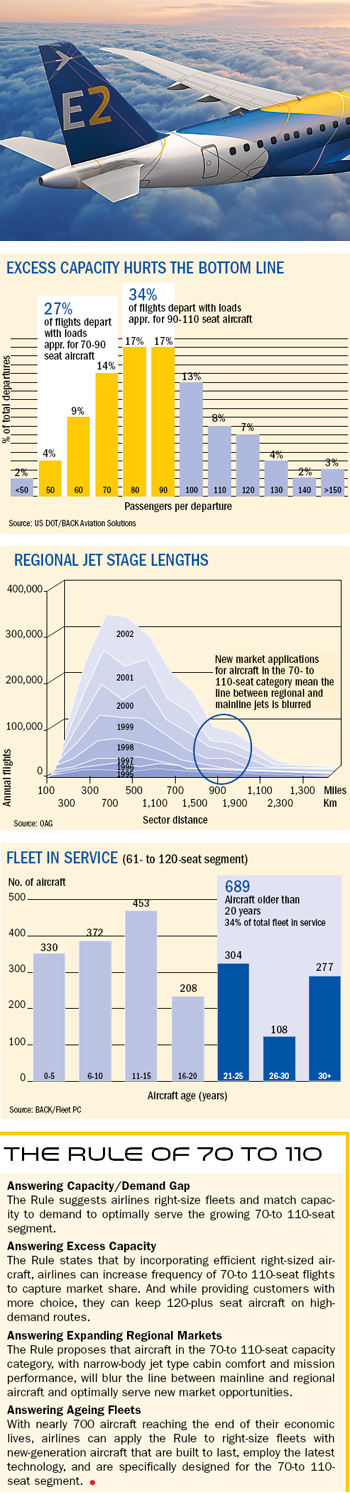

Embraer states that several mainline aircraft with high number of seats are increasingly flying routes where the demand is low. Meanwhile, regional markets are still expanding, putting pressure on the current breed of regional jets to carry more passengers more frequently. Clearly, passenger demand is trending towards the 70- to 110-seat segment, a range for which an efficient aircraft family didn’t exist until now. In other words, the industry is facing an acute equipment gap at the same time a relevant portion of the segment’s fleet is approaching the end of its economic operational life.

Demand-Capacity Gaps

Embraer states that mainline jets with 120-plus seats are effective in serving large-market, high volume city pairs. And on lower demand routes, 50-seat regional jets have been successful. However, market volumes requiring 70- to 110-seat jets are currently being served inefficiently due to the industry’s lack of optimised aircraft. Commercial carriers have a limited number of options to right-size fleets for efficient operation in the 70- to 110-seat category. Neither current mainline aircraft nor regional jets are best suited to serve the emerging 70- to 110-seat market.

Regional Jets (RJ) Stretched

As regional city pair frequencies reach their schedule limits, fully-booked, prime-time 50-seat RJ flights can often spill passengers. With a growing need to serve new long and thin markets, RJs are increasingly being pushed to enhance frequency in the drive to sustain revenue growth and market share. New longer distance missions require greater focus on cabin comfort and passenger amenities with baggage and cargo capacities similar to those found on mainline jets. Like the large capacity narrow-body jet operators, regional carriers have few equipment options to serve emerging demand in the 70- to 110-seat market segment.

Ag eing Commercial Fleet

More than one-third of the world’s in-service fleet of 61-to 120-seat aircraft are over 20 years in age and approaching the end of their economic lives. Fleet planners are challenged with making the right decision for their airline in the existing operating environment while anticipating the airline industry’s future. Retiring older aircraft gives operators the opportunity to optimise fleets, right-sizing for profitability in the 70-to 110-seat market.

Embraer states that the logic behind the Rule of 70 to 110 is easy to understand. Put simply, the Rule suggests that ideally, a carrier match aircraft capacity to passenger demand precisely. Currently, some flights don’t carry enough revenue passengers to cover operating costs. Yet other flights spill demand to competitors because aircraft are too small. Neither case is optimal. But a range of load factors, from breakeven to the spill point, can generate positive returns. Regularly turning away customers in a fiercely competitive market means loss in revenue and may also strengthen a rival’s market hold. Acquiring incrementally larger aircraft helps retain passengers and keeps an airline competitive as well as more profitable.

The shifting market dynamics of the present times, led Embraer to the principle of fleet capacity optimisation and the Rule of 70 to 110. Applied correctly, The Rule helps airlines achieve operating efficiency without compromising performance or passenger comfort. For both mainline operators and regional carriers, following the Rule of 70 to 110 can mean matching capacity to demand, increasing frequency, right-sizing fleets and maintaining existing markets while growing new business.

The Embraer 170, 175, 190, and 195 jets are a new-evolution family of aircraft, each engineered from the ground up to be comfortable, efficient and cost-effective. From the earliest planning stages, engineers understood the need for a new platform, an airframe created specifically for the 70- to 110-seat segment. The result incorporates new technology on the flight deck and proven design elements in the cabin, making the new airframe both pilot and passenger friendly.