INDIAN ARMED FORCES CHIEFS ON OUR RELENTLESS AND FOCUSED PUBLISHING EFFORTS

SP Guide Publications puts forth a well compiled articulation of issues, pursuits and accomplishments of the Indian Army, over the years

"Over the past 60 years, the growth of SP Guide Publications has mirrored the rising stature of Indian Navy. Its well-researched and informative magazines on Defence and Aerospace sector have served to shape an educated opinion of our military personnel, policy makers and the public alike. I wish SP's Publication team continued success, fair winds and following seas in all future endeavour!"

Since, its inception in 1964, SP Guide Publications has consistently demonstrated commitment to high-quality journalism in the aerospace and defence sectors, earning a well-deserved reputation as Asia's largest media house in this domain. I wish SP Guide Publications continued success in its pursuit of excellence.

Cost of Ownership

From a top-end BBJ3 (estimated cost $99 million), to a very light jet such as Phenom 100 (estimated cost $4.4 million), the cost of owning an aircraft is certainly high as there are recurring costs

When India’s richest man Mukesh Ambani of Reliance Industries travels in style in his Boeing Business Jet 2 (BBJ2), estimated to have cost $73 million, it does not surprise anyone. In 2007, when he gifted his wife Nita Ambani on her birthday, a $60-million Airbus ACJ319 corporate jet with entertainment cabins, a sky bar and fancy showers, this again was not surprising. The richest of Indians flying luxurious private jets is passé. They have the money. They have the wherewithal. They just can fly anywhere in the world without once thinking about the cost, I guess, till such time they (like Vijay Mallya who had to shift out his private jet ACJ319 out of Kingfisher Airlines) land in a major financial mess. Moving away from the uber rich, let us look at how one can broadly work out cost of business jet ownership in India. The options available are (a) outright private jet ownership (b) jet charters (c) fractional ownership and (d) jet cards.

Private Jet Ownership – For the Rich & Famous

From a top-end BBJ3 (estimated cost $99 million), to a very light jet such as Phenom 100 (estimated cost $4.4 million), the cost of owning an aircraft is certainly high as there are several recurring costs. The Gulfstream G650 is priced at $72.5 million; the Bombardier Global 7000 is pegged at $68 million; the Dassault Falcon 7X and the Embraer Lineage are at $52 million apiece; the Phenom 100, a very light jet is at $4.4 million. Besides the cost of acquisition of the aircraft, one has to factor in salaries for the pilot and other crew; maintenance of the aircraft, etc, and this highly variable, depending on the aircraft, the business model, etc.

Air Charter costing

For an air charter company, the broad costing includes (a) aircraft purchase/lease (b) operational expenses (licence fees, salaries of pilots and other staff; aviation turbine fuel; airport taxes and other charges) and (c) maintenance cost. With the business in mind and the services provided, the charter operator has to factor in all the costs, plus the squeezed margins to put a price tag on what the charter is going to cost. Maintaining a business jet as per global safety norms is an expensive affair. As per the Economist the profit margins for the airline industry was less than one per cent on average over six decades. One can imagine the plight of the charter operator.

Though the airport charges are less for aircraft under 100 tonnes, private jet operators/charter operators are constrained with availability of hangar space and other related infrastructure for them to offer the best of services to customers. The landing and parking charges depend on the aircraft’s weight, seat configuration, landing time and duration of use of parking and housing facilities ‘etc’ at different airports which have their own pricing methodology. The landing charges vary between Rs. 436 for a very light jet and Rs. 14,000 for ultra large business jets. For a person availing charter service, he or she would have to often pay a ‘dead-head’ (return journey of the flight), even though the person is flying only one way.

Crew Cost, key element

An important factor in the aviation industry is human resources, particularly the flying crew. Business jet operators are a harried lot, unable to find the right candidates for their operations and the attrition rate is said to be high, as these pilots are constantly on the lookout for better career options, commercial airlines being their prime destination. The charter operator has to keep in mind the attrition rate and offer salaries which sometimes may not be commensurate with market conditions.

The pilots themselves would have invested heavily into their training programmes and certainly would like better returns on their investment. According to a report, one has to spend between $7,500 and $12,000 to attain the FAA issued Private Pilots’ Certificate. In India, the Delhi Flying Club charges Rs. 5 lakh to Rs. 6 lakh for private pilots’ licence, while a commercial pilots’ licence (CPL) may cost anywhere between Rs. 22 lakh and Rs. 25 lakh.

Jet hire rates

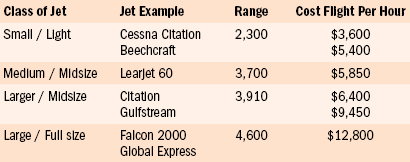

As executive jets are broadly classified as very light jets/light/small jets; medium/midsize; and full-size/large or heavy jets, the cost of hiring depends on the jet chosen. The hourly jet rates vary from aircraft to aircraft and here is an indicative rate list.

Fractional ownership

The concept of fractional ownership of business jets has not caught on in India, where it is either direct ownership route or the charter route. Even the concept of jet cards has been making tardy progress. The normal share divisions in fractional ownership are ‘Whole’, ‘Quarter’, ‘Eighth’, and ‘Sixteenth’. Fractional ownership can offer the advantage over charter, whereby the ‘dead-head’ is not charged against the end customer.

Jet Cards giving easy access

There are several companies which offer jet cards which allows companies and individuals to buy blocks of flight time from charter operators, besides having their own aircraft. The arrangement works good for the charter operator whose flight utilisation time goes up and for the jet card member there is easy availability of aircraft.

In 2013, Baron Aviation launched reportedly India’s first jet card programme. Baron has committed to buying blocks of flight time from several Indian charter operators, including Raymonds Aviation, which owns a Challenger 604 and two of the helicopters. It is seeing demand from new private aviation consumers, including wealthy individuals flying to the Middle East, particularly Dubai on shopping trips. The company, which is part of the Baron Luxury & Lifestyle group, says that it is contracting for between 70 and 100 per cent of the operators’ available fleet hours.

The group offers three levels of Baron Eagle membership, with members establishing a prepaid deposit that is used to cover the cost of flights. At the Platinum level, members pay $3,30,000 for up to four cards that can be transferred among individuals and with refunds for any amounts not spent on flights. A gold card costs $80,000 and allows bookings for domestic or international flights from India. The silver card costs $40,000 and is for domestic flights only.

According to Baron CEO and Chairman Rajeev Wadhwa, demand for international flights by Indian private jet travellers has increased by 16 per cent since 2011. He feels that India’s rising ranks of billionaires view a jet card programme as a more viable alternative to full aircraft ownership.

Similarly Kochi-based K-Air premium jet card programme gives access to a good aircraft fleet in India and Asia to its members. K-Air states that it guarantees aircraft availability with as little as 10 hours notice and there is a choice of up to 20 aircraft types including helicopters. Jet card members can buy blocks of 15/30/50/100 hours and renew or walk away when complete.

The pricing includes airport charges, night charges and it varies depending on the category of aircraft chosen and the destination. Each trip is calculated based on flying carried out and the amount deducted from the Premium Jet card annual charges.

There are many companies that sell jet membership, or block-time cards. These are either licensed resellers of unused fractional shares, or they are charter brokers who make arrangements with charter companies who sell blocks of time to them, at a discounted rate.

JetSetGo

At a time when business aviation is emerging in India, we have a new business model taking birth. Kanika Tekriwal, CEO of JetSetGo Aviation Services, has launched India’s first online marketplace for private jets and helicopters. JetSetGo has access to a fleet of 300 plus aircraft. JetSetGo is an aggregator of private jets and helicopters. It allows charter customers to book a private jet online by entering travel details. The customers can get to see online real time availability of aircraft and prices and once the customer selects, JetSetGo reconfirms with operator after which a minimal booking deposit is made. After the balance is paid JetSetGo takes over to ensure that the customer gets to travel to his or her destination at very competitive costs. Entrepreneurs like Kanika are changing the face of private jet travel in India, which till now has been prohibitive. JetSetGo has raised an undisclosed amount of funding from Yuvraj Singh’s startup fund YouWeCan Ventures. The company will use funds for improving service and marketing.

Aircraft Management, the way to go

One way a private jet operator can defray his costs is by offering the jet to an aircraft management company, though nascent in India. The aircraft management company provides all the support such as pilots, maintenance crew; complies with DGCA requirements; flight planning, etc. By offering the aircraft to an aircraft management company, the owner can lower the ownership costs, while paying annual fees to the aircraft management company. The advantage is that the utilisation of the aircraft improves considerably and an aircraft up in the air makes money than while on the ground.